In the last reported quarter, domestic company-owned restaurant comp sales slumped 6.1% while that of North America franchised restaurants dropped 7.2%. Investors will be on the lookout for this metric, but estimates suggest that the downtrend might continue.

Weak North America commissary sales have also been a matter of concern for the company for some time, along with higher labor costs due to effects of The Affordable Care Act (Obamacare.)

Lower operating results due to slumping domestic sales, and rising delivery and technology costs are expected to weigh on the adjusted earnings of the Domino’s Pizza (DPZ) rival.

Amidst challenging times the previous quarter, Papa John’s announced its last reported results, failing to meet Street estimates. Along with it, the downward revision of 2018 earnings outlook made the stock take a severe beating plunging more than 10% then.

Last quarter, Revenue slipped 6.2% to $408 million, while earnings plunged 24.6% to $0.49 per share. North American region comp sales fell 6.1%.

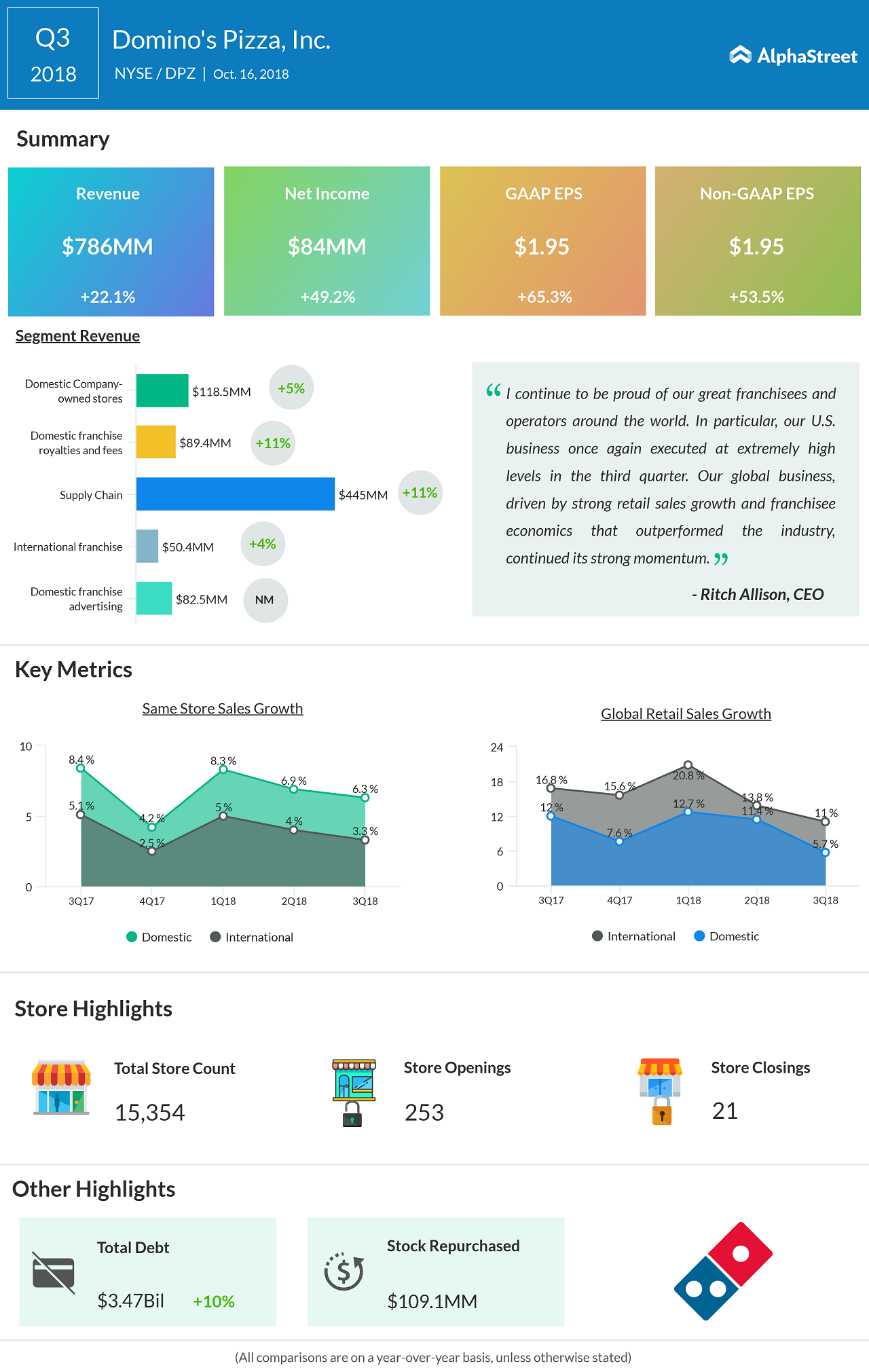

Alternatively, Domino’s Pizza posted its earnings less than a month ago, with a 65.3% jump in earnings on a revnue growth of 22.1%.

Pizza Takeover

Last month, reports of activist hedge fund Trian Fund Management considering a takeover of Papa John’s International Inc. (PZZA) emerged. After getting embroiled in a bitter fight with its founder John Schnatter who owns a 30% stake in the company, Papa John’s has been looking for buyers lately.

Trian is not alone as several other entities are said to be interested in buying the pizza chain, but there is no assurance that the hedge fund will make a bid or that a sale will take place. Trian holds a 13% stake in The Wendy’s Company (WEN), and it is said that talks were held between Wendy’s officials and Schnatter earlier this year to discuss a potential deal.