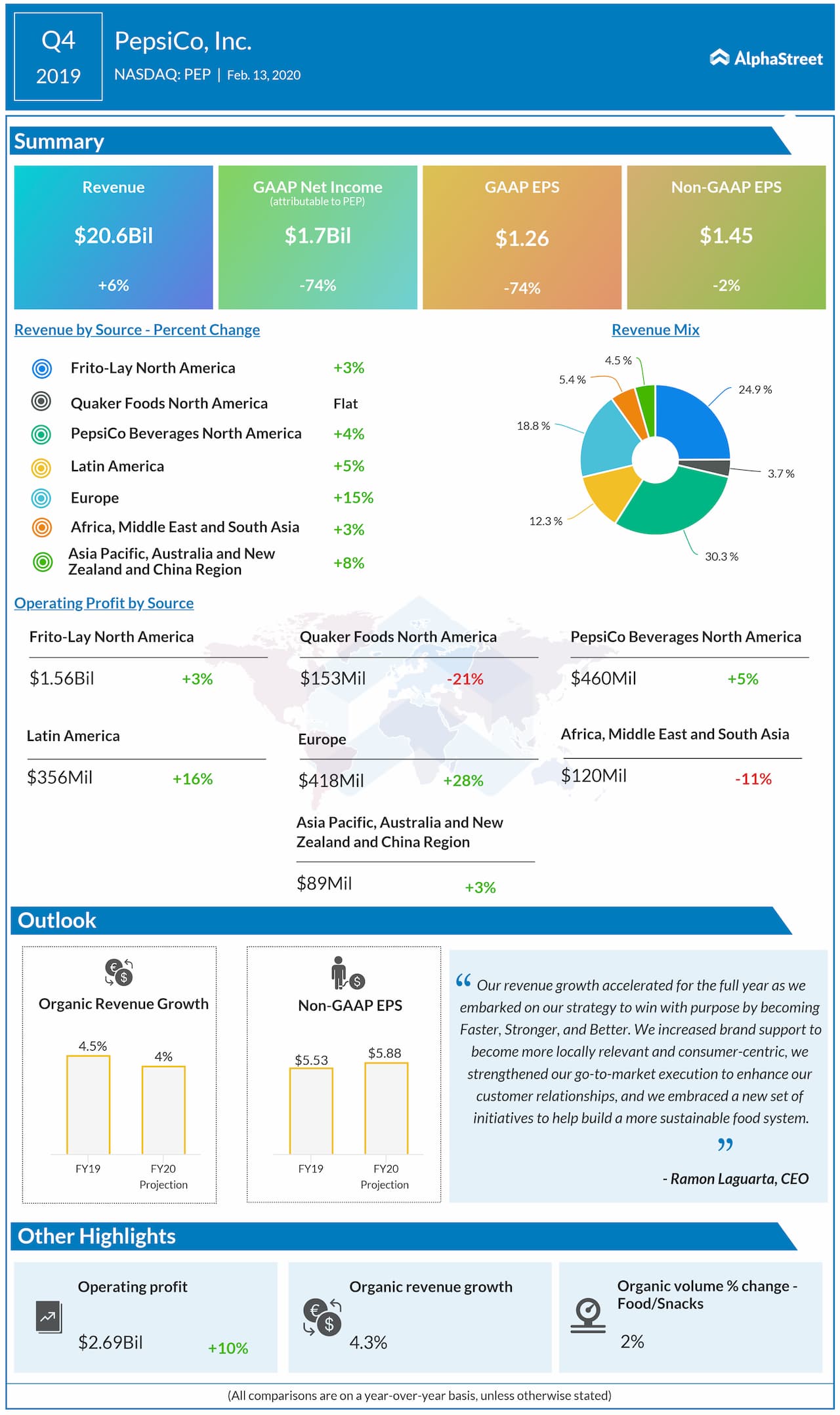

On a GAAP basis, net income was $1.76 billion, or $1.26 per

share, compared to $6.8 billion, or $4.83 per share, in the prior year period. Last

quarter’s results included a one-time benefit from income taxes of $4.9 billion.

Core EPS was $1.45, slightly above forecasts of $1.44.

During the quarter, the company saw revenue increases across all its segments and geographies both on a reported and organic basis, with the exception of the Quaker Foods North America division where revenues remained flat.

Also read: PepsiCo Q4 2019 Earnings Preview

For fiscal year 2020, organic revenue growth is expected to

be 4%. Core constant currency EPS is expected to increase by 7%. Core EPS is

estimated to increase by 6% to $5.88.

PepsiCo declared a 7% increase in its annualized dividend to

$4.09 per share, effective with the dividend expected to be paid in June 2020.

The Frito-Lay business has been growing value share in the salty, savory and micro snack categories. The investments being made in marketing and product innovation are paying off with strong revenue growth in large brands such as Doritos, Cheetos and Fritos. The beverages division has benefited from strong growth in Gatorade and Bubly.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions