Browser company Opera Ltd (NASDAQ: OPRA) has big plans for 2021. Of late, the company has been gradually transforming into much more than an ordinary browser by expanding its product line-up and acquiring complementary businesses. The management expects to see a positive financial impact from these efforts by around 2022.

Opera’s expansion efforts have been focused on three verticals — news, fintech and gaming. Adding to its core products such as Opera News and Opera GX, the company recently launched an in-browser payments solution Dify, besides acquiring YoYo Games earlier this year. The acquisition of YoYo Games, creator of GameMaker Studio 2, was aimed at driving traffic towards Opera GX, a browser built specifically for gamers.

Opera’s other strategic investments include social media company StarMaker, as well as fintech businesses OPay and Nanobank.

A browser to scale businesses

In an interview with AlphaStreet, Opera CFO Frode Jacobsen said the ultimate focus of the company is to create a browser that stands out to users, and not to copy what Chrome or Safari does.

“We have realized over the past year that the browser is also a very good platform to launch new businesses, because people constantly spend time on it or make purchases or do transactions. So we can improve that experience and use that as a catalyst to drive new businesses.” Jacobsen said. The CFO cited its 200 million monthly active users on Opera News as an initial result of this effort.

Opera is apparently opting to push services on the basis of customer behavior in various geographic regions. While Opera News was more focused on emerging markets and Asia, gaming is more oriented towards Europe and the Americas. Jacobsen added that scaling these opportunities to newer markets forms a core strategic agenda for the year.

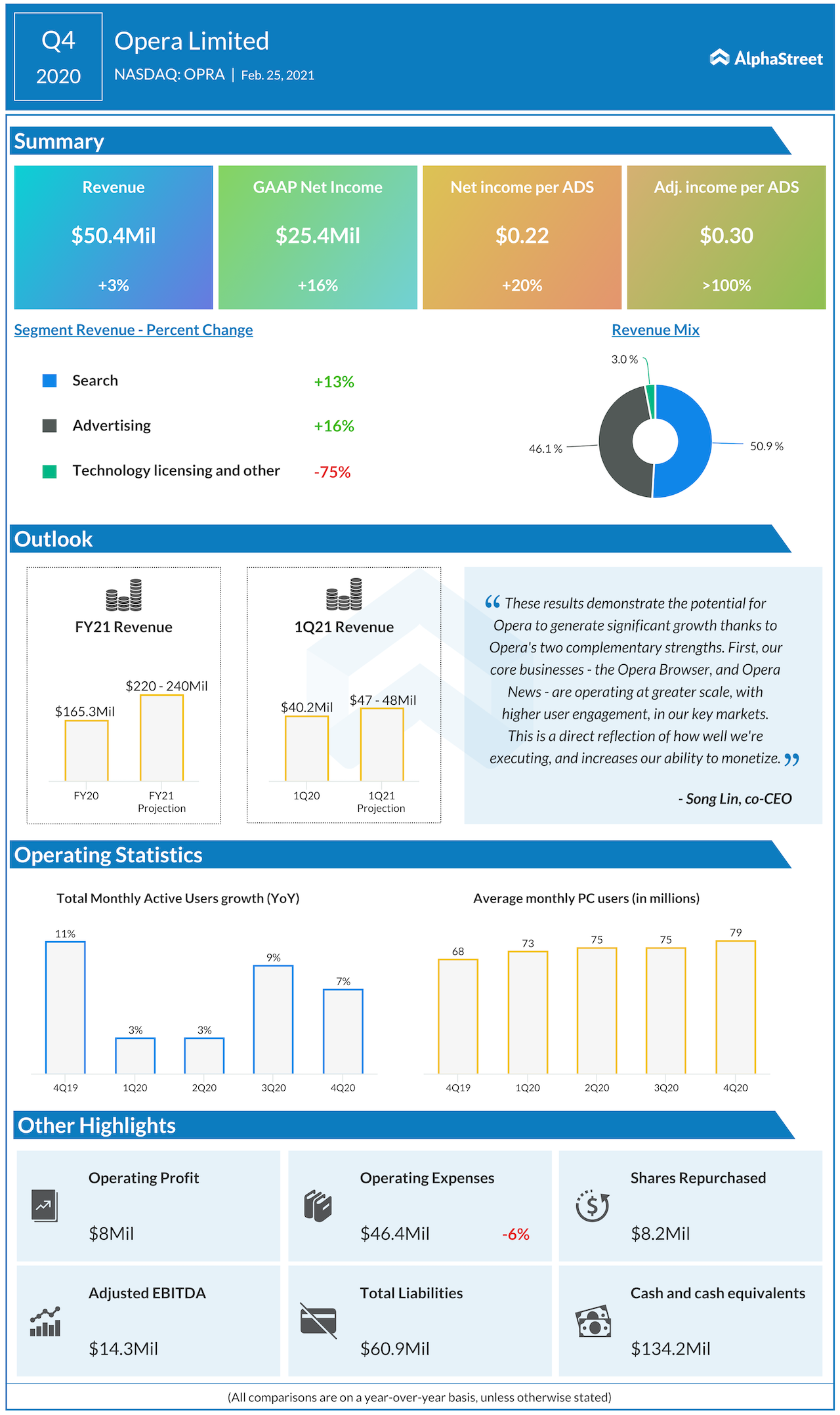

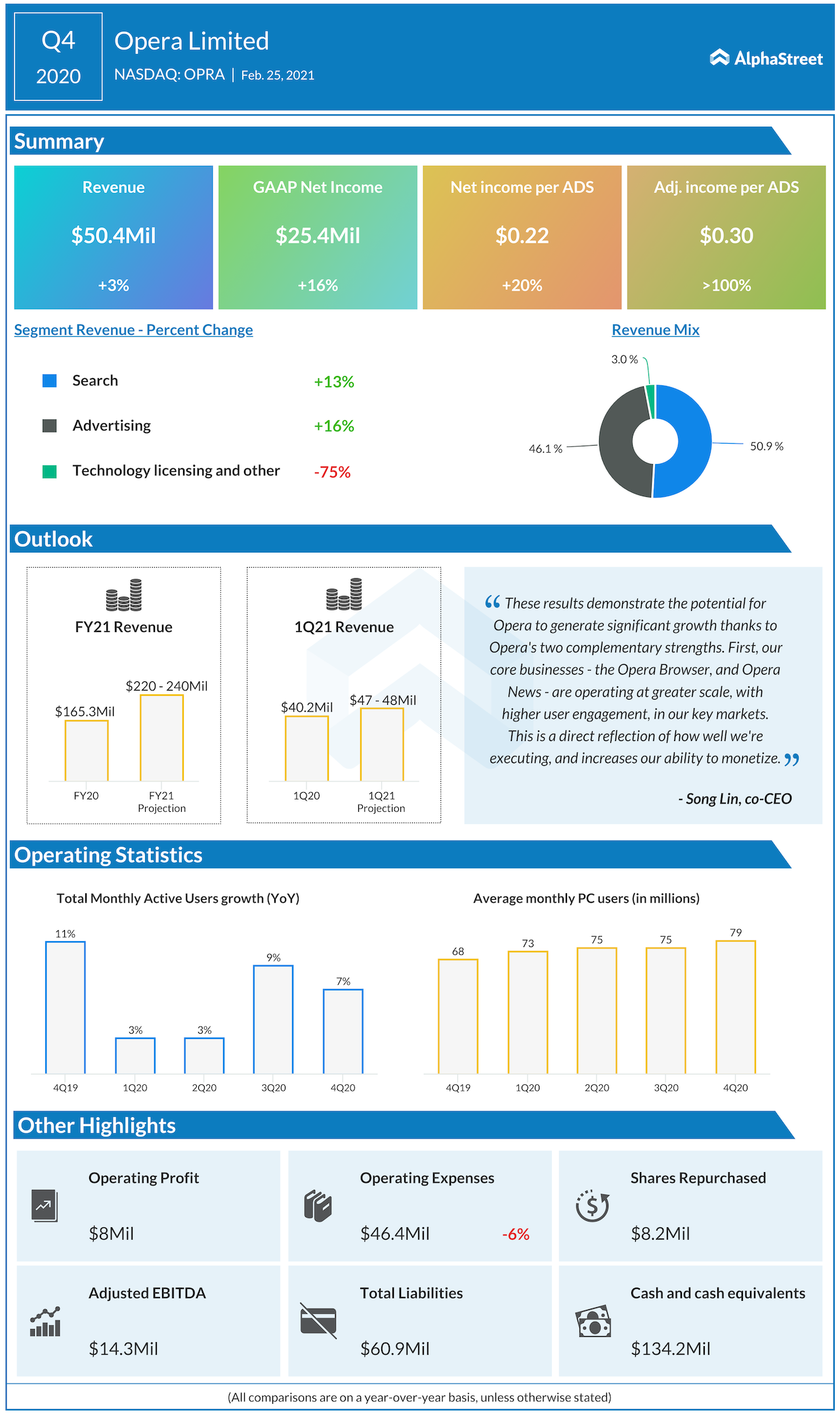

Financials

For fiscal 2020, the Norwegian company reported a profit of 44 cents per ADS, a cent shy of what it achieved last year. Annual revenue, meanwhile slipped 7% to $165.3 million, primarily due to weakness in advertising revenues during the COVID-19 period.

The executive pointed out that the firm is growing by maintaining a healthy profit and cash flow, which in turn, is used for further expansion. “While we are accelerating our growth, we are still doing that by guiding profitability for our business. It’s different from the promise of some event in the future that will suddenly magically make you profitable. For us, it’s more a question of how much of our cash flow did we reinvest in scale.”

For more insights into Opera Ltd, read the latest earnings call transcript

In fiscal 2021, the management aims to streamline these investments into product innovation, marketing and distribution across new markets.

Opera, which had over 380 million monthly active users at the end of fiscal 2020, has seen its stock rise over 43% in the past one year. The stock’s 12-month average price target is at a 14% upside from Friday’s trading price.

____