Consumer goods giant Procter & Gamble (PG) reported higher organic sales and earnings for the first quarter when strong demand for beauty products drove up shipments. The above-consensus results triggered a rally and the stock gained about 5% in premarket trading Thursday. The company also reaffirmed its full-year guidance.

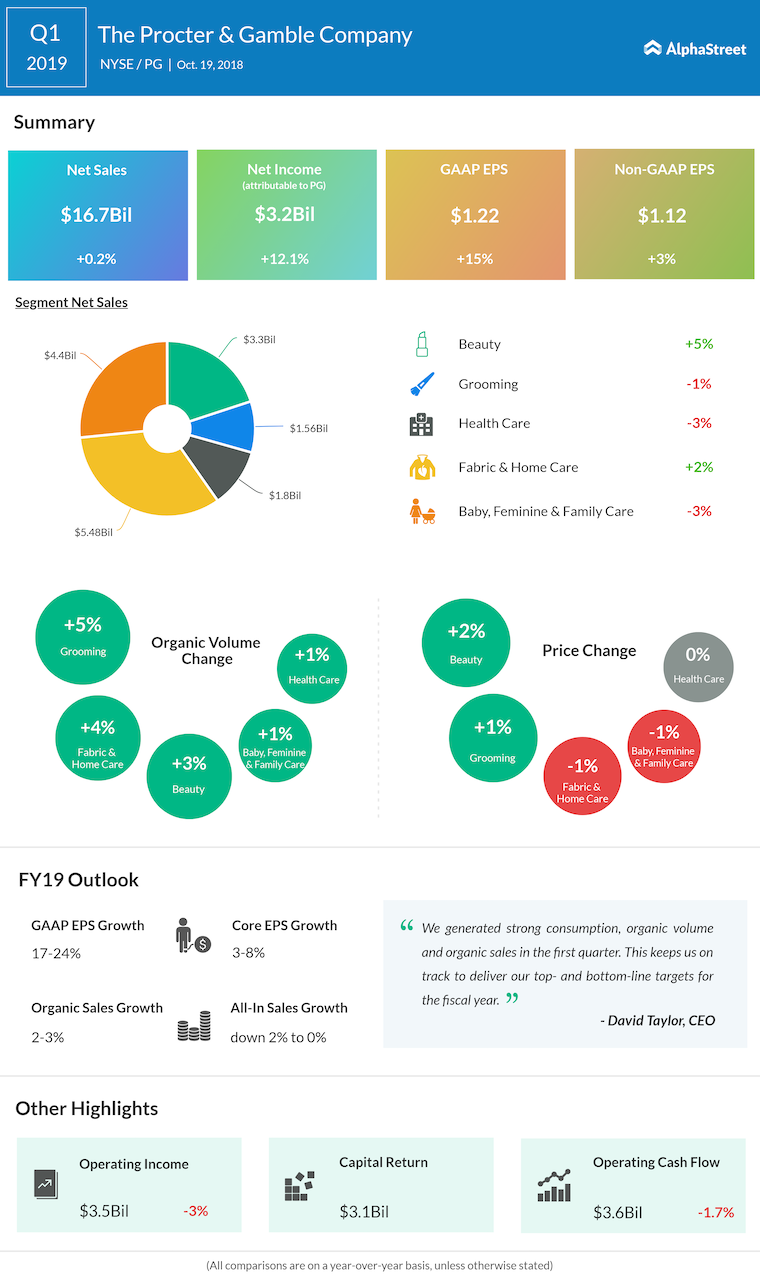

Net income attributable to Procter & Gamble shareholders rose 12% to $3.2 billion in the first quarter and earnings per share climbed 15% to $1.22. Core earnings, adjusted for one-off items, moved up 3% to $1.12 per share. Benefitting from gains from the dissolution of the PGT Healthcare partnership and lower tax rate, the bottom-line came in slightly above estimates.

During the September quarter, sales of the Cincinnati, Ohio-based conglomerate remained broadly unchanged at $16.7 billion as higher demand for beauty products was offset by decline in the other major segments. While the top-line was negatively impacted by unfavorable foreign exchange, organic sales grew 4% year-on-year.

“We generated strong consumption, organic volume and organic sales in the first quarter. This keeps us on track to deliver our top- and bottom-line targets for the fiscal year. Our focus on superiority, productivity and improving P&G’s organization and culture is driving improved results,” said CEO David Taylor.

The management reaffirmed its 2019 outlook for organic sales growth in the 2-3% range and guided all-in sales growth between -2% and breakeven. It continues to expect core earnings to grow in the 3-8% range, compared to the preceding year. Full-year adjusted free cash flow productivity is estimated at 90% or above.

The improvement in the results, compared to the previous quarter, has come as a much-needed boost for the company that struggles to cope with losing market share amid growing competition and higher expenses. Of late, margins have come under pressure from the heavy discounts offered by the company to compete with private labels and smaller players.

Shares of P&G closed the previous trading session lower but gained about 5% in premarket trading. The stock has lost about 12% since the beginning of the year.