- Margin Expansion: The segment’s gross profit margin improved by 546 basis points to 15.4%, driven by a favorable product mix and higher pricing.

- Offsetting Effect: This margin growth helped mitigate a 291 basis point decline in the Marine segment’s gross profit margin and a 40 basis point contraction in the company’s consolidated gross profit margin, which finished the quarter at 20.0%.

- Retail Context: Despite the rise in wholesale revenue, the company noted that North American On-Road retail sales decreased by low-double digits, reflecting broader industry demand trends.

Business & Operations Update

M&A or Strategic Moves

Polaris disclosed no new acquisitions during the fourth quarter. The company continued its share repurchase program, retiring 1.2 million shares of common stock. No third-party deal discussions were confirmed in the latest disclosure.

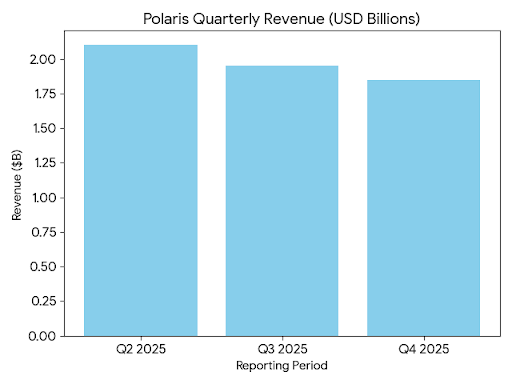

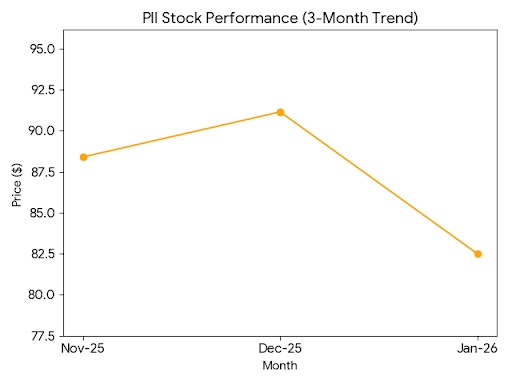

Financial Trends

Equity Analyst Commentary

Institutional research from BMO Capital Markets and Baird highlighted the impact of elevated interest rates on consumer demand for discretionary power sports equipment. Analyst reports noted that high floor-plan financing costs for dealers contributed to the year-over-year decline in wholesale shipments. Documentation from Emkay Global indicated that North American retail sales volumes remained varied across the off-road and marine categories.

Guidance & Outlook

Management issued guidance for the full year 2026, projecting revenue growth in the range of 0% to 2%. The company expects adjusted earnings per share to be between $5.75 and $6.25. Factors to watch include the stabilization of interest rates and the impact of the centralized distribution model on operating margins.