The company experienced positive momentum in HR solutions administrative services organization with double-digit worksite employee growth and solid sales performance in professional employer organization (PEO), retirement, and insurance services.

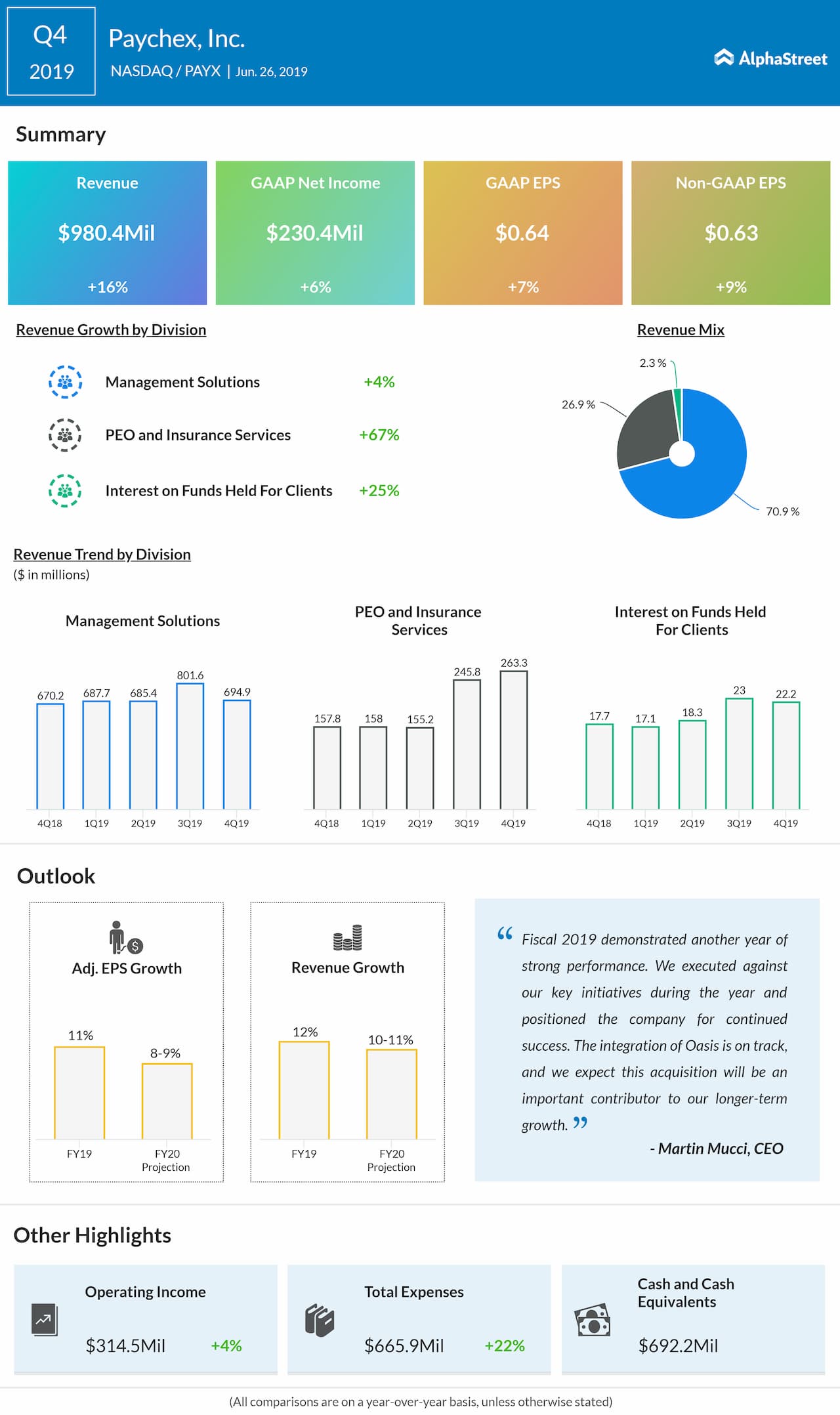

Total revenues grew by 16% to $980.4 billion. Excluding the acquisition of Oasis Outsourcing Group Holdings, total revenue rose by about 5% compared to the same period last year.

Looking ahead into fiscal 2020, the company expects total revenue growth in the range of 10% to 11% and earnings growth of about 8%. Adjusted earnings are predicted to grow in the range of 8% to 9% for the full year.

For fiscal 2020, management solutions revenue is anticipated to grow about 4% and PEO and Insurance Services revenue is predicted to grow in the range of 30% to 35%. Interest on funds held for clients is anticipated to grow in the range of 4% to 8%. Operating margin is projected to be about 36%, reflecting the expected impact of higher PEO direct insurance costs.

Also read: Workday Q1 2020 earnings

For the fourth quarter, Management Solutions revenue rose by 4%. Retirement services revenue also benefited from an increase in the number of plans served as well as an increase in revenue earned on the asset value of participants’ 401(k) funds.

PEO and Insurance Services revenue jumped by 67% year-over-year. Excluding the acquisition of Oasis, PEO and Insurance Services revenue increased by about 10%. Insurance Services revenue benefited from an increase in the number of health and benefit clients and applicants.

Interest on funds held for clients increased 25%, resulting primarily from higher average interest rates earned. Funds held for clients average investment balances were flat for the fourth quarter, as the impact of lower client withholdings resulting from the Tax Act and changes in client base mix offset the impact of wage inflation.

Shares of Paychex ended Tuesday’s regular session down 1.60% at $84.80 on the Nasdaq. Following the earnings release, the stock declined over 2% in the pre-market session.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.