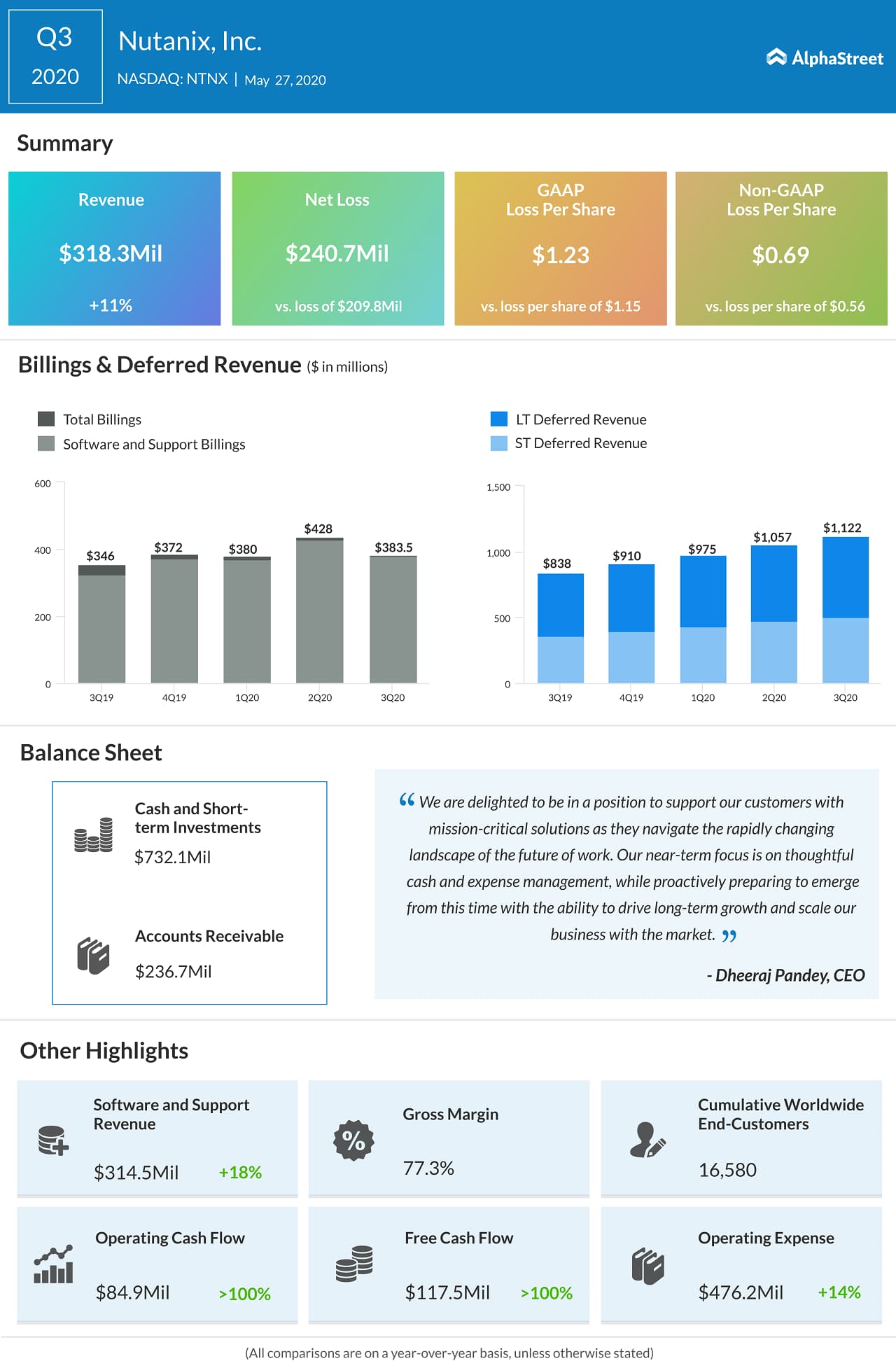

Q3 results

In Q3, Nutanix closed 59 deals worth over $1 million with 11

of these customers spending at least $1 million in Q2. The company, which has a

total of 16,580 customers, now has nearly 910 of the Global 2000 as customers

and these customers have collectively spent 37% more in Q3 than in the same

quarter a year ago.

Demand increased for Nutanix’s end-user computing offerings in March and April. In other areas of business, modernization of some projects was postponed to future quarters as customers experienced rapidly changing financial circumstances as a result of the virus outbreak.

[irp posts=”51389″]

Cost savings

To reduce the operating expenses, Nutanix has taken several cost saving initiatives. The company had implemented two weeks of unpaid leaves for its employees; the first one in Q4 and the second one in the first quarter of FY21. The senior executive team also took a 10% pay cut starting from April. Nutanix restricted the hiring of new employees and paused the merit increases as well as bonuses for the existing employees. The company had planned to conduct major events and worldwide sales meetings in the virtual mode.

Answering to a question on furloughs and slower hiring, CEO

Dheeraj Pandey said:

When we went public, we had 1,800 employees which was 3.5 years ago, maybe close to 4 years and now we have more than 6,000 employees, about 70% of our workforce has never seen a Private Nutanix and I think it behoves us to actually look back and think about every dollar that we used to spend 4, 5 years ago, how do we go back to the basics and become a start-up again. So we’re using this opportunity to really go to that as well.

For the immediate future, Nutanix expects operating expenses

to be around $375 million to $400 million per quarter.

Future ahead

In early May, Nutanix pulled back its fiscal 2020 outlook citing the uncertainty created by the deadly pandemic. The company also withdrew the previously announced business model targets for calendar 2021.

Nutanix plans to focus more aggressively on the subscription

revenue model in the future. During the earnings call, CFO Dustin Williams

said:

Although the future clearly looks encouraging, the short term comes with a high degree of uncertainty. We are still in an unprecedented and volatile time period. And importantly, we are still in the early innings of transforming our business to a subscription model fueled by low cost renewals. While we’re making great progress on the transformation, we have not yet reached a point where the predictable renewal business makes up a substantial portion of our quarterly results.

He also added that the company plans to issue annual guidance for FY21 during its Q4 conference call.

Nutanix expects that corporate initiatives around remote work, hands free IT automation, disaster recovery, and lift and shift to private and public cloud infrastructure will be some of the pillars of digital transformation in the future.

Check out the entire Nutanix Q3 2020 earnings call transcript