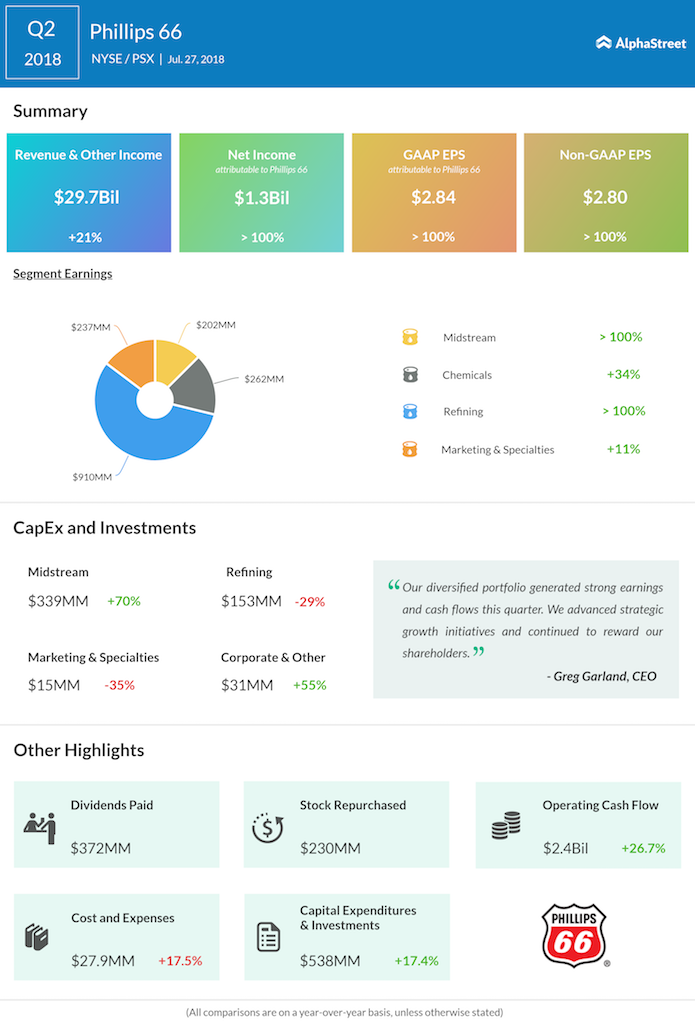

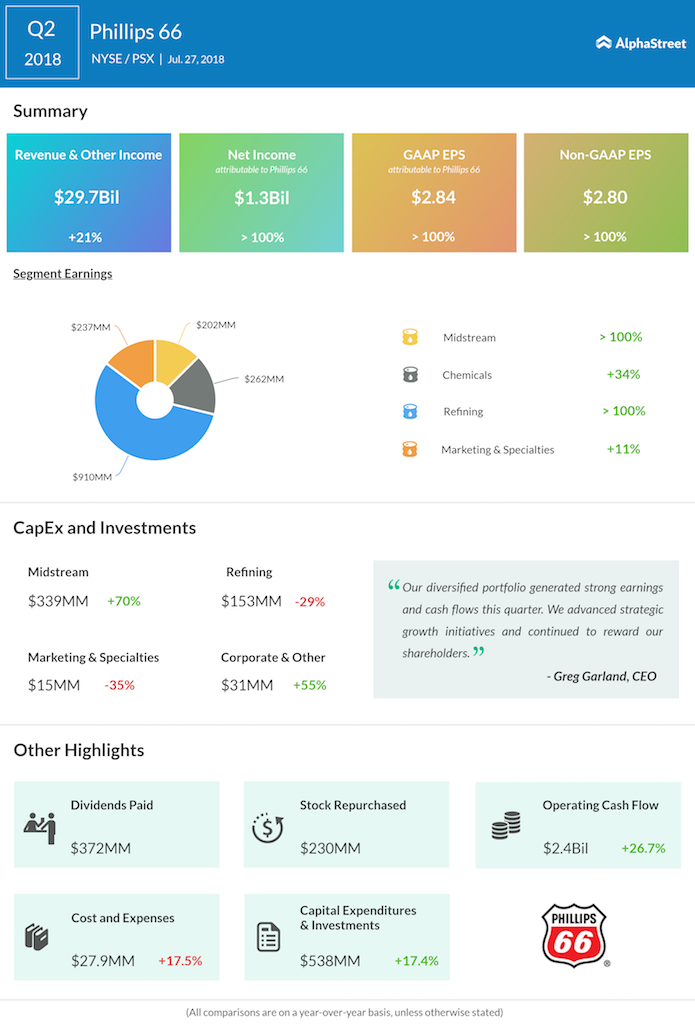

During the quarter, Phillips 66 returned $602 million to shareholders through dividends and share repurchases. Capital expenditures and investments totaled $538 million.

Greg Garland, Chairman and CEO said, “We advanced strategic growth initiatives and continued to reward our shareholders. In Refining, we operated at full capacity and continued to capture the benefits of advantaged feedstocks through our integrated supply network. CPChem achieved full operations at its new US Gulf Coast petrochemicals assets, contributing to solid earnings growth. In Midstream, the expansion of our Sweeny Hub will further grow and optimize our NGL value chain. Most recently, Phillips 66 Partners completed the Gray Oak Pipeline open season to capitalize on growing Permian crude production.”

Crude unit modifications to run more domestic crudes and reduce feedstock costs have been completed at the Lake Charles Refinery, and additional improvements are expected in the fourth quarter. Completion is now expected in the third quarter of 2019.

Related: Phillips 66 Q2 2018 Earnings Call Transcript

Related: Phillips 66 Q1 2018 Earnings Infographic