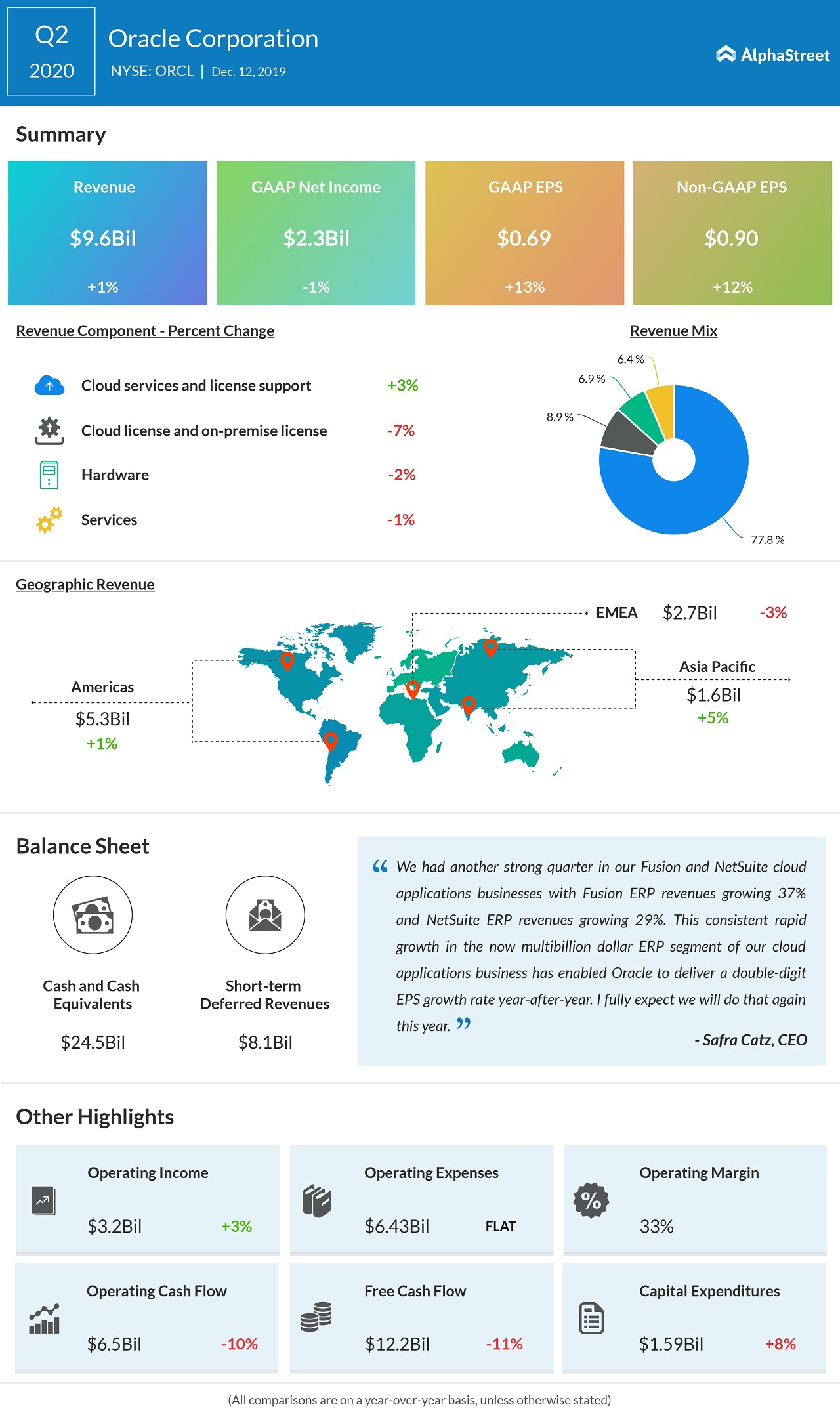

Helped by the stable demand for the company’s cloud and

license support products, which account for about three-fourths of the total

revenues, the top-line came in at $9.6 billion, up 1% year-over-year, but lower

than the street estimate.

Cloud Services and License Support revenues were $6.8 billion, while Cloud License and On-Premise License revenues were $1.1 billion.

READ: Alteryx CFO Kevin Rubin on Q4 outlook, stock sell-off and the possibility of getting acquired

ADVERTISEMENT

CFO Safra Catz said, “We had another strong quarter in our

Fusion and NetSuite cloud applications businesses with Fusion ERP revenues

growing 37% and NetSuite ERP revenues growing 29%.”

CTO Larry Ellison added, “It’s still early days, but the

Oracle Autonomous Database already has thousands of customers running in our

Gen2 Public Cloud. Currently, our Autonomous Database running in our Public

Cloud business is growing at a rate of over 100%.”

Oracle shares fell 1.98% immediately following the announcement. The stock has gained over 23% so far this year and 2% in the past three months.