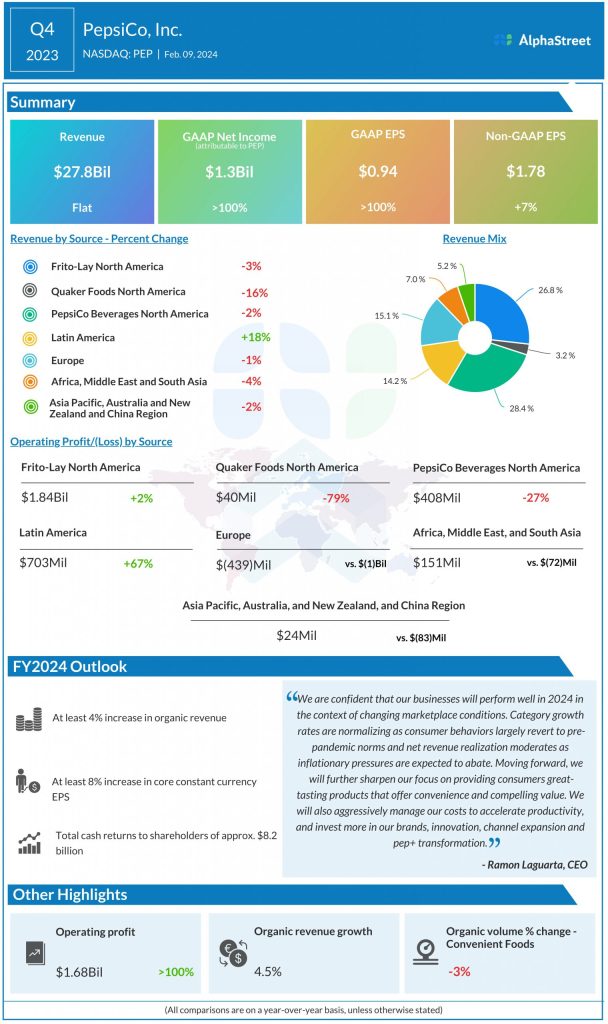

While the inflation-induced pressure on consumer spending persists, sales should benefit from improvements in sentiment amid easing recession fears and economic recovery. Maintaining its long-term share repurchase and dividend program, PepsiCo aims to return a total of $8.2 billion to shareholders in fiscal 2024. It is looking for an organic revenue growth of about 4% and a core constant currency EPS growth of about 8%.

Q1 Data on Tap

When PepsiCo reports March-quarter results on Tuesday, April 23, at 6:00 am ET, Wall Street will be looking for adjusted earnings of $1.52 per share, which is broadly unchanged from the year-ago quarter. Market watchers forecast a 15% jump in Q1 revenues to $18.1 billion.

Ramon Laguarta, the company’s CEO, said at the Q4 earnings call, “We feel good about the consumer in ‘24 in the U.S. We feel good in the sense of very low unemployment, we feel good about the fact that we think wages will go higher than inflation next year. And we hope that by the summer interest rates will go down and that will create another source of oxygen for this possible incoming household. So, we feel good about the consumer in the U.S., but if you think about those three elements, we decided to have at least four as the guidance for the top line.”

Mixed Q4

In the final three months of fiscal 2023, the company generated total revenues of $27.8 billion, which is in line with the revenue it generated in the prior-year period and below the market’s projection. The only operating segment that registered sales growth is Latin America, up 18%, which was offset by declines in the other segments.

Earnings, adjusted for one-off items, moved up 7% annually to $1.78 per share in Q4 and topped expectations. Unadjusted profit more than doubled to $1.3 billion or $0.94 per share. Interestingly, PepsiCo’s quarterly profit consistently beat/matched analysts’ estimates for more than a decade.

PEP traded higher in early trading on Thursday, after opening the session around $170. The stock has gained about 6% in the past six months.