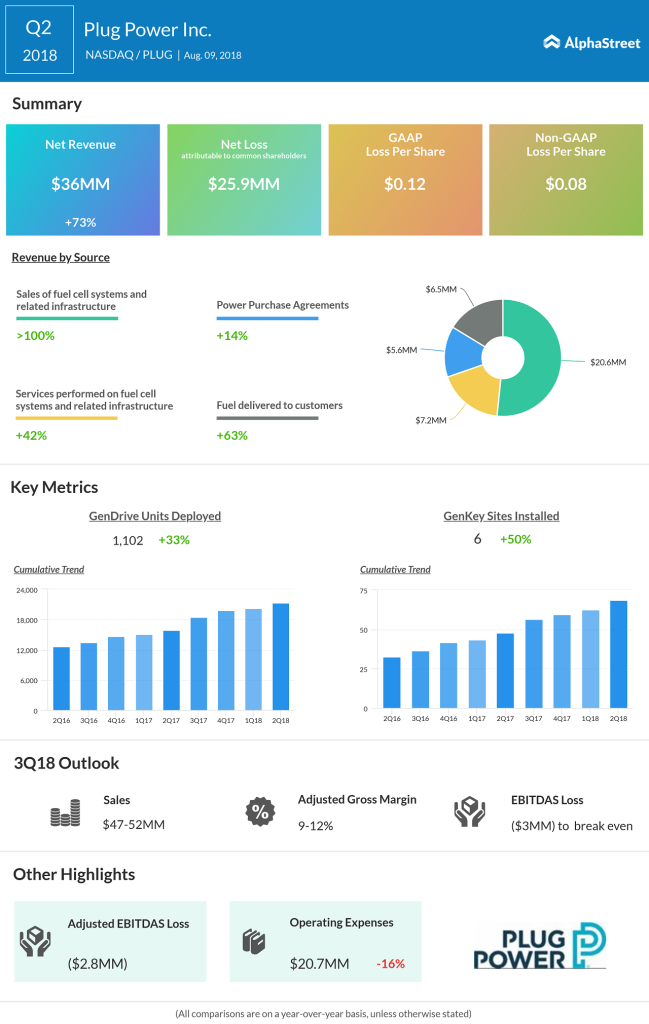

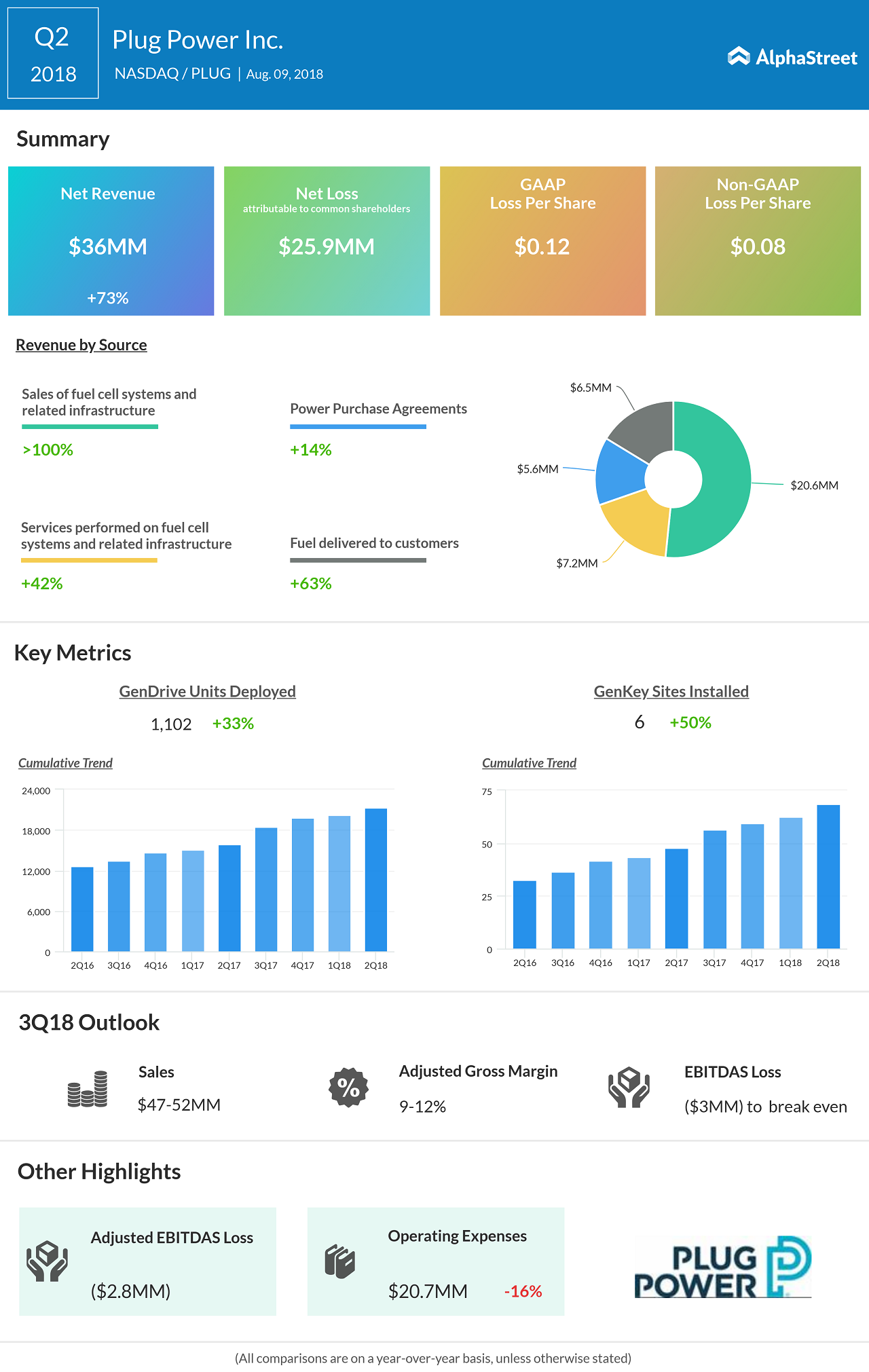

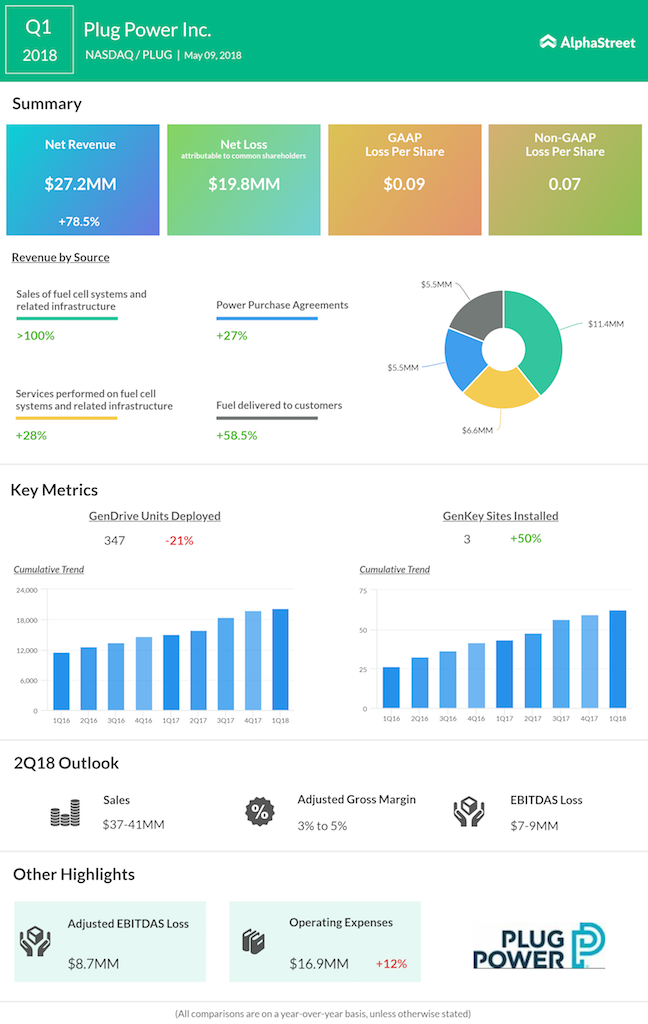

During the Q2 2018, the company shipped a total of 1,102 GenDrive units compared to 830 units in the prior-year period. Six GenFuel sites were installed in the quarter versus four in the prior-year period. Plug Power had 67 sites under fuel delivery contract on June 30, 2018, versus 46 sites on June 30, 2017

Free cash flow for the second quarter of 2018 was negative $20.4 million compared to negative $43.4 million in the second quarter of 2017. As of June 30, 2018, Plug Power had a total cash position of $55.4 million, including cash and cash equivalents of $15.0 million and restricted cash of $40.4 million.

The company’s priority remains being an EBITDAS-breakeven business in the second half of 2018 as well as one that is positioned to be cash flow and EBITDAS positive from next year.

Related Infographic