Estimates

Procter & Gamble will be publishing first-quarter results on Friday, October 18, at 6:55 am ET. On average, analysts following the company project a net income of $1.9 per share for the September quarter, on an adjusted basis. That compares to earnings of $1.83 per share reported in the year-ago quarter. The positive bottom-line forecast reflects an estimated 11% increase in Q1 sales to $21.96 billion.

While the management sees a strong year ahead, there are concerns about the slow recovery in China which is an important market for the company. There has been a slowdown in organic sales growth, reflecting economic challenges and geopolitical tensions, and the trend is likely to continue in the near term. In the US market, softening inflation and improving economic conditions bodes well for the company. Last year, it delivered stable earnings growth, recovering from a very high inflationary period.

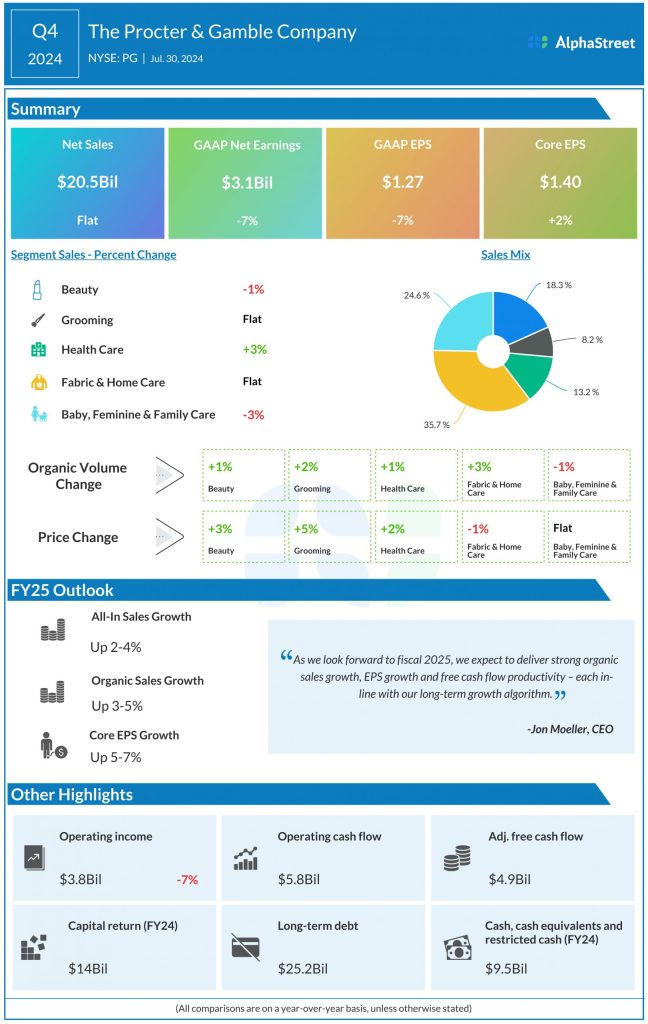

In the fourth quarter of 2024, core earnings edged up 2% year-over-year to $1.40 per share. Net earnings attributable to the company decreased 7% annually to $3.1 billion or $1.27 per share. Meanwhile, Q4 sales remained unchanged year-over-year at $20.5 billion and organic sales rose 2%. Earnings beat estimates, while revenue fell short of expectations.

“We’ll double down on productivity up and down the P&L and across the balance sheet. We’ll double down on enabling our organization to execute our integrated strategy with excellence, to delight consumers and win in the marketplace, to deliver the level of balanced growth and value creation results you and we expect. Our strategy is dynamic and sustainable. It adapts to the changing needs of consumers, customers, and society and is focused on growing markets, creating versus taking business, the most sustainable and typically most profitable way to grow,” said Procter & Gamble’s CEO Jon Moeller at the Q4 earnings call.

Road Ahead

Procter & Gamble’s profit exceeded expectations regularly in the recent past, while quarterly revenues fell short of expectations. The company said it expects all-in sales growth in the range of 2-4% for fiscal 2025. Full-year organic sales growth is expected to be 3-5%.

Procter & Gamble’s stock opened Tuesday’s session higher and traded up 1% in the afternoon. In the past six months, the shares gained more than 10%.