Meanwhile, the company is expected to report earnings of 30 cents per share in Q2, compared to 50 cents per share it reported a year ago, as it continues to shell out money on reach and marketing.

With numerous other key players such as UberEats, Postmates and Doordash offering tight competition, investments into promotion and expansion are inevitable to stay relevant.

Meanwhile, Amazon’s withdrawal from the food delivery business last month would come as a major relief. It also makes Grubhub an ideal takeover target for Amazon if it plans to reenter the business through acquisition.

It’s not a far-fetched idea given the fact that the e-commerce major has acquired a significant stake in UK-based food delivery company Deliveroo.

READ: What Alphabet executives discussed during Q2 2019 earnings call

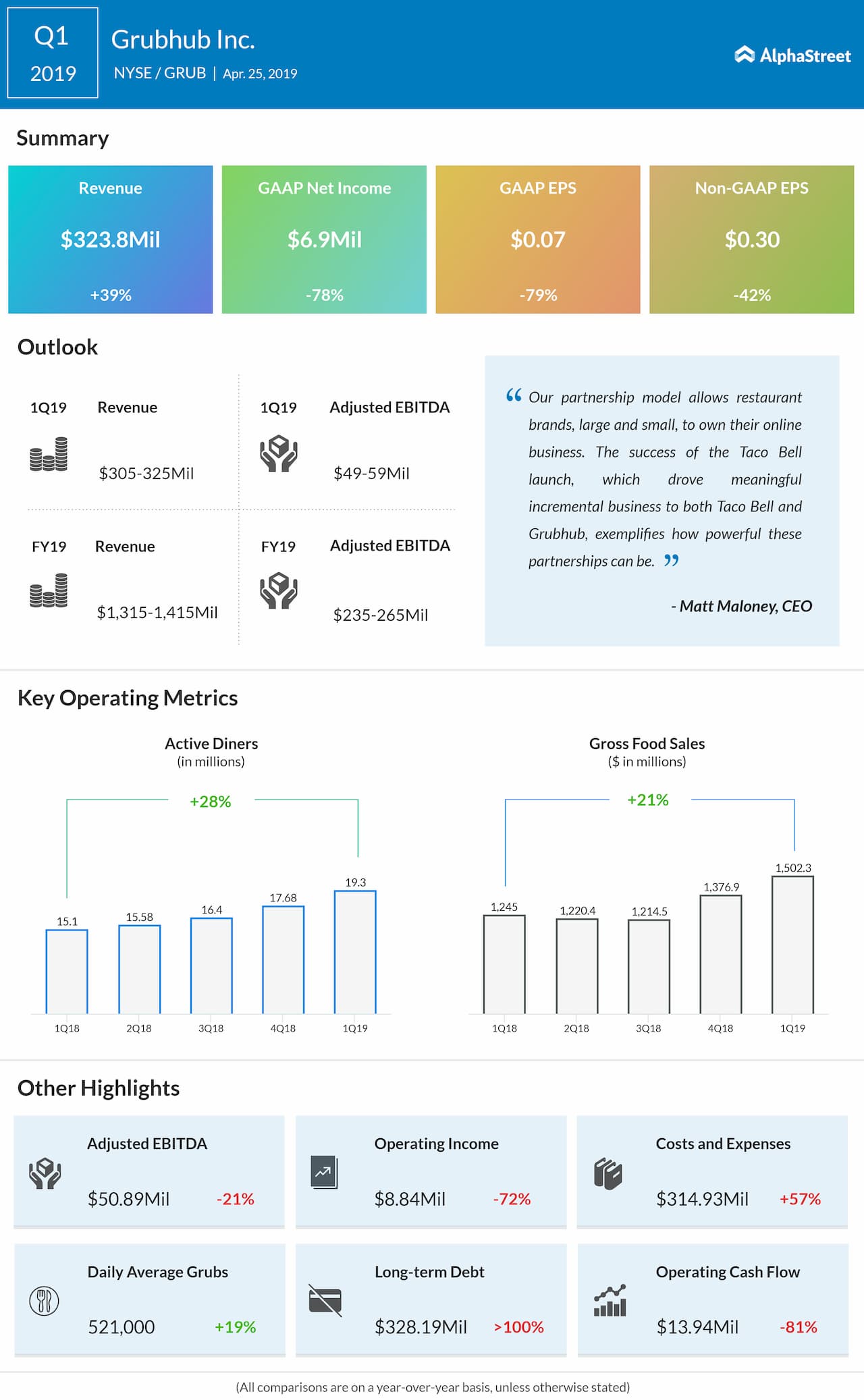

Meanwhile, Grubhub is also pursuing its expansion goals by acquiring smaller firms such as Seamless, LevelUp and Tapingo. Its partnerships with major brands such as KFC, Smoothie King, and Taco Bell should provide enough top-line leverage during the quarter.

Grub shares have been trading mostly sidewise since the beginning of this year, primarily due to lackluster quarterly performances and fear of increasing competition. The stock has a 12-month average price target of $95.11, suggesting a 28% upside from Friday’s trading price.