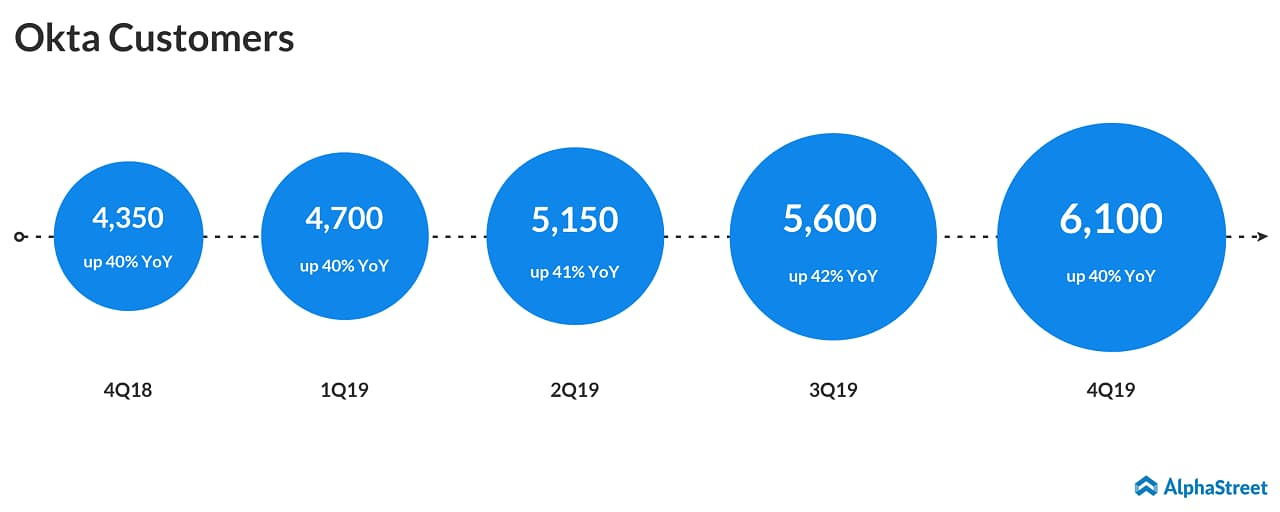

Okta Inc (OKTA) narrowed its Q4 loss and revenue surged 50% compared to the prior year quarter. The cloud-based identity and access management company posted a loss of 4 cents per share compared to a loss of 8 cents per share in the prior year quarter. Revenue of $115.5 million surpassed analysts’ estimates.

Analysts had expected the company to post a loss of 8 cents per share on revenue of $107.95 million for the quarter ended January 31, 2019. Shares of Okta, which ended Thursday’s trading session up 1.54% at $81.21, plunged 9% during the extended hours of trading.

For the first quarter of fiscal 2020, the company expects revenue to be $116 million and $117 million, representing a year-over-year growth rate of 39% to 40%. Non-GAAP loss per share is predicted to be $0.22 to $0.21.

For the full-year 2020, revenue is targeted to be $530 million to $535 million, representing a year-over-year growth rate of 33% to 34% and non-GAAP loss per share to be $0.53 to $0.48.

“We’re pleased to close out a strong fourth quarter and fiscal year thanks to our relentless execution and focus on customer success, which is demonstrated by 53% subscription revenue growth and 50% growth in customers with over $100,000 annual recurring revenue in Q4,” said CEO Todd McKinnon.

Okta also announced today that it has entered into an agreement to acquire cloud-based business firm Azuqua. The proposed acquisition is expected to close during Okta’s fiscal first quarter.

According to Graphical Research, North America Identity and Access Management (IAM) market value in 2017 was projected to be over 4 billion and is anticipated to reach over $7 billion, growing at a CAGR of more than 7%.

Also read: Salesforce (CRM) stock slumps on weak outlook despite upbeat Q4 earnings

Okta stock, which hit a 52-week high ($87.72) on February 20, 2019, had increased 27% since the beginning of this year and 21% in the past three months period.