Q3 Report Due

The Rochester-based tech firm will publish its third-quarter 2025 results on Wednesday, March 26, at 8:30 am ET. In recent years, quarterly earnings consistently beat estimates. For the third quarter, analysts forecast earnings of $1.48 per share, which is sharply higher than the $1.38/share the company earned in the year-ago quarter. It is estimated that Q3 revenues increased 4.8% annually to $1.51 billion.

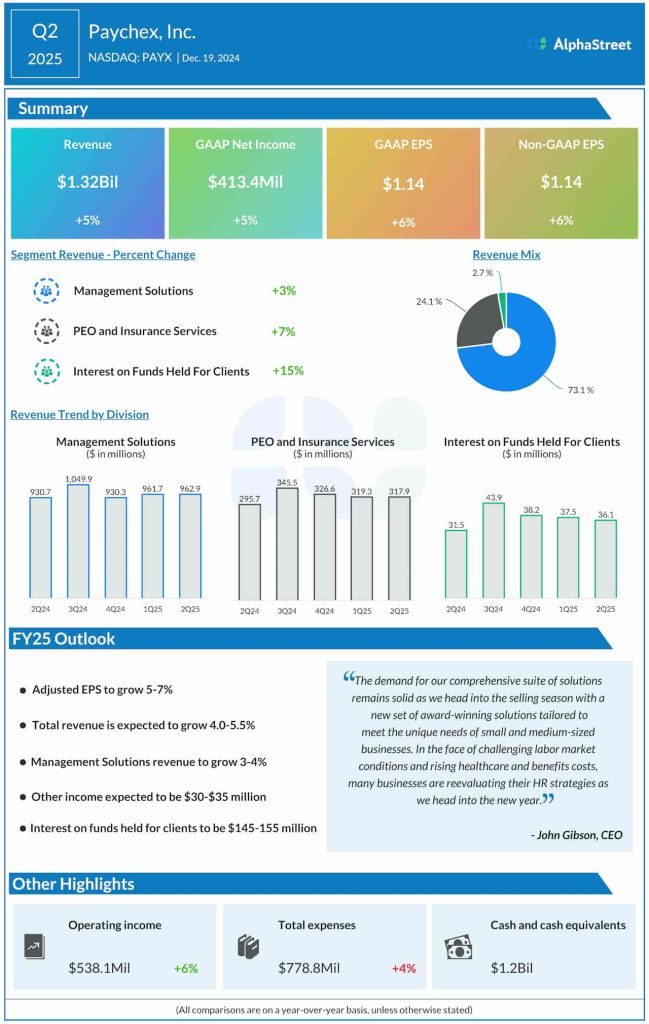

In the second quarter, Paychex’s revenues increased 5% year-over-year to $1.32 billion, in line with analysts’ estimates. Revenue from Management Solutions, the largest operating segment, grew 3%. Driven by the positive top-line performance, adjusted earnings rose to $1.14 per share in the November quarter from $1.08 per share in the same period of 2024, exceeding expectations. Net income, including special items, was $413.4 million or $1.14 per share in Q2, up from last year’s profit of $392.7 million or $1.08 per share.

Road Ahead

For the whole of fiscal 2025, Paychex executives forecast a 5-7% increase in adjusted earnings. Full-year revenue is expected to grow between 4% and 5.5%, with Management Solutions revenue rising an estimated 3-4%. Small and medium-sized enterprises constitute a significant portion of Paychex’s clientele. Challenges facing that business segment, including labor shortage and nonavailability of affordable capital, can have an impact on Paychex’s business.

From Paychex’s Q2 2025 earnings call:

“The demand for our HR technology and advisory solutions remains healthy as we head into the key selling season. A challenging labor market and rising healthcare and benefits costs are forcing many small businesses to re-evaluate their HR strategies and technology needs and they can rely on Paychex to help them succeed. Our sales activities and pipelines are strong, most notably in our PO and middle-market HCM businesses, where we have invested, as you know, to take advantage of the growth opportunities we see in these attractive markets and where we believe our breadth of solutions provide us with a competitive advantage.”

Paycor Deal

Earlier this year, Paychex signed an agreement to acquire Paycor, a leading provider of HCM and payroll software, to enhance its AI-driven HR technology capabilities. The $4.1 billion transaction, which is subject to customary closing conditions, is expected to close in the first half of calendar 2025. Meanwhile, as a longstanding leader in the industry, Paychex leverages its increasing market share and extensive data resources to maintain a competitive edge over rivals.

After retreating from its recent peak, Paychex’s stock has remained almost flat. The shares traded lower on Tuesday afternoon, after opening at $147.99.