Micha Kaufman, CEO and founder of Fiverr (NYSE: FVRR) feels the pandemic has reinforced the thesis that the firm has been preaching for 10 years. And guess what – the change is now happening rapidly. The Israeli freelance marketplace saw accelerated growth in all verticals since the lockdowns started. In an e-mail conversation with AlphaStreet, the company stated:

“We expect our timing to profitability to accelerate by approximately one year from what we expected. We now expect to reach EBITDA profitability in the second half of 2021.”

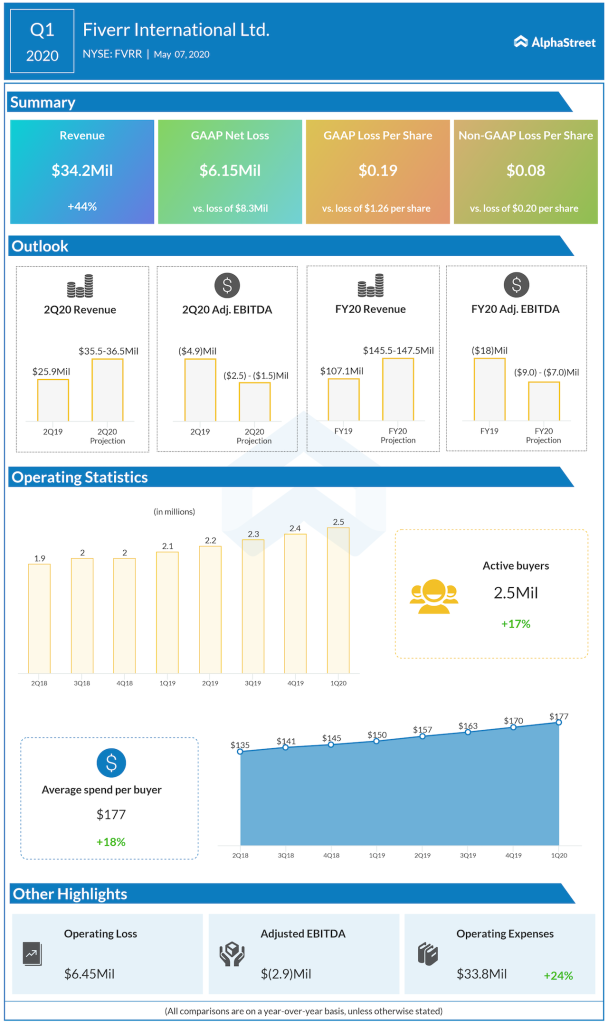

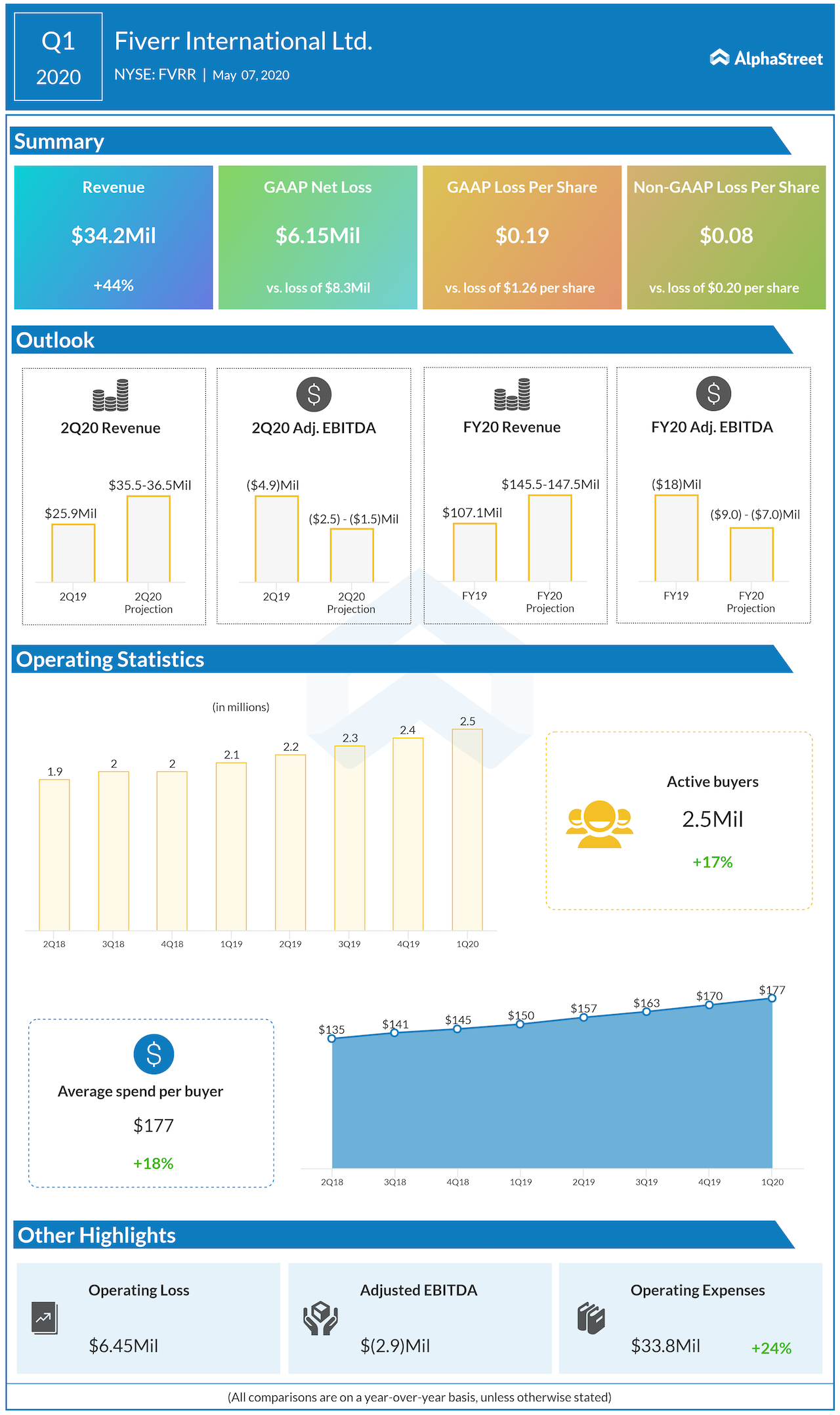

The management sounded highly optimistic when it announced first-quarter financial results on Thursday. The guidance on 2020 revenue was raised to $145.5 – $147.5 million from the prior projection of $139 -$141 million. View on EBITDA loss was also slashed to $7-9 million from the earlier estimate of $13-15 million.

FVRR stock has more-than-doubled since the beginning of this year, partly stimulated by the optimistic outlook provided by the firm. The company went public in June last year.

Trends

in customer addition

While

the company maintains that the acceleration was broad-based across all verticals,

the management said it witnessed particular strength in digital content-related

categories such as gaming, social media, online lessons and ebooks. Separately,

there was apparently a renewed interest in categories that were closely aligned

with moving business from offline to online.

The company claims that the customer addition trend was spread across geographic regions as well. The response to a question on geographic trend stated:

“We are seeing the strength of our business not only in the US, but across the world, especially in several European countries where our timely investments in local expansion were in place right around the time when global stay-at-home orders intensified. Both new seller and new buyer registration have been particularly strong in Spain and France in recent weeks.”

In February, Fiverr had launched its global marketplace in the German language, which was followed by Spanish and French in April.

Post-pandemic

marketing strategy

In the management’s words, the company has benefited from word-of-the-mouth publicity as people are spending more time online and on social media platforms during the pandemic. However, it’s not slacking on the marketing side. On their marketing initiatives, the company said:

“We have also moderately stepped up our marketing investment in recent weeks as the less competitive advertising space opened additional performance marketing opportunities for us.”

The firm added that trends for organic and paid channels are seeing strength, driven by its channel diversification and international expansion.

[irp posts=”49952″]

While Fiverr – and to some extent, it’s peer Upwork (NASDAQ: UPWK) – has definitely benefited in the short-term, it needs to been seen how the trend catches up in the aftermath of the crisis. The company also did not have a definite answer to whether a pullback would be seen in activity as countries return to normalcy. Speculations on this factor will be driving force on the stock going forward.

For more insights about Fiverr, read the latest earnings transcript here. It’s free.