Strong performance

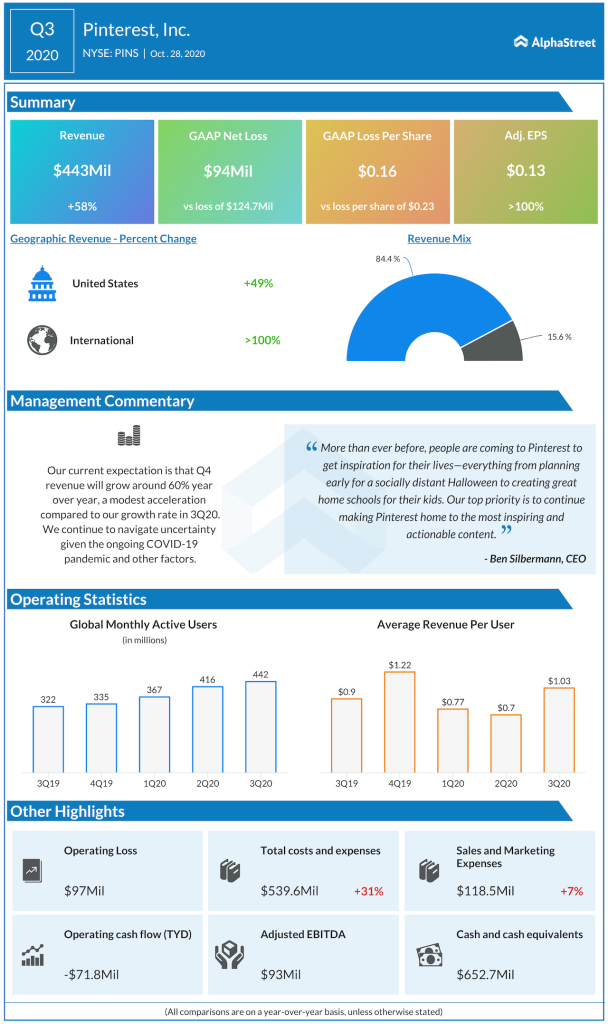

Like its peers in the social media space, Pinterest too saw higher engagement during the pandemic period. Its monthly active users (MAUs) increased consistently in the double-digit range through the first three quarters of the year. In the most recent quarter, global MAUs rose 37%.

Favorable trends

Pinterest will continue to benefit from the rise in ecommerce that took place during the pandemic. The platform has proven to be a good place for buyers and sellers to find what they are looking for and also the apt destination for small brands to expand their presence by reaching out to more people.

The company is also likely to benefit from the pickup in advertising. During the third quarter, Pinterest saw a return in demand from advertisers who had previously put their activities on hold. The platform uses data to help advertisers connect with suitable customers which helps in terms of conversions.

Pinterest has significant opportunity for international expansion. The company has seen consistent double-digit growth in its international user base throughout this year. In the third quarter, international MAUs increased 46% year-over-year while revenues jumped 145%.

Although international ARPU is lower compared to the US, it has been growing consistently recording a rise of 66% in Q3. Based on its cash reserves, Pinterest can invest in further expansion which paves the way for further growth.

Outlook

Pinterest expects revenue to grow around 60% year-over-year in the fourth quarter of 2020. The company still faces uncertainty from the pandemic. However, analysts have projected revenues of $1.63 billion for fiscal year 2020, which reflects a growth of 42% from FY2019. Revenues are further projected to grow 41% to $2.31 billion in FY2021 from FY2020.

Pinterest’s shares were up 2.7% in midday trade on Wednesday.

Click here to read more on social media stocks