There will be no restrictions on the use of proceeds and interest would be payable in cash. The conversion price will be $10.34 per share, subject to certain potential adjustments. Poseidon is expected to be provided warrant coverage, with the warrants to have an initial exercise price of $11.50 per share.

“Ocean Biomedical is thrilled with Poseidon’s continued support of the company as evidenced by this loan commitment. We look forward to finalizing the documentation and propelling Ocean Biomedical forward,” said Elizabeth Ng, Ocean’s chief executive officer.

A statement from Ocean this week revealed that its cancer-targeting immunotherapy antibody candidate has shown effective tumor reduction against an aggressive subset of Non-Small Cell Lung Cancer (NSCLC) with Epidermal Growth Factor Receptor (EGFR) mutations. The company will be hosting a cancer R&D update on October 19, 2023, to share details of its multipronged cancer program based on pioneering anti-CHI3L1 discoveries.

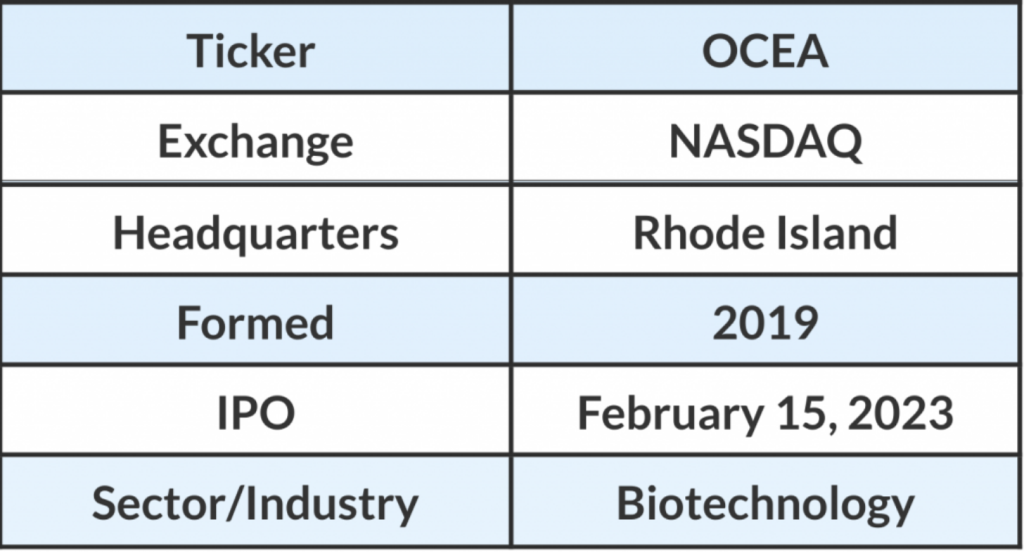

Ocean Biomedical is engaged in the development of therapeutic discoveries with the potential to achieve life-changing outcomes in areas like cancer, pulmonary fibrosis, and malaria. The company deploys the funding and expertise to move new therapeutic candidates efficiently from the laboratory to the clinic, to the world. It has a promising pipeline of late-stage pre-clinical assets in cancer, malaria, and fibrosis.