Ocean Biomedical, Inc. (NASDAQ: OCEA) is a biotechnology company that works with leading researchers and institutions to accelerate the development of new therapies. The company is focused on bringing together the resources needed to commercialize pharmaceutical candidates, mainly in the areas of oncology, fibrosis, and malaria.

The Business

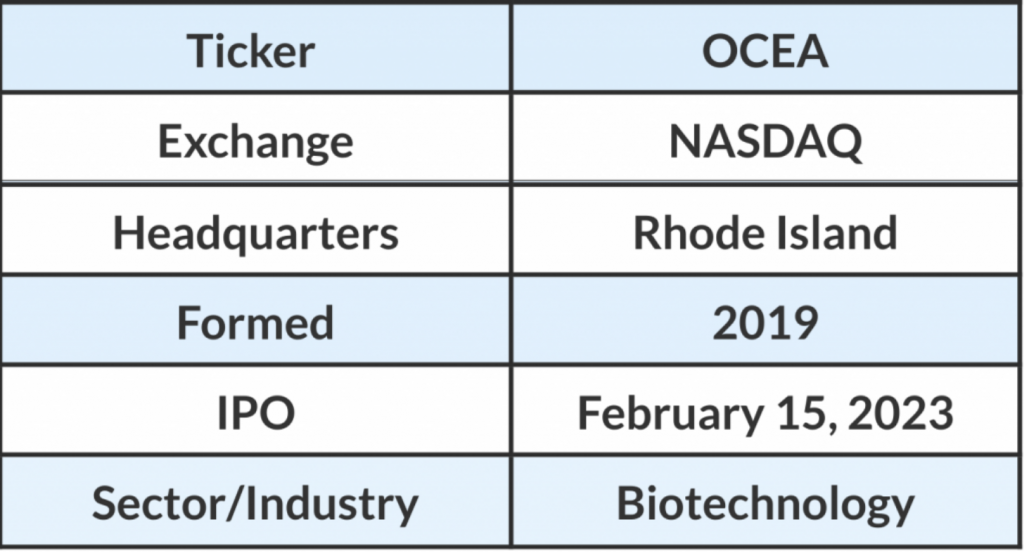

Established in 2019, Ocean Biomedical is headquartered in Rhode Island. It was founded by Dr. Chirinjeev Kathuria, who is also the executive chairman. Elizabeth Ng is the chief executive officer. The company’s stock trades on the Nasdaq stock exchange under the ticker symbol OCEA. By adopting a ‘licensing and subsidiary’ structure, Ocean looks to create mutual value for shareholders and licensing partners.

Programs

The company has a strong pipeline of pre-clinical assets for the treatment of malaria, fibrosis, and various types of cancers.

Cancer Program: Ocean works to advance immunotherapies for lung, brain, and other cancers while continuing to enhance the understanding of the broad anti-tumor mechanisms behind its anti-CHi3L1 discoveries. Studies have confirmed the effectiveness of anti-CHi3L1 in brain cancer, creating a 60% reduction in tumor growth in the human glioblastoma multiforme stem cell model in vivo.

Malaria Program: The Ocean team is pushing its discovery science forward on several fronts to develop new solutions to address the urgent global need to develop more effective therapies for malaria treatment. That includes enhancing the knowledge and control of the mechanisms by which the company’s PfGARP antigen induces malaria parasite death and optimizing/developing an mRNA vaccine candidate based on discoveries of PfGARP, PfSEA, and another antigen that may be able to simultaneously target the malaria parasite at different stages of the blood cycle.

Fibrosis Program: Scientists at Ocean Biomedical are also actively working to address the standard of care and treatment options for those suffering from Idiopathic Pulmonary Fibrosis. There are indications that the company’s candidate for treating IPF may also prove effective against many other fibrotic diseases. The progress achieved in the program includes testing the anti-fibrotic treatment candidate OCF-203, which has generated impressive reductions of fibrosis in multiple models and reduced collagen accumulation by 85%-90%.

Updates

Biotechnology company Virion Therapeutics, which entered into a JV partnership with Ocean Biomedical last year, has presented positive preclinical oncology data at the annual meeting of the Society for Immunotherapy of Cancer, SITC 2023.

Earlier, Ocean’s chief scientist Jonathan Kurtis received the Falk Medical Research Trust Transformational Award to advance a new class of anti-malarial drug candidates. His program includes a therapeutic small-molecule drug candidate for treating severe malaria and a therapeutic antibody for short-term malaria prevention.

At the Bourses

Currently, Ocean Biomedical’s stock is covered by analysts of EF Hutton, Fundamental Research Corp., and Taglich Brothers. The stock started trading on the Nasdaq stock market on February 15, 2023, following a reverse merger of special purpose acquisition company Aesther Healthcare Acquisition Corp. The performance of the stock was not very impressive in 2023, as it experienced volatility. While market watchers remain optimistic about OCEA’s growth prospects, the shares traded below their 52-week average so far this year.

Conclusion

The company has committed financial backing, including funding facilities with White Lion Capital and Alto Opportunity Master Fund. Last year, Ocean inked a pact with its stockholder Poseidon Bio, LLC, for a proposed debt facility consisting of convertible promissory notes with a principal amount of up to $10 million.

While the company follows an innovative business model, it is not immune to the growing competition the healthcare market is witnessing. Also, some of the new trends in the pharmaceutical sector, including consolidations, could be challenging for companies engaged in the development and commercialization of medicines.