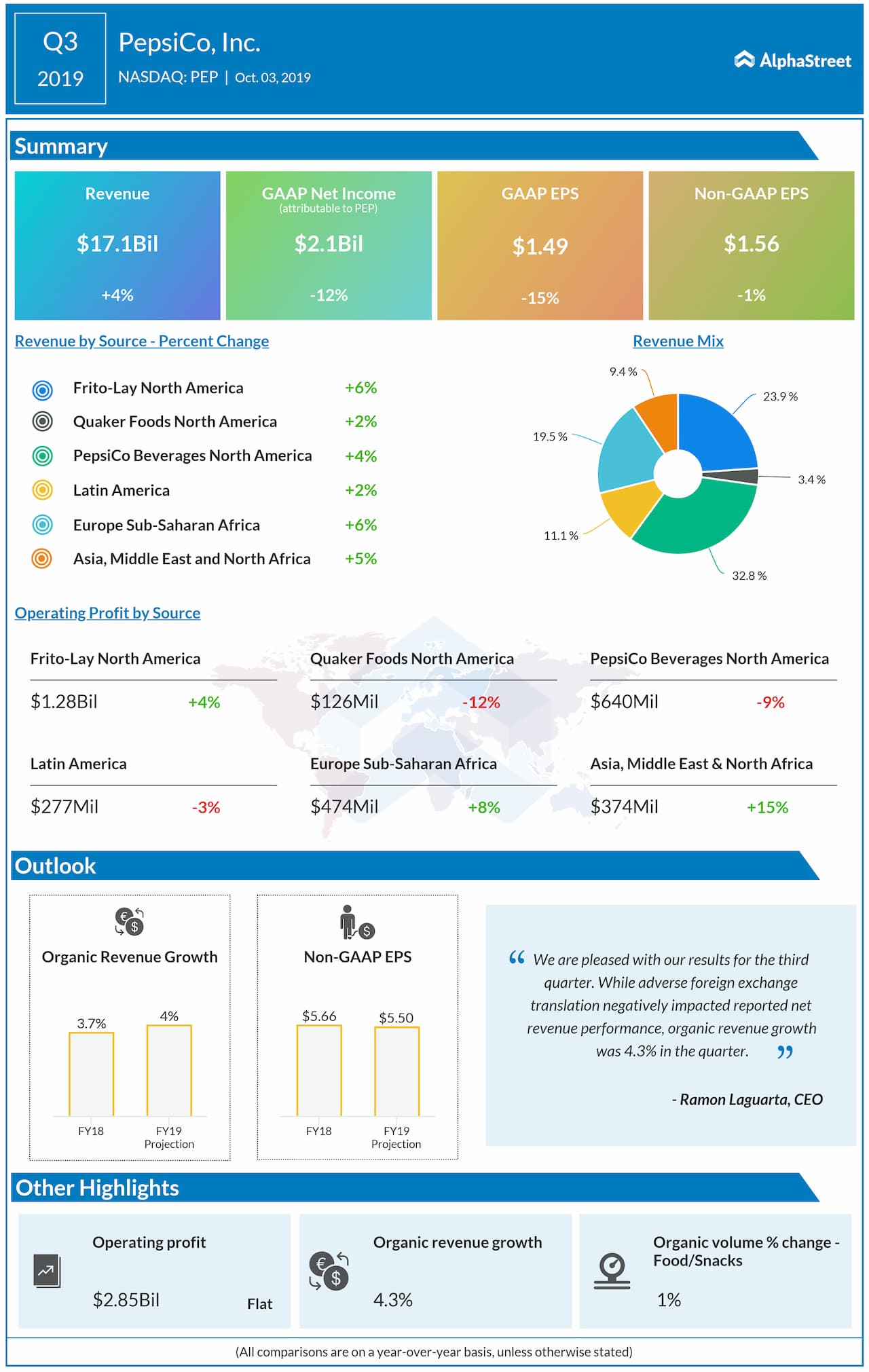

Net earnings were $2.1 billion, or $1.49 per share, compared

to $2.4 billion, or $1.75 per share, in the prior-year period. Core EPS amounted

to $1.56, surpassing forecasts of $1.50.

CEO Ramon Laguarta said, “We are making good progress against our strategic priorities and our businesses are performing well as we continue to make the necessary investments in our capabilities, brands, manufacturing and go-to-market capacity to propel our future growth.”

During the quarter, PepsiCo posted revenue increases across all its segments, both on a reported and organic basis. The highest growth was recorded in the Europe Sub-Saharan Africa segment, which rose 6% to $3.3 billion. This was followed by Frito-Lay North America which grew 5.5% to $4.1 billion.

The company saw mixed results for segment operating profit. Profits increased in the Frito-Lay North America, Europe Sub-Saharan Africa, and Asia, Middle East and North Africa segments. The remaining segments saw declines with the highest drop of 12% in Quaker Foods North America.

PepsiCo expects to meet or exceed its full-year 2019 organic revenue growth target of 4%. The company also expects core EPS to be $5.50, down 3% from 2018. Core constant currency EPS is expected to decline by approx. 1%.

Rival beverage company Coca-Cola (KO) is scheduled to unveil its third-quarter numbers on October 18 before the opening bell. Market watchers predict a 2% dip in earnings to $0.56 per share.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions