A communiqué from the company earlier this month said it will file for voluntary reorganization by the end of January

The unfortunate episode raises several questions about the safety and reliability of utility services and points to the urgent need to adopt more effective measures to protect both the environment and the businesses involved. PG&E’s action plan includes restoration and rebuilding activities in the affected areas, which will be taken up in association with the federal agencies and community organizations.

Related: PG&E Corp. Q3 2018 Earnings Conference Call Transcript

John Simon, CEO of the company, said, “Our most important responsibility is and must be safety, and that remains our focus. To be clear, we have heard the calls for change and we are determined to take action throughout this process to build the energy system our customers want and deserve.”

Meanwhile, the management expressed hope that the court would give the green signal for its move to enter into a $5.5-billion agreement for debtor-in-possession financing, with a consortium of banks as the lead arrangers. If approved, the financing will give the company access to the capital required for carrying out maintenance works and investing in safety and reliability during the bankruptcy period.

Among the recent wildfires in which PG&E was involved, the Camp Fire in California was the most destructive. Around 14,000 houses and 500 business units were destroyed in the massive fire, which also caused 86 deaths.

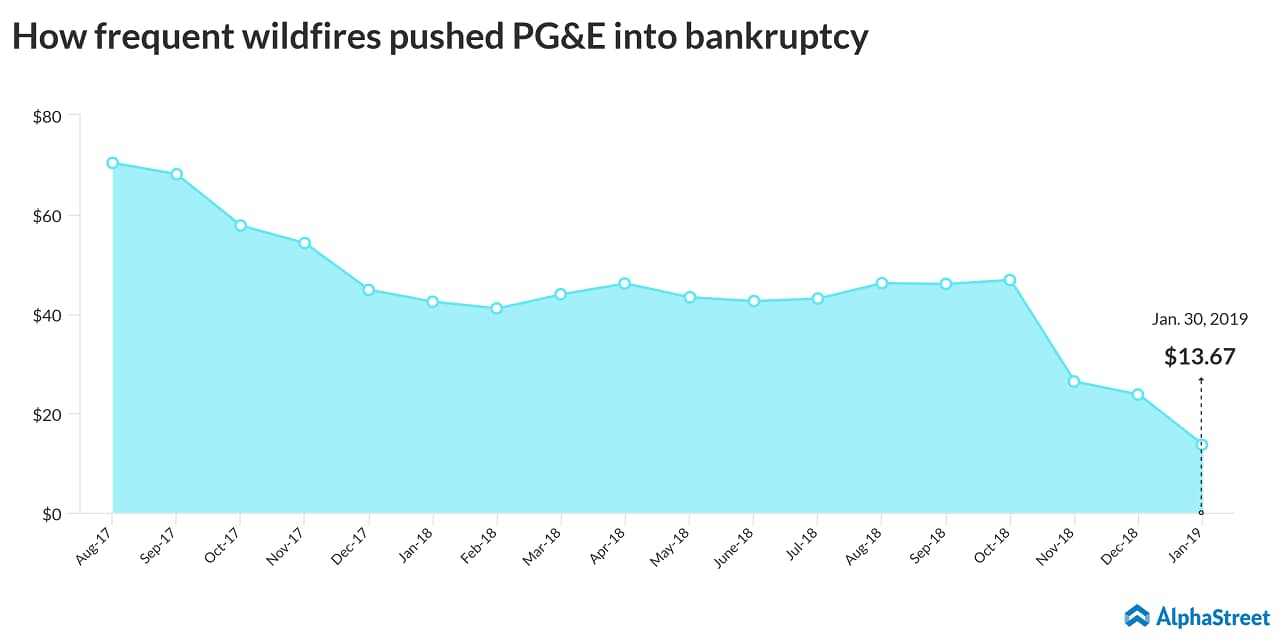

Though PG&E shares dropped in the pre-market following the bankruptcy report, they bounced back and gained about 7% when trading started Tuesday. The stock had fallen to an all-time low earlier this month.