Better-than-expected results

Stellar smoke-free performance

PM’s smoke-free business delivered a solid performance in Q1 2025, with a 15% growth in revenues and a 27.7% rise in gross profit. Shipment volumes were up 14.4%. This segment now accounts for 42% of total revenues and 44% of total gross profit. The company’s smoke-free products are available in 95 markets and it has expanded its multi-category smoke-free portfolio to 46 markets.

The smoke-free momentum was driven by growth in ZYN and IQOS. ZYN nicotine pouches saw shipments in the US increase by 53% to 202 million cans. Outside the US, nicotine pouch volume in cans also grew 53%. During the quarter, shipments almost trebled outside the Nordics and the product is gaining traction in markets like Austria and Switzerland.

IQOS heated tobacco units (HTU) adjusted in-market sales (IMS) volume grew 9.4% in Q1, with strong performance in Japan and Europe. The company expects double-digit growth for the remainder of the year.

Resilience in combustibles

Revenues in the combustibles segment remained flat YoY in Q1 2025 but rose 3.8% on an organic basis, helped by volume growth and strong pricing, partly offset by negative geographic mix. Gross profit grew 2% on a reported basis and 5.3% organically. Cigarette volumes were positive and the company continued to see growth in markets where smoke-free products are not permitted. Marlboro continued to gain market share in the quarter and PM’s overall cigarette category share increased to 24.8%.

Raised profit outlook

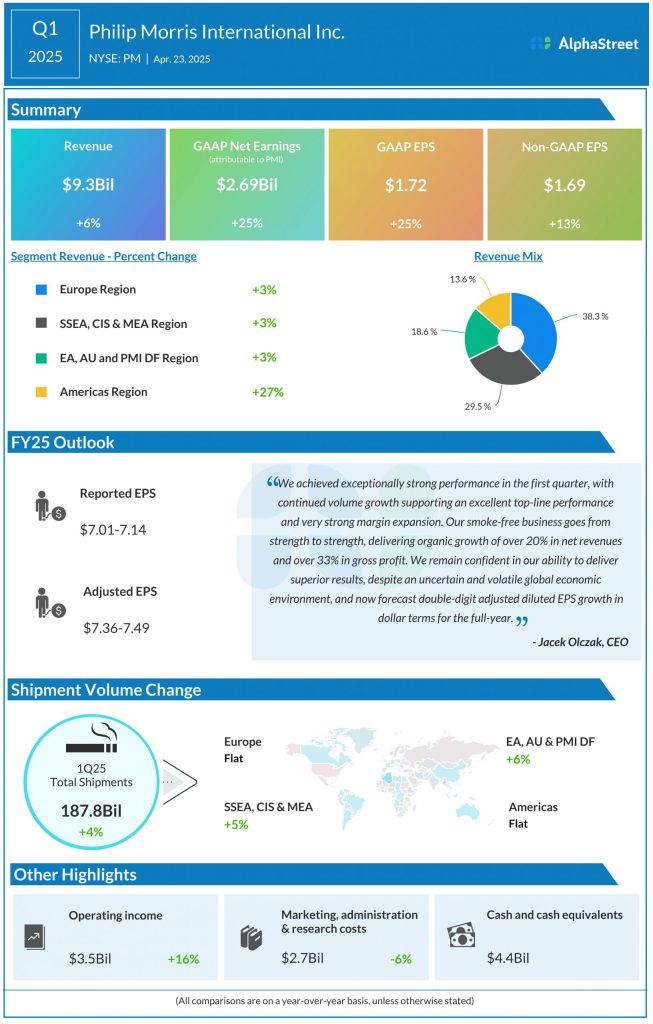

Philip Morris raised its earnings outlook for the full year of 2025 and now expects reported EPS to range between $7.01-7.14 and adjusted EPS to range between $7.36-7.49. It continues to expect organic revenue growth of 6-8% for the year.