Strong quarter

Trends

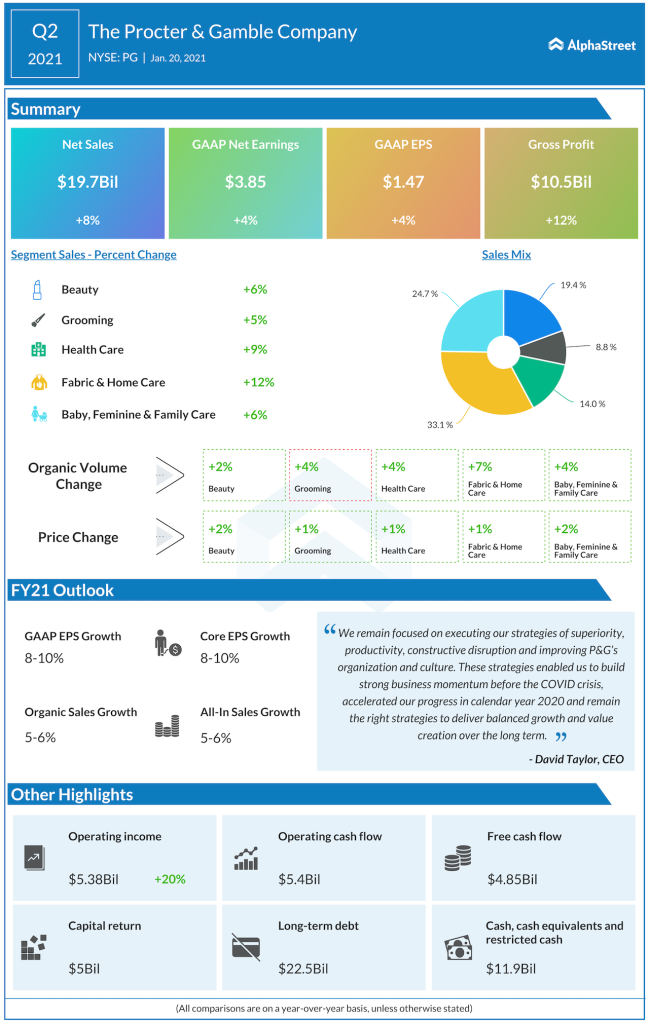

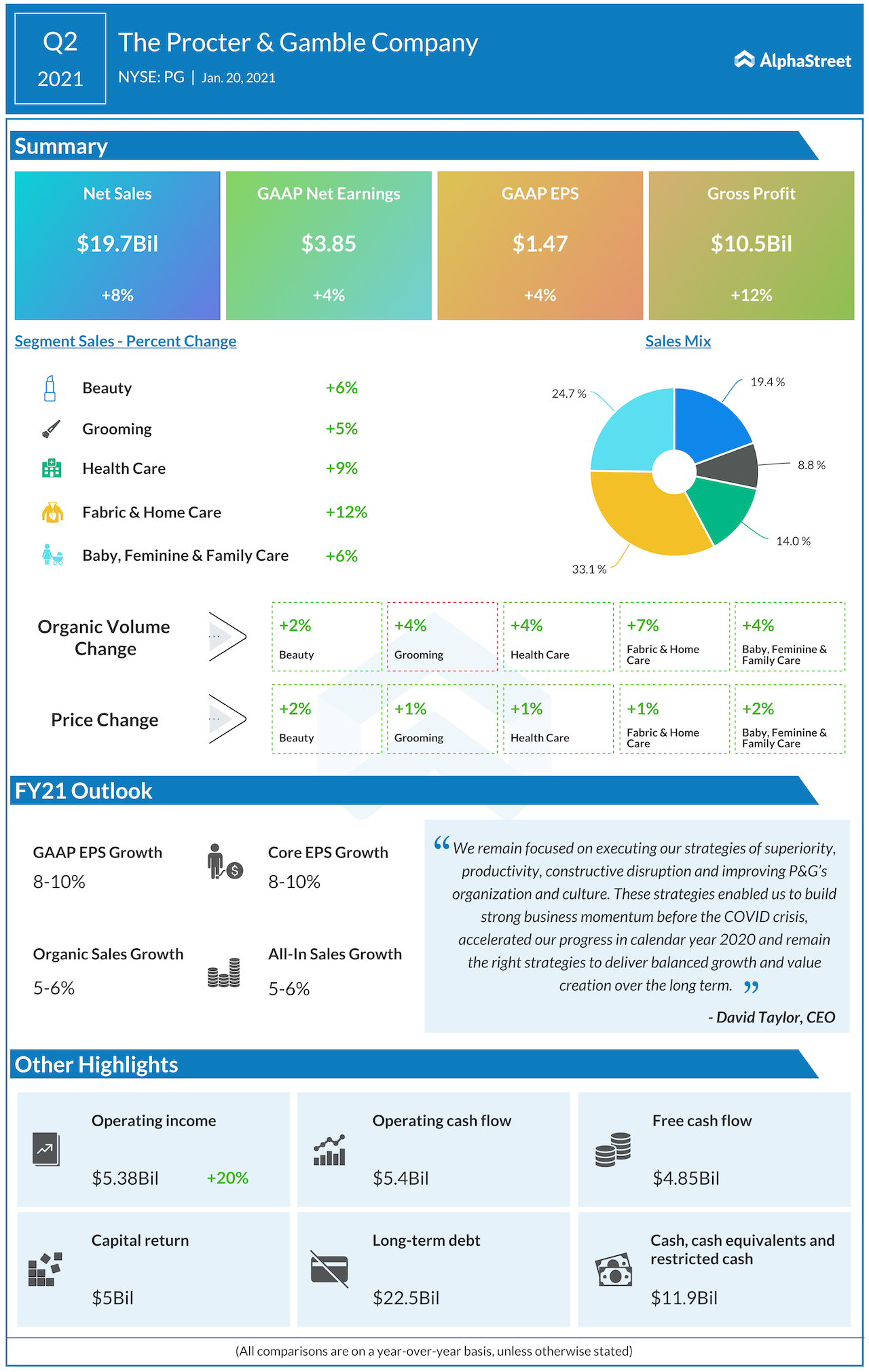

During the quarter, P&G delivered strong sales growth across all its segments with the Fabric & Home Care and Health Care divisions reporting the highest growth rates of 12% and 9% respectively, both on a reported and organic basis.

Organic sales in Home Care rose around 30% driven by higher demand for home cleaning products amid the COVID-19 pandemic. The company saw growth in the high teens in dish care, air care and surface care.

The Beauty segment benefited from the launches of hand soap and hand sanitizer products while the Grooming segment witnessed a growth of over 20% in organic sales for appliances due to higher demand for at-home shaving and styling products.

The impacts of the pandemic have varied across categories and regions. The trend of people spending more time at home benefits the family and home care divisions but negatively affects categories like SK-II and deodorants. Geographically, the company saw growth in its North America market but it witnessed declines across the Asia, Middle East and Africa regions.

From the Q2 transcript:

“We’ve seen some supply chain benefits from higher throughput, as we simplify the number of SKUs, the costs have increased to source materials, maximize safety and importantly, to transport finished goods. So, as and when we’re out of COVID, we expect some of the current tailwinds to our business will dissipate, but some very strong headwinds, should also abate or disappear.”

P&G believes that certain trends witnessed during the pandemic are likely to continue over the mid to long-term and these will help drive growth in the top and bottom line. People are likely to continue spending more time at home and their habits related to cleaning, health and hygiene are also likely to change driving growth for the company’s products.

P&G also expects to see a preference for established brands and a lasting shift to ecommerce and believes it is well-positioned to take advantage of these trends. Despite the challenges in the near-term from the pandemic and the economy, the company remains optimistic about its long-term prospects.

Outlook

P&G raised its guidance for fiscal year 2021 and the company now expects all-in sales growth of 5-6% versus the previous range of 3-4%. Organic sales are expected to increase 5-6% versus the earlier range of 4-5%. Both GAAP EPS and core EPS are expected to increase 8-10% versus FY2020. The company plans to return around $18 billion to shareholders during FY2021 in the form of dividends and stock repurchases.

Click here to read the full transcript of Procter & Gamble Q2 2021 earnings conference call