The company is next expected to report quarterly results on Monday, September 30, before the market opens. For the current fourth quarter, analysts expect earnings of just $1.43 per share, 24 cents lower than a year ago.

It may also be noted that the estimate was downsized five times during the past 90 days from the initial estimate of $1.62 per share, signifying rising skepticism in the market.

READ: Is Lululemon’s bull run coming to an end?

ADVERTISEMENT

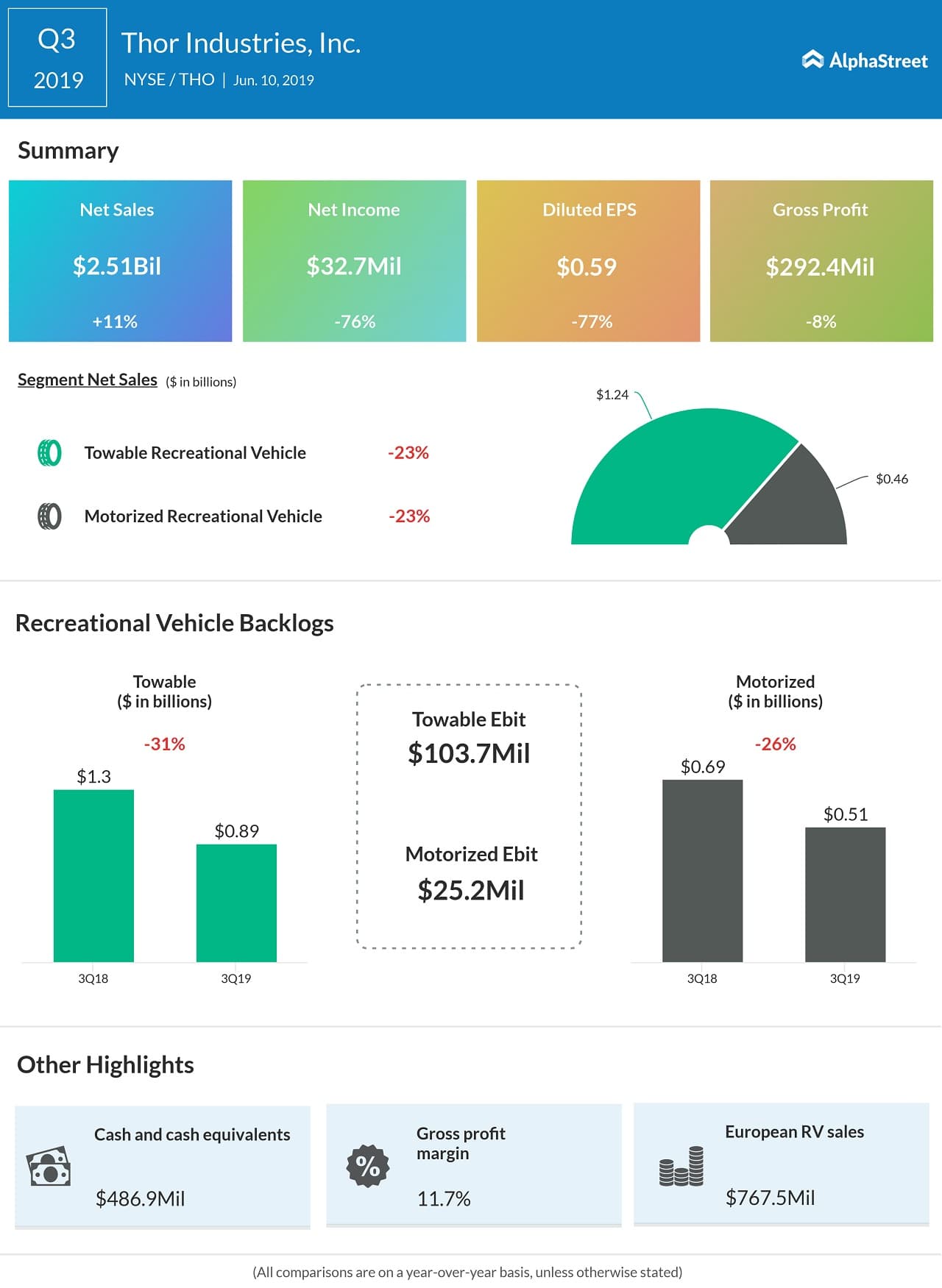

Meanwhile, the company is expected to see a 25% increase in revenues to $2.35 billion, as the recent acquisition of Germany-based rival Erwin Hymer Group comes into play. However, most of the gains on the bottom-line from this acquisition would be offset by weakness in North America sales, as well as higher freight and material costs.

THO stock has a 12-month average price target of $47, which is at a 7% downside from the last close. Despite the declines, the market feels the stock is overvalued and has an average rating of Moderate Sell.