All eyes will be on defense tech firm Palantir Technologies’ debut tomorrow. None of Palantir executives will ring the bell tomorrow when the company’s Class A stock starts to trade on NYSE under the ticker symbol PLTR. To go public, the company has taken the route of direct listing method like Spotify (NYSE: SPOT) in 2018 and Slack Technologies (NYSE: WORK) in 2019.

Overview

Palantir was founded in 2003 to build software for use in counterterrorism operations. In 2008, the data analytics company released its first platform, Palantir Gotham, for customers in the intelligence sector.

Gotham enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants. Defense agencies in the US then began using Gotham to investigate potential threats and to help protect soldiers from improvised explosive devices.

Also read: Lemonade (LMND): A successful IPO of 2020

Palantir later began working with leading companies across industries, including companies in the energy, transportation, financial services, and healthcare sectors. In 2016, the Denver-headquartered firm released its second software platform, Palantir Foundry, to address a common set of challenges faced by the large companies.

Financials

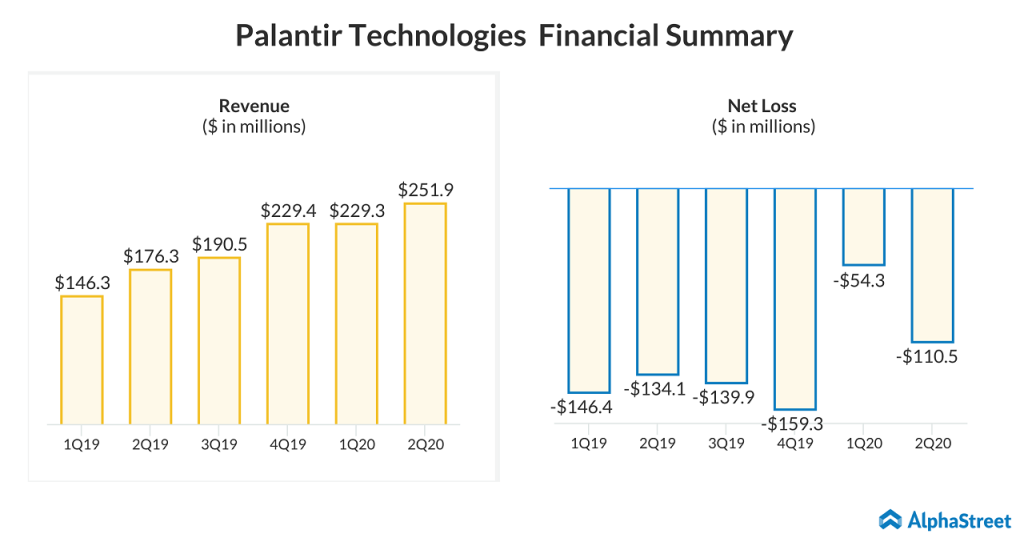

Palantir generated $742.6 million in revenue in 2019, reflecting a year-over-year increase of 25% from 2018. In the first half of this year, during a period of significant geopolitical instability and economic contraction, the company generated $481.2 million in revenue, reflecting a growth rate of 49% over the same period last year. In 2019, average revenue per customer was $5.6 million.

In 2019, the company incurred a net loss of $579.6 million. In H1 2020, net loss decreased to $164.7 million, down from a loss of $280.5 million in H1 2019.

In the first half of 2020, Palantir platforms were used by 125 customers, including some of the largest and most significant institutions in the world. As of June 30, 2020, Palantir had 2,398 full-time employees, with employees located both in the US and outside the US.

Direct listing

Instead of choosing the traditional IPO route, Palantir has chosen the direct listing method to become a public company. Reports suggest that Palantir might trade at $10 a share. In the direct listing method, no new shares are created and only existing, outstanding shares of the company are sold to the public.

In conventional IPOs, new shares of the companies are created and underwritten by intermediaries who are called as underwriters. Usually, the company going public through IPO will be paying the underwriters a certain percentage of the capital raised through the public listing. Through direct listing, this amount is saved by the company.

Also read: Snowflake (SNOW) creates a record as the most successful software IPO ever; stock more than doubles

Outlook

Normally, the companies that are becoming public wouldn’t forecast their financial outlook. However, Palantir issued a press release last week on its guidance. For the third quarter of fiscal 2020, the company expects revenue to grow 46-47% year-over-year to a range of $278 million to $280 million. For the full-year 2020, revenue is anticipated to be in the range of $1.05 billion to $1.06 billion, representing a year-over-year increase of 41% to 43%. For the full-year 2021, Palantir expects year-over-year revenue growth to be greater than 30%.

Market opportunity

Palantir estimates the total addressable market (TAM) for its software across the commercial and government sectors around the world to be approximately $119 billion. The company estimates the TAM in the commercial sector to be $56 billion. The TAM in the government sector, including government agencies in the United States and abroad, is anticipated to be $63 billion. TAM in the US government sector is expected to be $26 billion and the TAM in the international government sector is estimated to be $37 billion.

Few more big listings awaited

Holiday rentals giant Airbnb and cybersecurity firm McAfee are expected to go public before the end of this year. Workplace collaboration and planning software maker Asana is also set to join Palantir by going public through the direct listing method tomorrow. Asana will trade on the NYSE under the ticker symbol ASAN.

Palantir might be a growth stock in the future, but we need to wait for the initial excitement and hype to fade out.