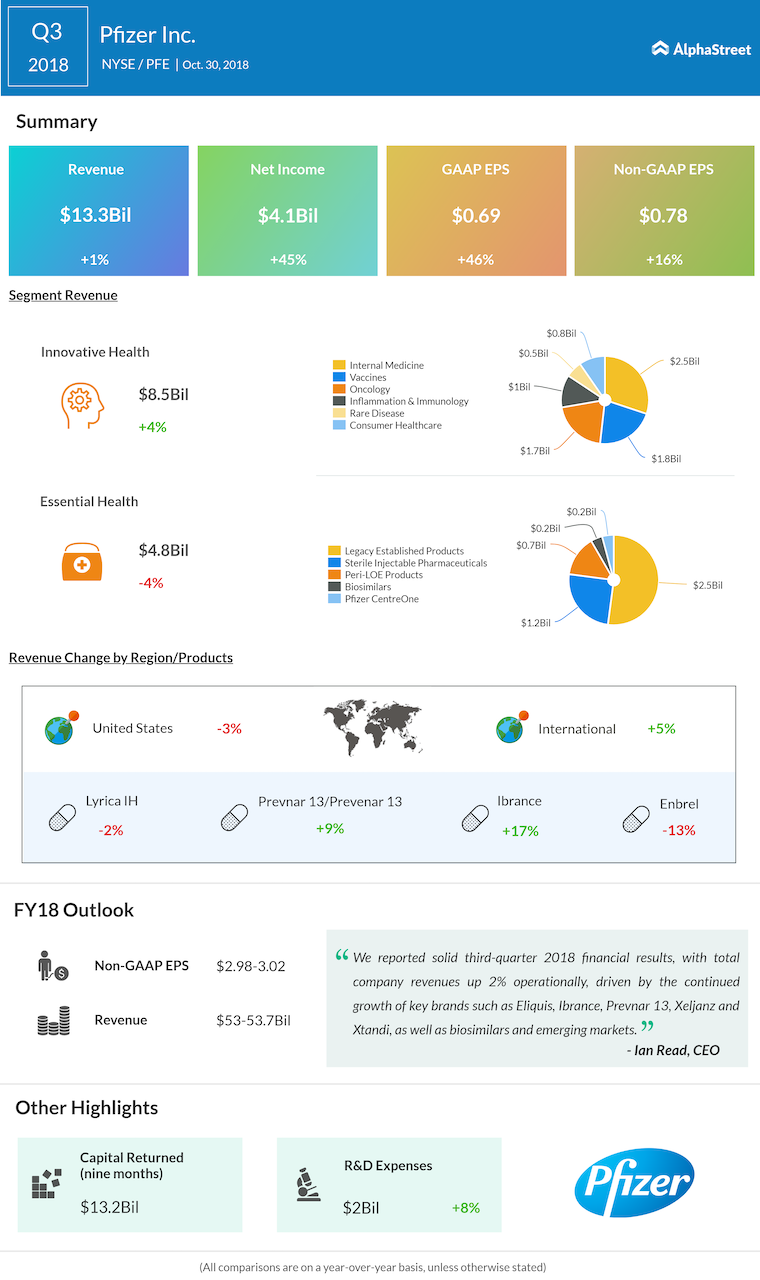

Reported net income grew 45% to $4.11 billion, or $0.69 per share, while adjusted net income rose 15% to $4.6 billion, or $0.78 per share, from the prior-year period.

Related: Pfizer Q3 2018 Earnings Transcript

During the quarter, Pfizer posted a 5% increase in revenues in its Innovative Health segment, on an operational basis, driven by growth in brands such as Eliquis, Ibrance and Xeljanz. The segment revenues were negatively impacted by the loss of exclusivity of Viagra and the shift in reporting of Viagra revenues in the US and Canada to the Essential Health business, as well as lower revenues for Enbrel due to biosimilar competition.

Revenues in the Essential Health segment declined 4% operationally, mainly due to operational declines in the Legacy Established Products, Peri-LOE Products and the SIP portfolios in developed markets. This decline was partially offset by growth in emerging markets and biosimilars.

Earnings Preview: Key brands could fuel Pfizer’s Q3 revenues

Pfizer updated its guidance range for the full year of 2018 and now expects revenues to come in the range of $53 billion to $53.7 billion versus the previous range of $53 billion to $55 billion. The revised outlook reflects lower-than-expected Essential Health revenues, primarily due to continued legacy Hospira product shortages in the US, and unfavorable changes in foreign exchange rates.

Adjusted diluted EPS is now expected to come in the range of $2.98 to $3.02 versus the prior range of $2.95 to $3.05. The midpoint of the EPS guidance range remains unchanged from the July update. The updated EPS guidance reflects around $12 billion in expected share repurchases for 2018.

As announced earlier this month, COO Albert Bourla will take over the role of CEO from Ian Read on January 1, 2019. Mr. Read will transition from the position of Chairman and CEO to Executive Chairman of the Board of Directors.

Taking into account the importance of digital technologies in research and other business processes, Pfizer is appointing a Chief Digital Officer to accelerate its digital capabilities. Lidia Fonseca will join the company as Executive Vice President, Chief Digital and Technology Officer in January 2019.