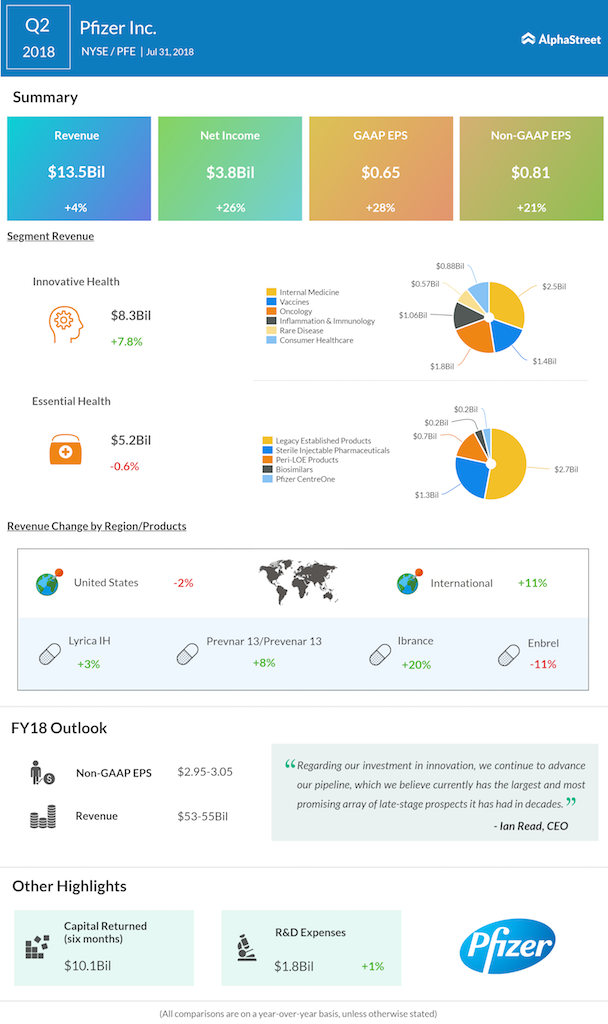

Revenue rose 4% to $13.5 billion driven by the continued growth of key brands as well as biosimilars. This was partially offset by product losses of exclusivity, a decline in legacy Established Products in developed markets and ongoing legacy Hospira supply shortages.

Looking ahead into the full year 2018, Pfizer lowered its revenue outlook to the range of $53 billion to $55 billion from the prior estimate of $53.5 billion to $55.5 billion. The revenue estimate was updated solely to reflect recent unfavorable changes in foreign exchange rates in relation to the US dollar from mid-April 2018 to mid-July 2018.

However, adjusted EPS guidance was lifted upward to $2.95-$3.05 from the previous forecast of $2.90-$3.00, reflecting share repurchases totaling about $6.1 billion already completed in 2018.

“We are looking ahead to several potential near-term opportunities in core therapeutic areas, and continue to see the potential for approximately 25-30 approvals through 2022, of which up to 15 have the potential to be blockbusters. We continue to believe our pipeline positions us to deliver life-changing medicines to patients while enhancing shareholder value,” executive chief Ian Read said.

Innovative Health revenue increased by 5% operationally, primarily driven by continued growth from key brands in emerging markets and the US. Operational revenue growth for Eliquis, Ibrance, Xeljanz, and Xtandi was 42%, 19%, 37% and 21%, respectively.

During the first half of 2018, Pfizer returned $10.1 billion directly to shareholders through a combination of $4 billion of dividends and $6.1 billion of share repurchases.

EC approves biosimilar for cancer

In a separate release, Pfizer said the European Commission (EC) has approved Trazimera, a biosimilar to cancer treatment drug Herceptin.

Related: Pfizer plans to split into 3 units, foray into hospital business

Shares of Pfizer ended Monday’s regular trading session up 0.47% at $38.59 on the NYSE. The stock rose 6% year-to-date and 16% in the past year.

Related Infographics: Q1 Earnings