— The pre-tax income from Midstream slipped to a loss from a profit last quarter, due to the inclusion of impairments related to its equity investment in DCP Midstream, LLC.

— The Chemicals’ pre-tax income fell by 17% sequential due to a reduction to equity earnings from a lower-of-cost-or-market inventory adjustment.

— Refining’s pre-tax income dropped by 13% quarter-over-quarter due to higher turnaround costs as well as lower realized margins, primarily reflecting weaker gasoline crack spreads in the Central Corridor.

— Marketing and Specialties’ pre-tax income jumped by 41% sequentially on higher margins, driven by favorable market conditions.

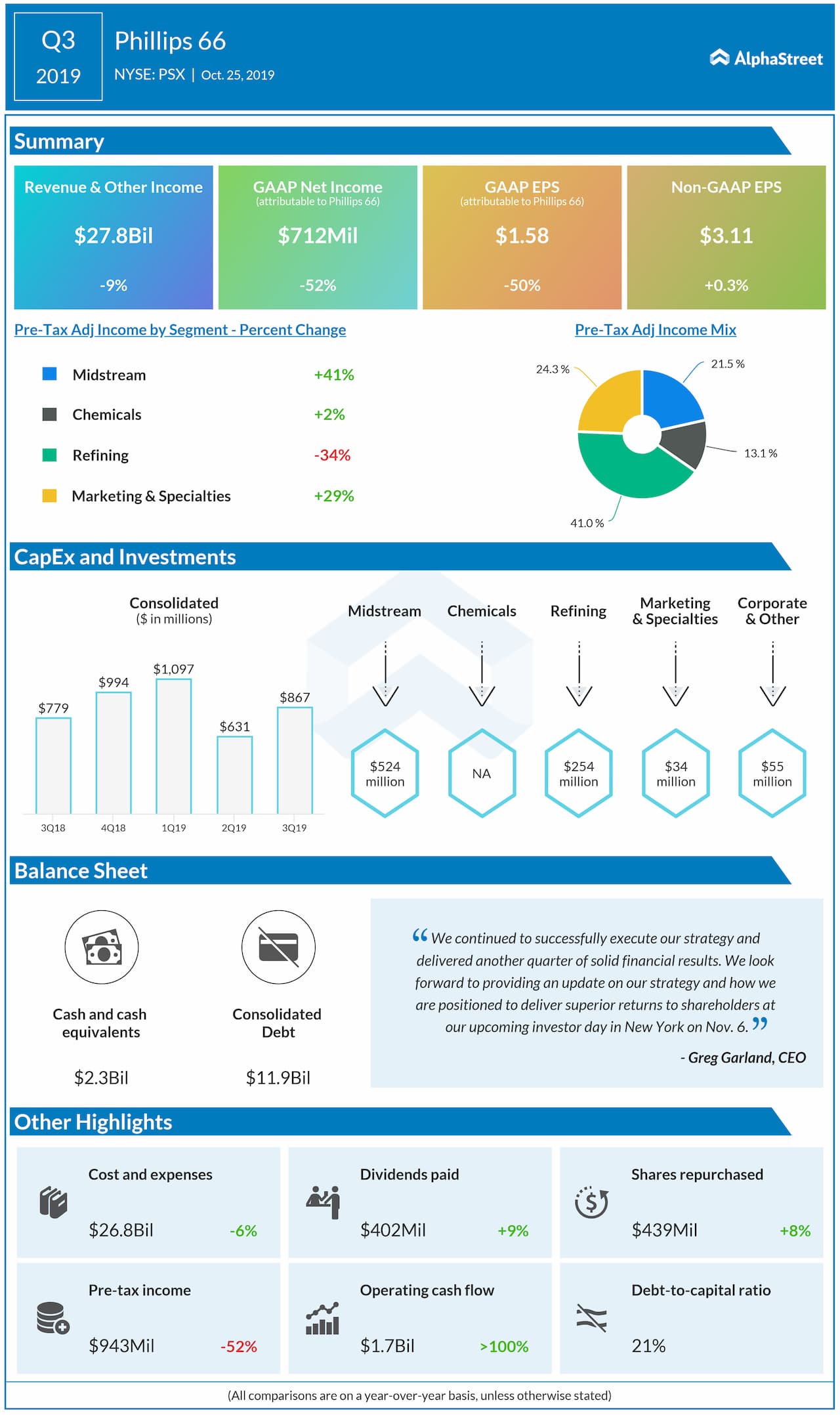

— During the quarter, Phillips 66 funded $402 million of dividends, $439 million of share repurchases and $867 million of capital expenditures and investments.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.