For the whole year, Plug Power sees about $182-185 million in revenue, jumping 40% from last year. Plug Power also estimates to achieve $235-245 million worth gross billings for the year.

Back in the second quarter, Plug Power had acquired AFC, an organization that manufactures membranes — a key component in fuel cell stacks. By the fourth quarter, Plug Power started shipping products with Plug Power’s membranes.

It is expected that Plug Power will benefit from this as it announces its quarterly results on Thursday.

LOOKING BACK

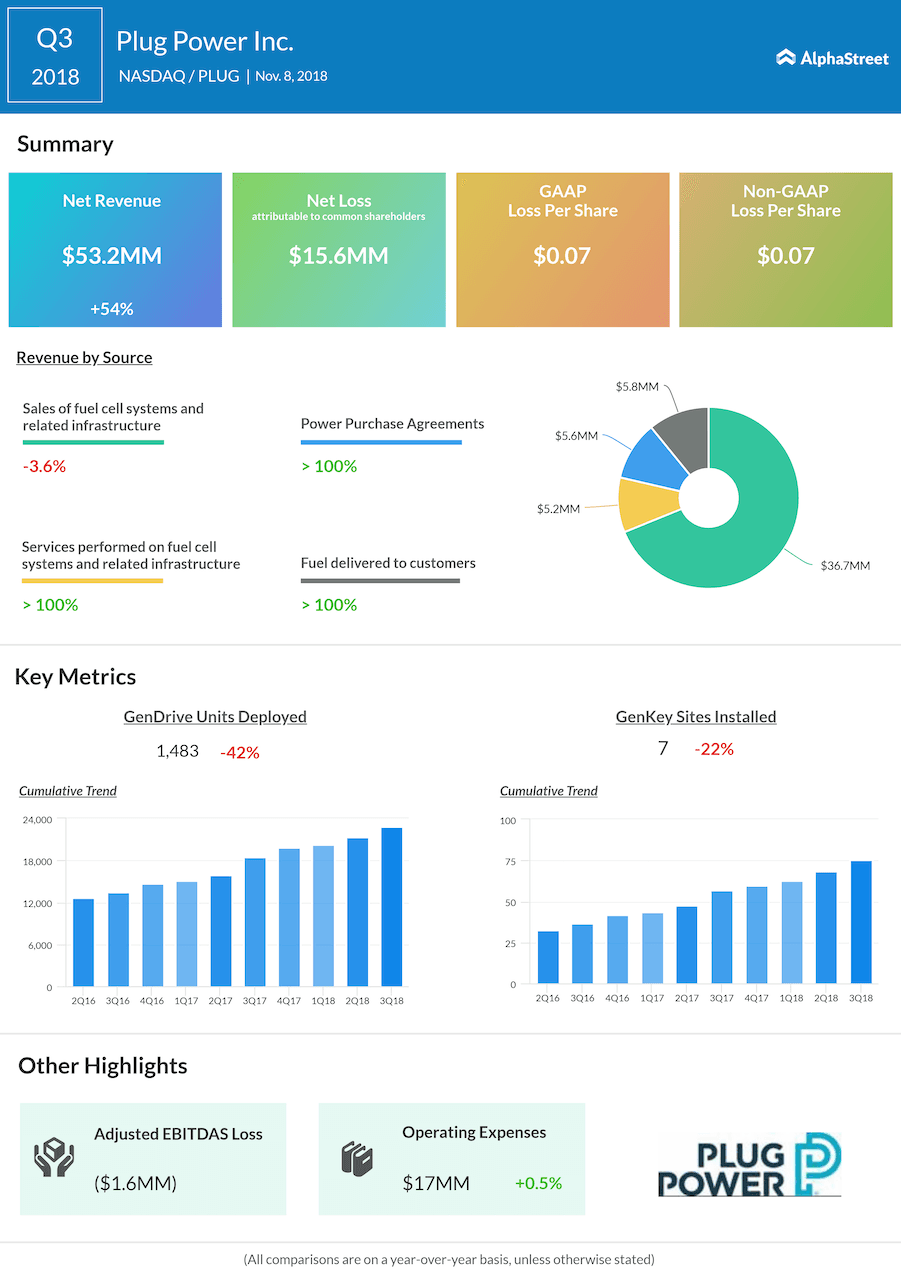

In the previously reported third quarter, Plug Power sold at least 1,400 GenDrive fuel cell units and seven GenFuel hydrogen stations — delivering products to nine different customers.

Back in November, Plug Power also announced the launch of its a new manufacturing facility in Clifton Park, with the support of NY State’s Empire State Development. As of Nov. 8, Plug Power had the capacity to produce about 20,000 fuel cell products annually.

The battery maker’s upbeat results then raised shareholder confidence, as it then sent the stock up when the results were announced. If the latest results beat estimates, this trend is expected to continue.

(Update: Removed market consensus from an earlier version of the story since the company has already posted preliminary results)