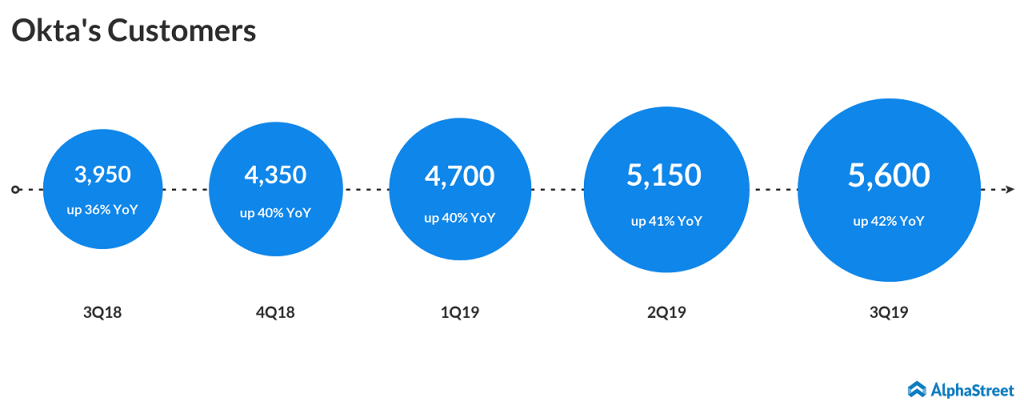

Revenue surged 58% year-over-year, due to 58% growth in subscription revenue. GAAP net loss per share narrowed to $0.27 from $0.35 in the third quarter of fiscal 2018. The San Francisco, California-based firm grew its customers 42% year-over-year to 5,600 in the recently ended quarter.

For the final quarter of 2019, the company expects revenue of $107 million to $108 million, representing a year-over-year growth rate of 39% to 40%. Adjusted loss per share is estimated to be $0.09 to $0.08.

For FY19, revenue is predicted to be $391 million to $392 million, representing a year-over-year growth rate of 52% to 53%. Adjusted loss per share is targeted to be $0.37 to $0.36.

“We had a record third quarter with 58% year-over-year growth for both revenue and billings, which was driven by increased momentum in the enterprise. We saw 55% growth in customers with over $100,000 annual recurring revenue, representing a record 100 net new adds in a quarter,” said CEO Todd McKinnon.

According to Research and Markets, Cloud Identity and Access Management (IAM) market is estimated to grow to $4.86 billion by 2023, increasing from $1.265 billion in 2018 at a CAGR of 30.89% over the forecast period.

Salesforce (NYSE: CRM) beat Q3 estimates, provides strong outlook

Shares of Okta ended Tuesday’s session at $60.65, down 6.5%. The stock’s value had jumped 137% in the year-to-date period and 114% in the past 52 weeks.

We’re on Apple News! Follow us to receive the latest stock market, earnings and financial news at your fingertips