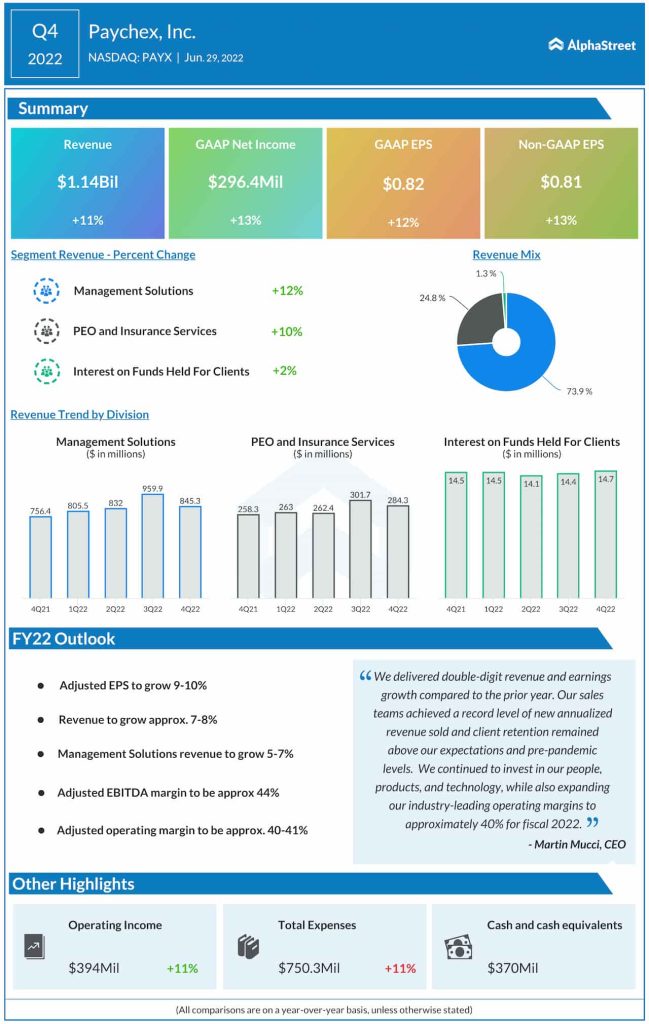

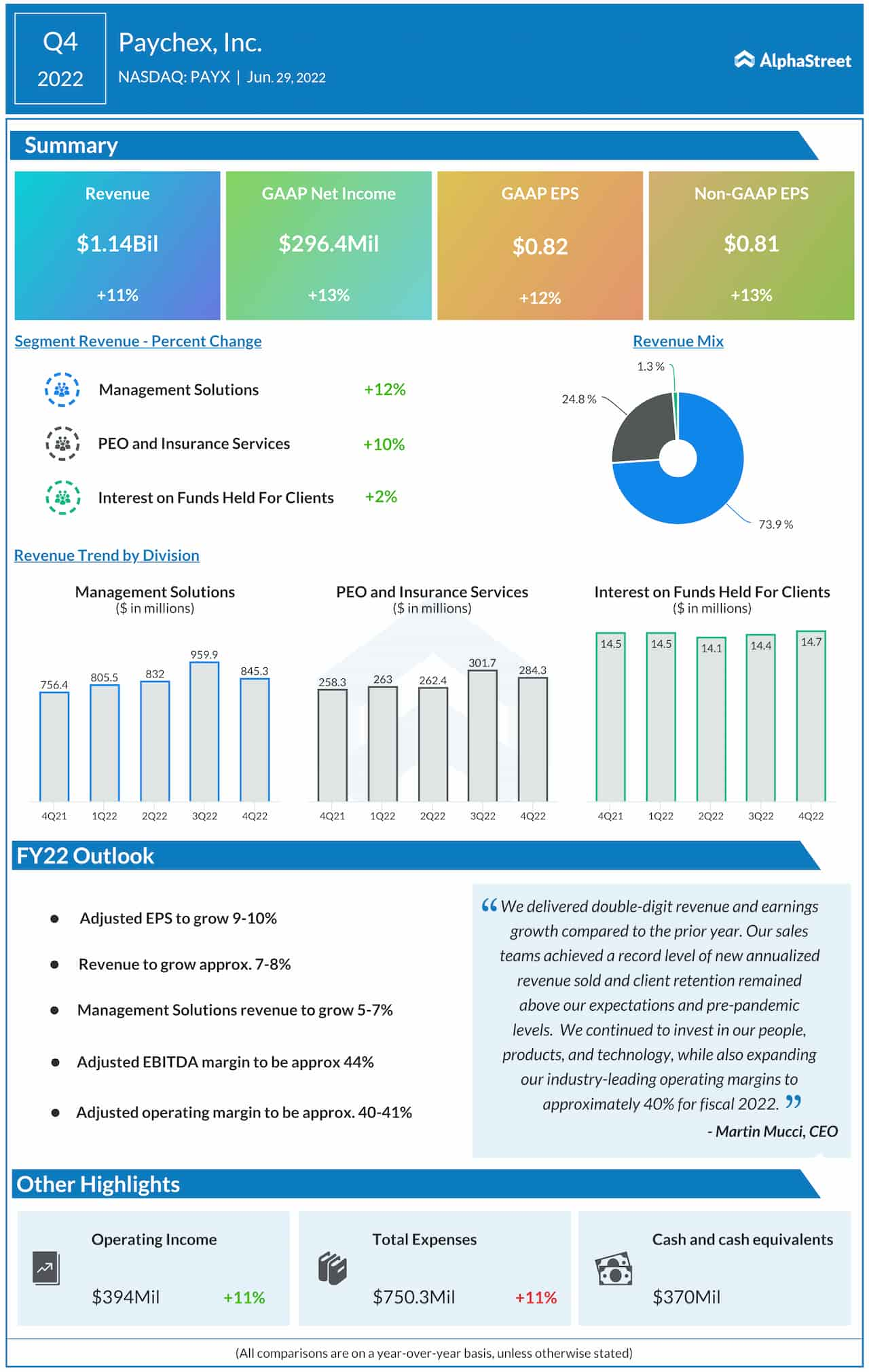

At $1.14 billion, fourth-quarter revenues were up 11% year-over-year and above the consensus forecast. The top line benefited from strong performance by the main operating segments.

Adjusted profit, excluding special items, moved up to $0.81 per share from $0.72 per share in the comparable period in fiscal 2021. On a reported basis, net income was $296.4 million or $0.82 per share in the latest quarter, compared to $263 million or $0.73 per share in the prior-year period.

Check this space to read management/analysts’ comments on Paychex’s Q4 2022 results

“We delivered double-digit revenue and earnings growth compared to the prior year. Our sales teams achieved a record level of new annualized revenue sold and client retention remained above our expectations and pre-pandemic levels,” said Martin Mucci, CEO of Paychex.