Quarterly performance

Trends

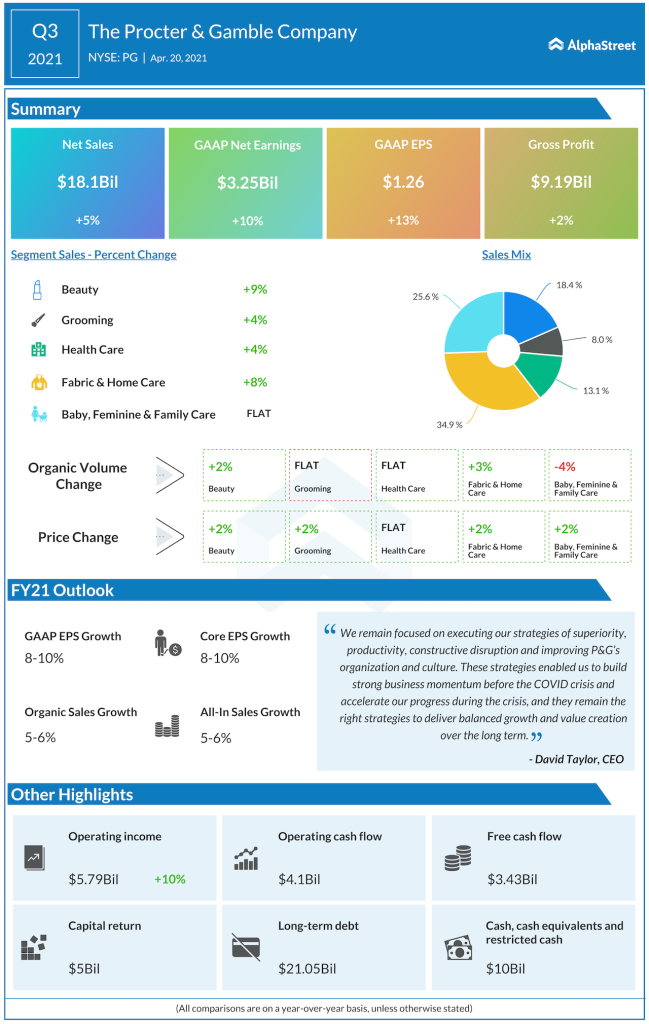

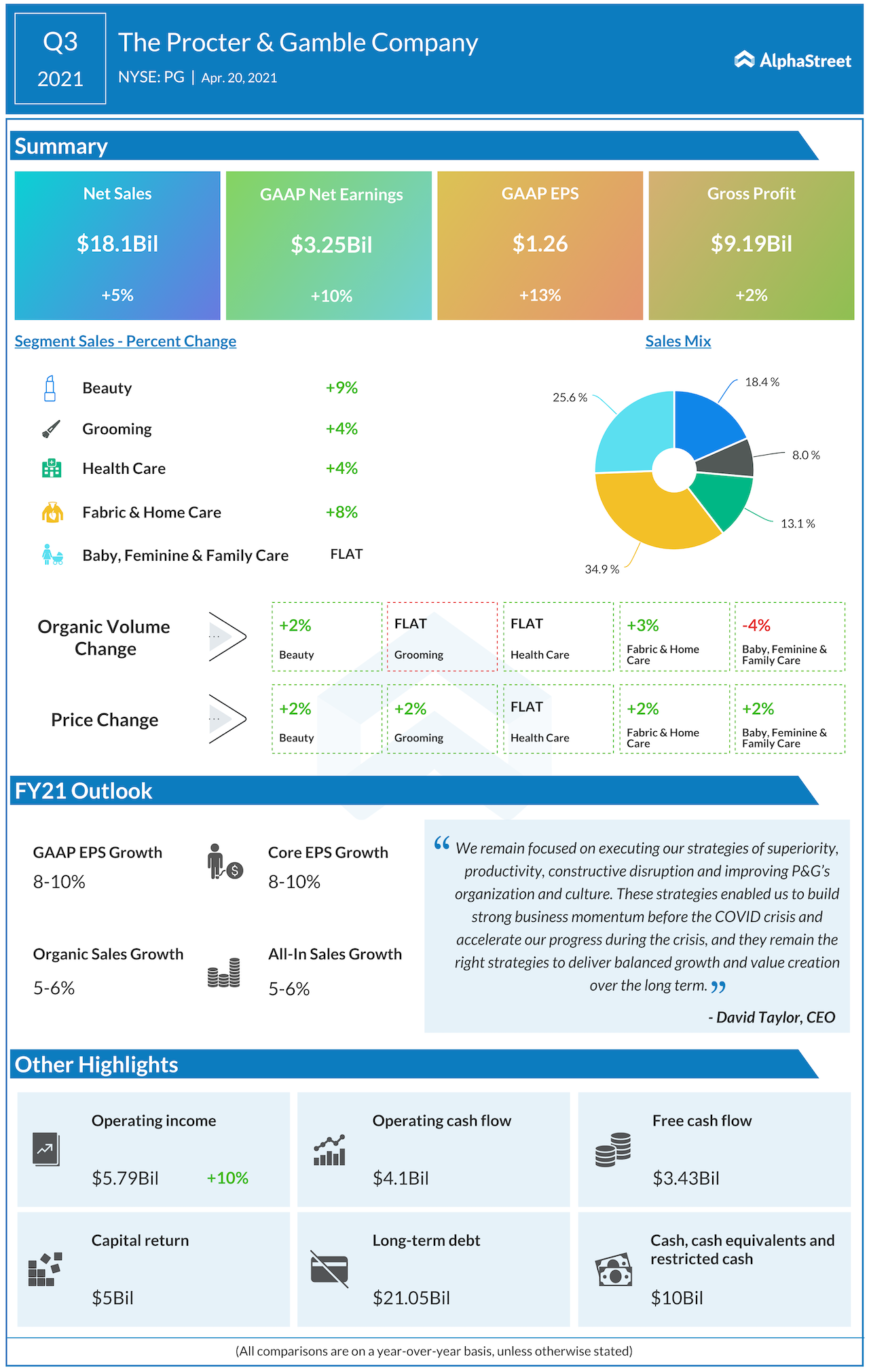

During the quarter, P&G witnessed organic sales growth across all its segments barring Baby, Feminine and Family Care. The company saw demand increase for many of its products amid the COVID-19 pandemic and this momentum is still visible. Within the Grooming segment, organic sales for appliances jumped more than 20% as customers continued to shave and style themselves at home as opposed to visiting salons.

Within the Fabric and Home Care segment, organic sales in home care increased in the high teens due to a spike in demand for cleanings products amid the pandemic. Fabric and Home Care organic sales increased 7%.

P&G has managed to gain or hold market share within the leading categories. The company’s innovation in products has proved beneficial in driving growth. Its Dawn Powerwash dish care product, which was launched a year ago, raked in sales of around $150 million in its first year and drove an all-outlet market share growth of over 400 basis points in the US.

In China Hair Care, products such as Pantene Quench Shot Masks and 3 Minute Miracle have brought new customers to the Pantene brand and helped drive a market share growth of over 35% in the conditioner and treatment segments over the past 12 months.

Outlook

P&G expects organic sales to grow 5-6% in FY2021. Core EPS is expected to grow 8-10% YoY. The company expects a negative impact of $125 million after-tax from commodities. The challenges from commodity costs are expected to increase in the next fiscal year and to combat this, P&G will raise its prices from mid-September within its Baby Care, Feminine Care and Adult Incontinence businesses. The exact timing and amount of these price increases will vary by brand and sub-brand in the range of mid-to-high single digit percentages.

Click here to read the full transcript of Procter & Gamble Q3 2021 earnings conference call