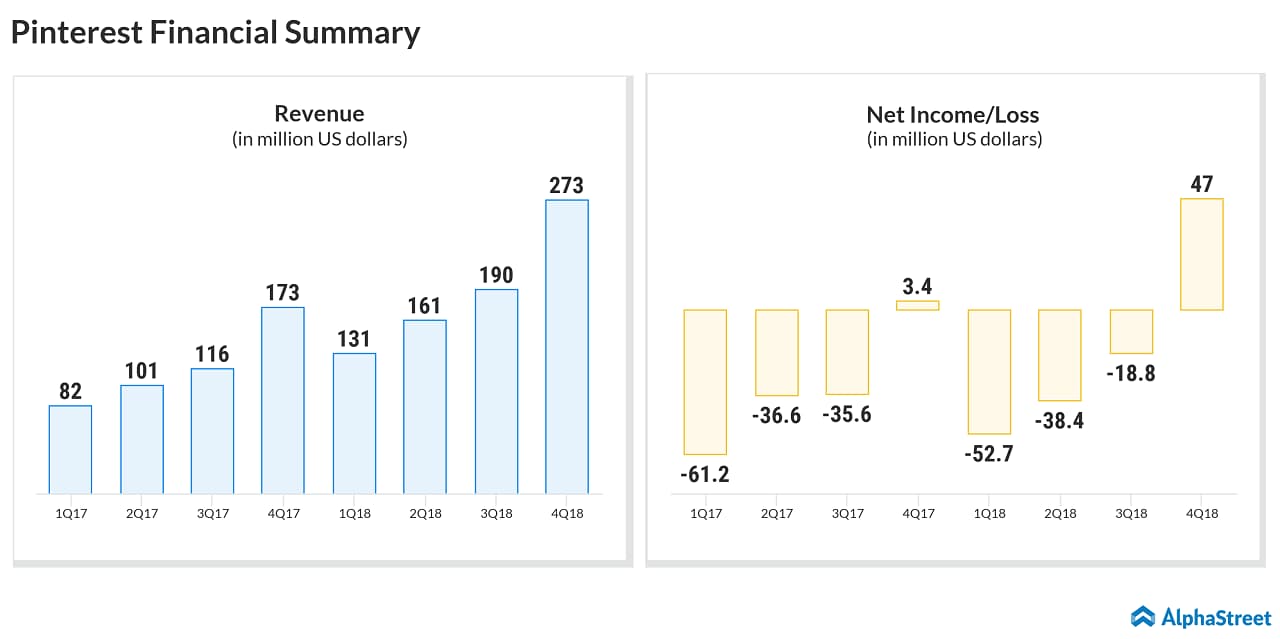

After becoming a public company in April, Pinterest (NYSE: PINS) will be reporting its first quarterly results on Thursday, May 16 after market closes. For the first quarter of 2019, analysts expect the social media firm to post a loss of 15 cents per share on revenue of $200.41 million. Pinterest stock, which jumped 28% on its opening day from IPO price of $19, has surged 8.86% to $28.99 today.

For the three months ended March 31, 2019, the San Francisco, California-based company expects to report revenue in the range of $198.9 million to $201.9 million, representing an increase of 51% to 54% compared to the three months ended March 31, 2018. The increase in revenue was primarily driven by a 22% increase in average monthly active users and a 24% to 26% increase in Average Revenue per User (ARPU) for the low and high estimated preliminary results, respectively.

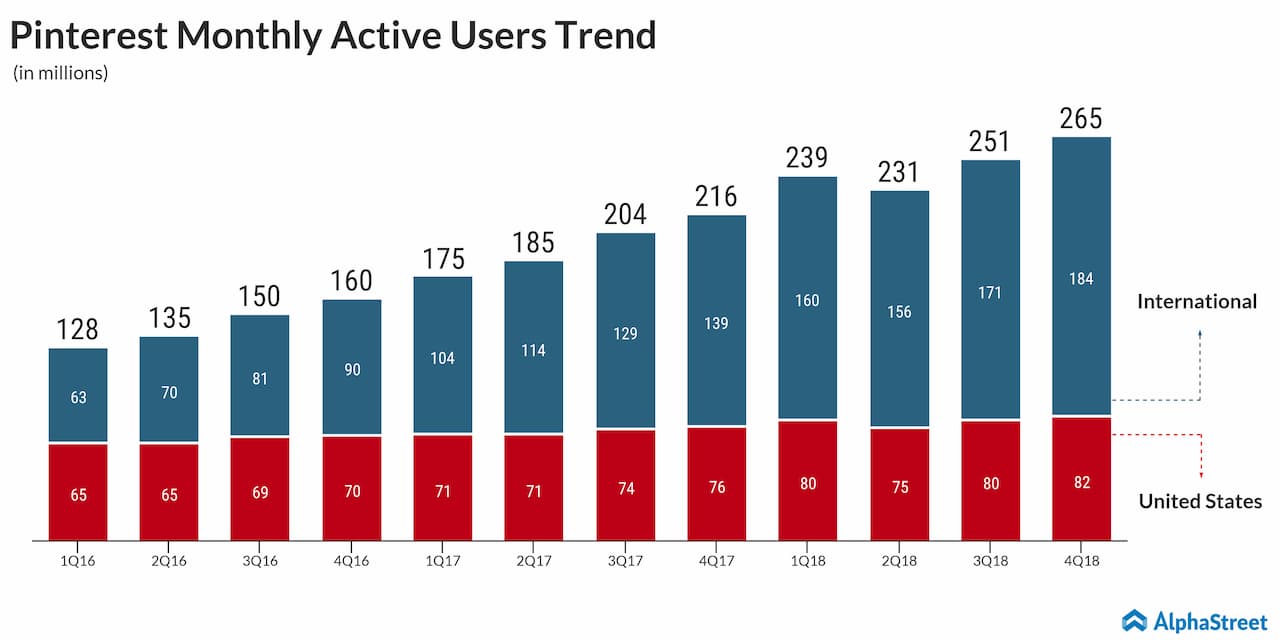

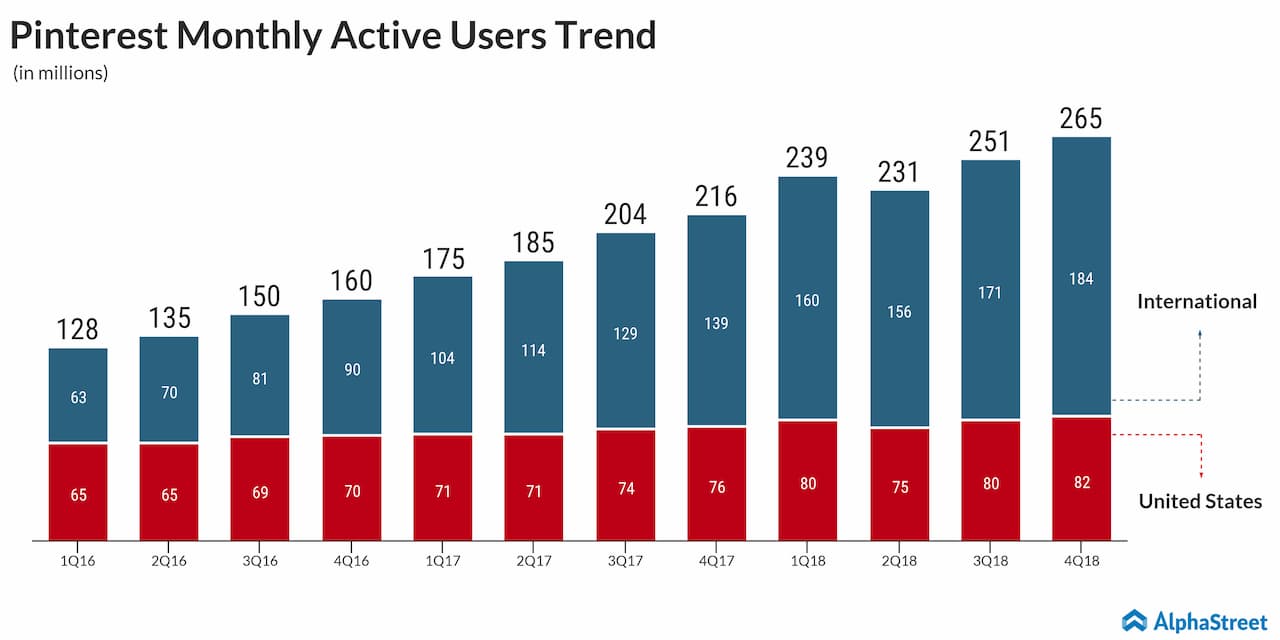

Loss from operations is estimated to be in the range of $50.5 million to $47.5 million, representing a decrease of 8% to 14% compared to the three months ended March 31, 2018. As of March 31, 2019, Pinterest targets to report global MAUs of 291 million, up 22% from March 31, 2018.

User growth trends, which are reflected in the number of MAUs, will be the key factor that will affect Pinterest’s revenue and financial results for the recently ended quarter. Pinterest generates revenue by selling advertising for marketers and companies that gain visibility for their brands. The company expects monthly active users to grow to 291 million as of March 31, 2019 and ARPU to grow to between $0.72 and $0.73 from $0.58 in the prior-year quarter.

For Pinterest, the addressable market opportunity includes brand advertising and performance-based advertising across various formats. According to IDC, the global advertising market is projected to grow to $826 billion in 2022 from $693 billion in 2018, representing a 5% compound annual growth rate. The digital advertising market alone is projected to grow to $423 billion in 2022 from $272 billion in 2018, representing a 12% CAGR. IDC report also says that the U.S. digital advertising market is projected to grow to $166 billion in 2022 from $104 billion in 2018, representing a 12% CAGR.

Also read: Lyft posts massive losses in its maiden earnings report

Ahead of its inaugural quarter reporting, many analyst firms have initiated coverage on Pinterest. Citi initiated with “Buy”, Baird initiated with “Outperform” and Deutsche Bank recommends to “Hold” the stock. UBS, Credit Suisse, JPMorgan, Bank of America Merrill Lynch and Goldman Sachs issued a “Neutral” rating for Pinterest.