From discount coupons to a full-fledged e-commerce marketplace, Groupon has come a long way. But in an environment dominated by the likes of Amazon, Alibaba, and even eBay, the company looks like it needs a wake-up call — something disruptive and innovative.

Amazon has Amazon Pay and Alexa, and Alibaba has similar products, if not a solid customer base back home. CEO Rich Williams might want to stop and think about this in the long run. What its competitors do, is stay in the public eye, and in this age of social media, it is a possible strategy to explore.

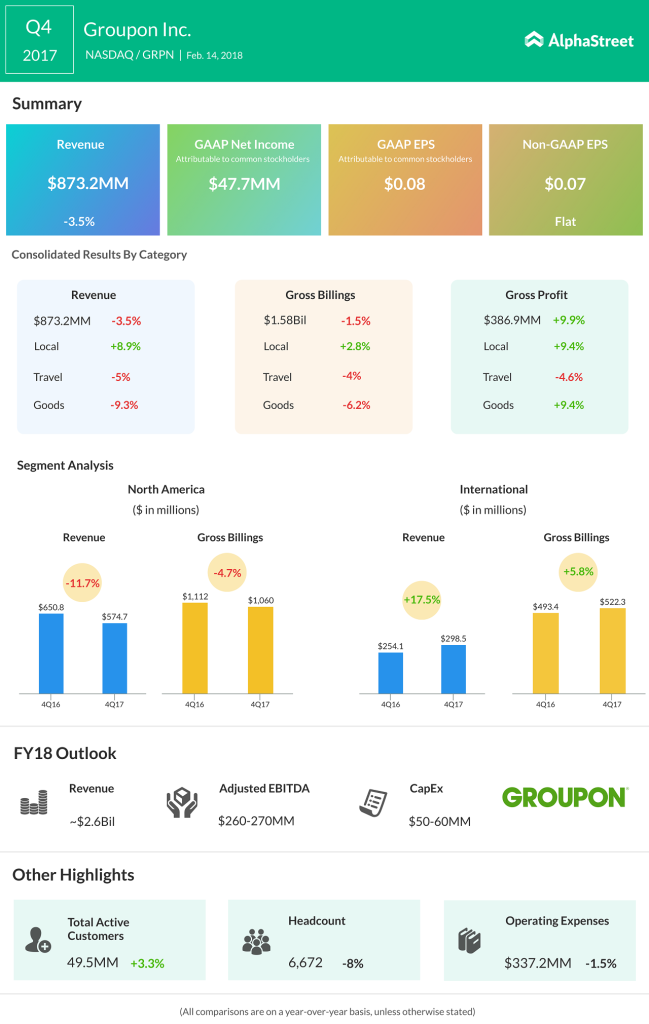

Meanwhile, we have composed a quick snapshot of the earnings in Q4 2017…