Market observers also predict that the company’s earnings would touch $4.4 billion by 2019, riding on strong performance across all platforms, which include Booking.com, Agoda, Priceline, Kayak, RentalCars and Opentable.

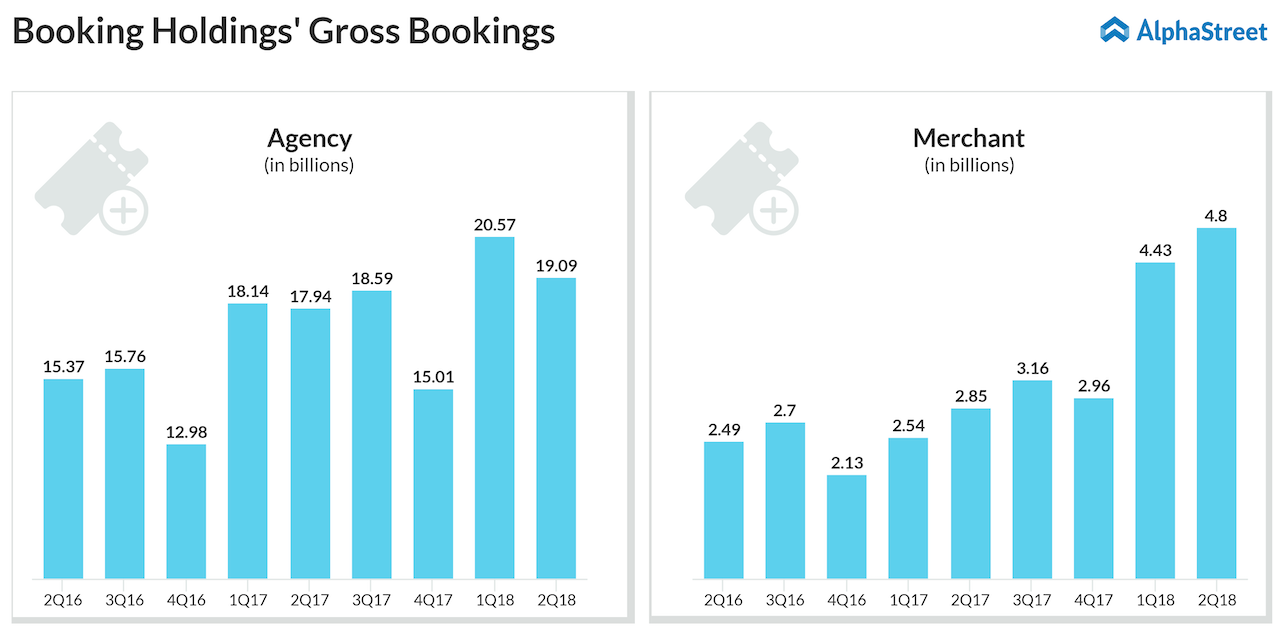

Agoda and RentalCars will together provide the biggest boost to the company’s merchant revenues during the third quarter due to the operational improvements they are undergoing. During the prior sequential quarter, Booking reported 42.5% year-over-year increase in overall merchant revenues.

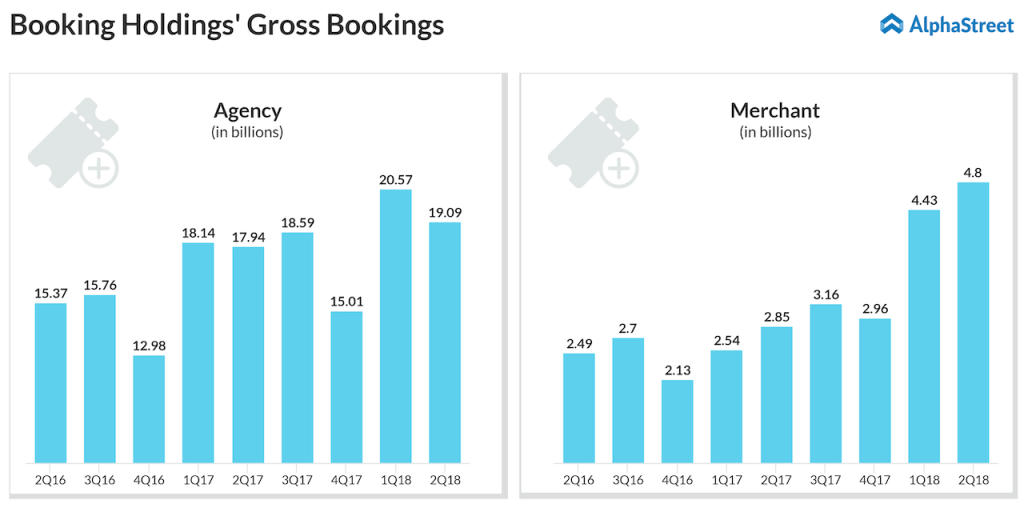

During the second-quarter earnings, Booking said it expects 6-9% growth in room nights booked in Q3, while gross bookings are expected to improve 3-6%, helped by its diverse inventory. Adjusted EBITDA is projected to be between $2.3 billion and $2.36 billion.

Meanwhile, there is one aspect about this company that the market might be taking very lightly – the rapidly increasing competition in the industry. India-based OYO is probably the biggest threat to Booking with operations fast expanding to China, Singapore, Malaysia, and Europe.

Unlike Booking, which acts as a hotel aggregator, OYO works closely with its property-owners to ensure a pre-set standard. As the travel and hospitality industry evolves to cater to more luxury conscious budget travelers, OYO seems to hold an upper hand over Booking.

However, that’s the long-term story. Ahead of its earnings, Booking looks rock solid, all set for another beat. Last week, rival Expedia’s (EXPE) shares jumped 8% after posting better-than-expected third-quarter earnings. The company reported earnings of $3.65 per share versus $3.12 expected by analysts.