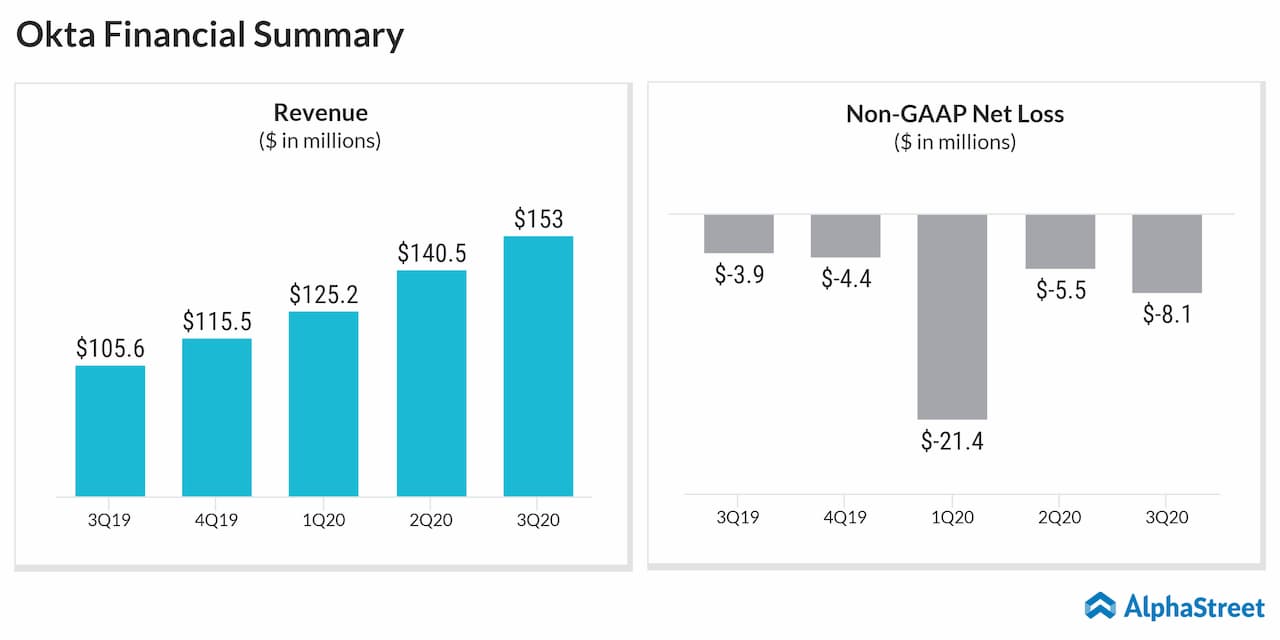

Revenue grew by 45% to $153 million. Subscription revenue surged by 48% to $144.5 million. The results reflected the growing importance of identity.

Looking ahead into the fourth quarter, the company expects revenue to grow 34% to 35% to a range of $155 million to $156 million, and adjusted net loss per share of $0.05 to $0.04. Adjusted operating loss is predicted to be $10.1 million to $9.1 million.

For fiscal 2020, the company lifted its revenue outlook to the range of $574-575 million from the previous range of $560-563 million. Adjusted loss guidance is narrowed to the range of $0.35-0.34 per share from the prior range of $0.44-0.42 per share.

For the third quarter, total remaining performance obligations (RPO) soared by 68% year-over-year to $1.03 billion. The current RPO, which is revenue expected to be recognized over the next 12 months, jumped by 52% to $515.9 million.

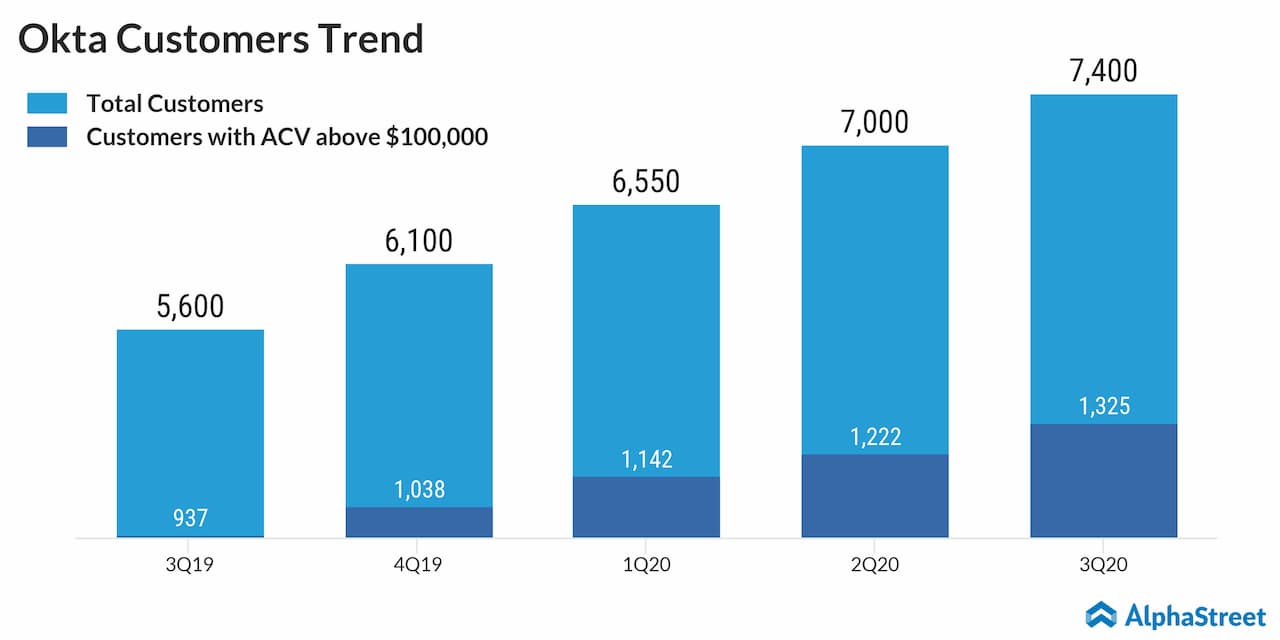

The company experienced industry-leading growth in subscription revenue, remaining performance obligations, and billings. This was driven by the strong execution and the continued secular tailwinds of increasing adoption of cloud applications, digital transformation, and deployment of zero-trust security environments.