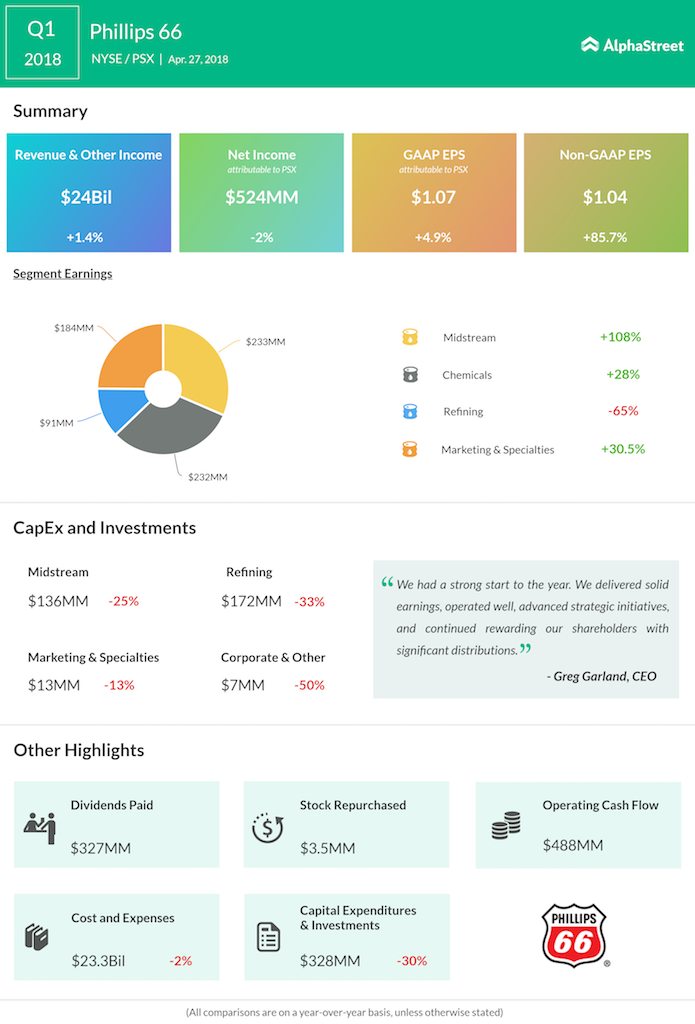

Marketing and specialties net income grew to $184 million from $141 million in the prior-year period. Net income at the Refining unit declined 65% to $91 million.

The company returned $3.8 billion to shareholders through dividends and share repurchases in the quarter.

In Midstream, Phillips’ master limited partnership, Phillips 66 Partners, received sufficient binding commitments to proceed with construction of the Gray Oak Pipeline system, which will provide crude oil transportation from West Texas to destinations in the Corpus Christi and Sweeny/Freeport markets, including the Phillips 66 Sweeny Refinery. The pipeline is expected to start service by the end of 2019.