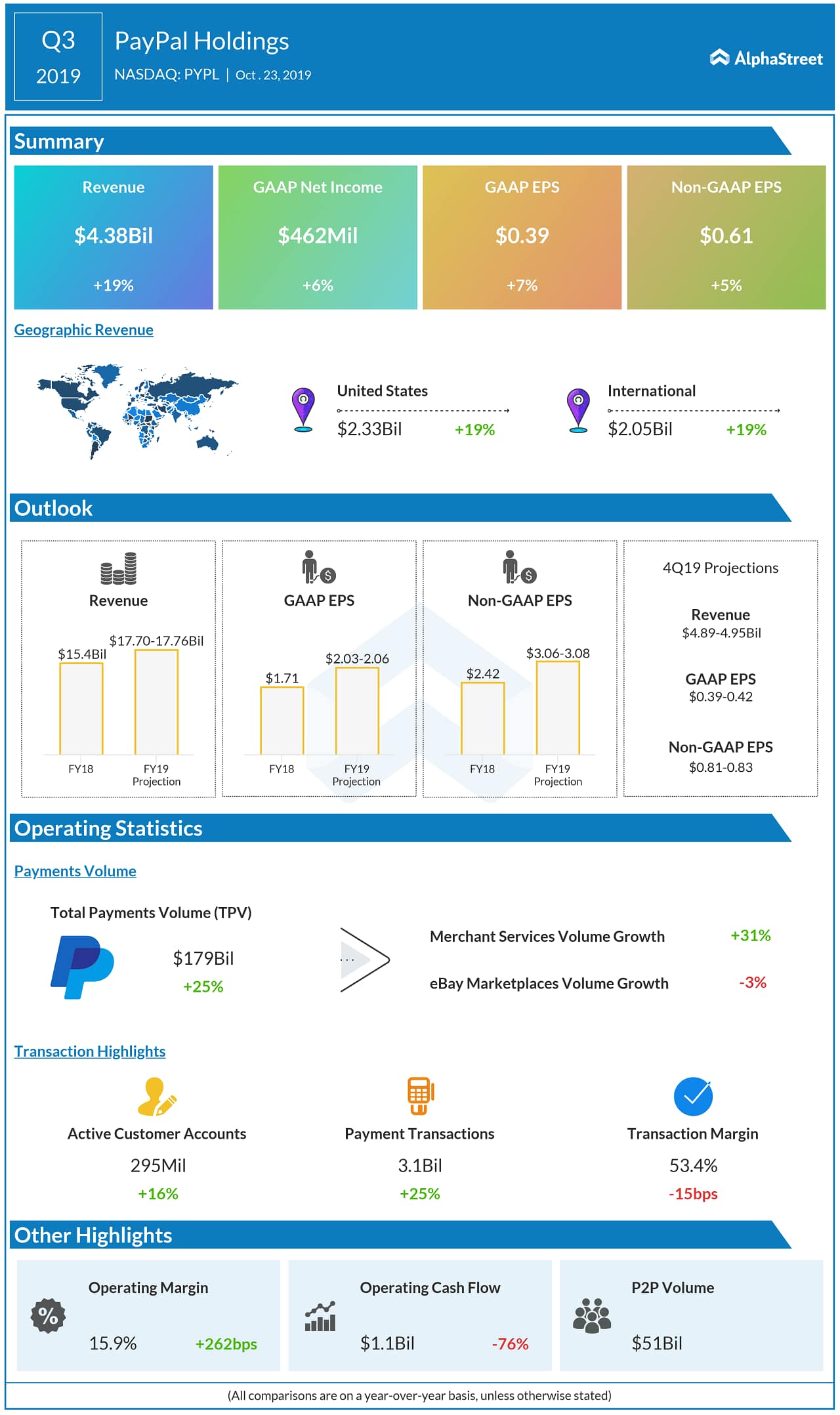

Net new active accounts of 9.8 million brought the total active accounts to 295 million accounts, up 16%. Payment transactions surged 25% to 3.1 billion, and $179 billion in total payment volume was up 25%.

PYPL shares jumped 4.5% immediately following the announcement. The stock, which is yet to fully recover from the downtrend that followed the second-quarter results, trades slightly above the $100-mark ahead of the earnings release. The shares have gained 16% since the beginning of the year.

READ: Budweiser, Corona to drive Anheuser Busch InBev Q3 earnings

Outlook

For full-year 2019, PayPal expects revenue to grow 15% on an FX-neutral basis, to a range of $17.70 – $17.76 billion. For the same period, GAAP EPS is anticipated in the range of $2.03 – $2.06 and non-GAAP EPS in the range of $3.06 – $3.08.

CEO Dan Schulman said, “This quarter we announced that we will be the first foreign payments platform to be licensed to provide online payment services in China, a very significant development that has the potential to meaningfully expand our addressable market.”

Last week, American Express (AXP) said its third-quarter earnings grew in double digits to $2.08 per share as revenues rose to about $11 billion helped by an increase in cardmember spending

Listen to on-demand earnings calls and hear how management responds to analysts’ questions