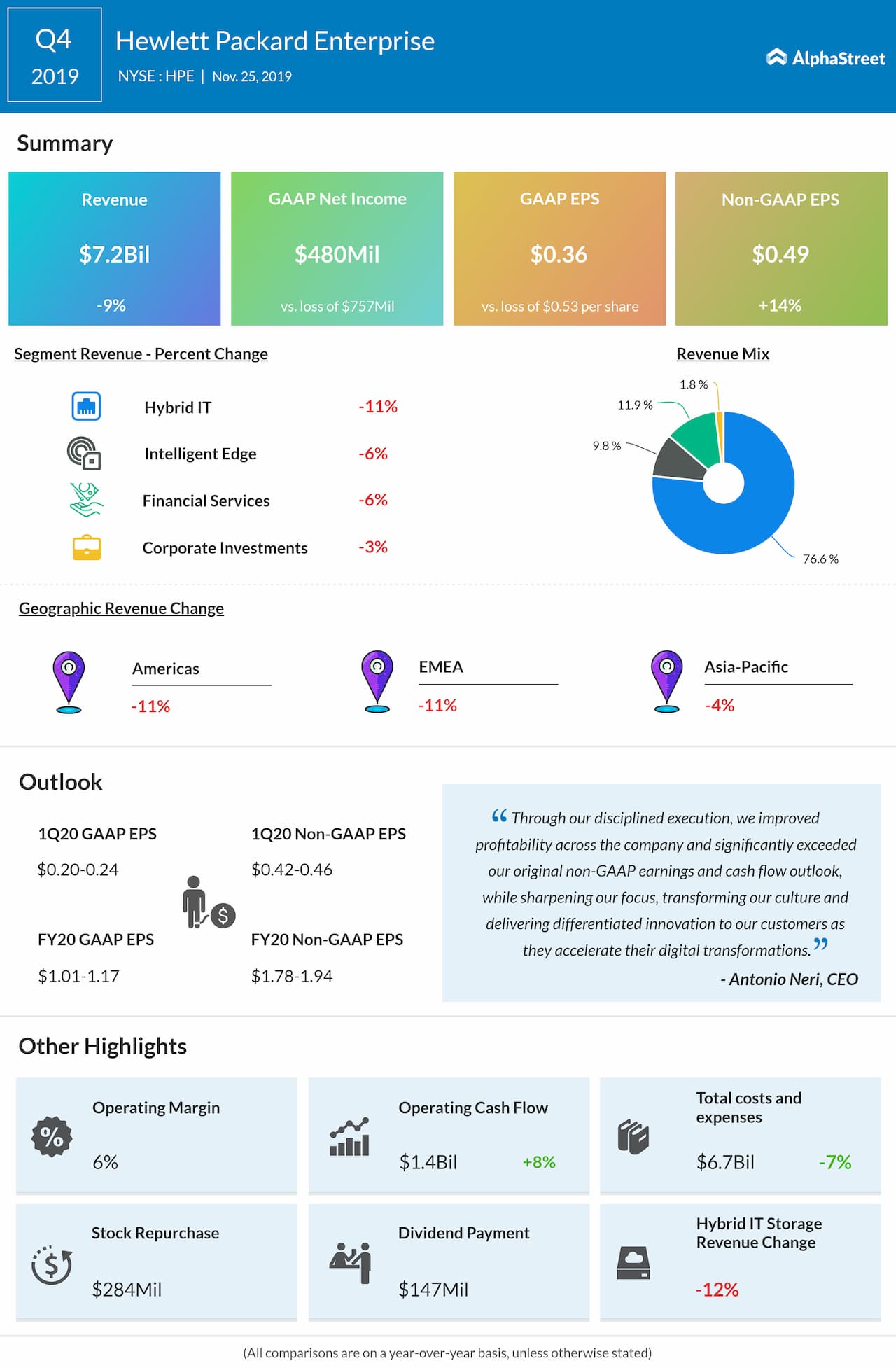

Hewlett Packard Enterprise (NYSE: HPE) on Monday delivered Q4 adjusted earnings of 49 cents per share, beating Wall Street expectation of 46 cents per share and higher than the management’s projection range.

Meanwhile, revenues of $7.2 billion

were down 9% year-over-year. Analysts were expecting Q4 revenues of $7.4

billion.

HPE shares slipped 3.2% immediately following the earnings announcement. The stock has gained almost 30% since the beginning of this year.

For fiscal 2020, Hewlett Packard Enterprise maintained its GAAP EPS outlook of $1.01 – $1.17 and non-GAAP EPS outlook of $1.78 – $1.94.

For the first quarter of 2020, the San Jose, California-based firm estimates non-GAAP EPS to be in the range of $0.42 to $0.46.

CEO Antonio Neri said, “I am confident in our ability to drive sustainable, profitable growth as we continue to shift our portfolio to higher-value, software-defined solutions and execute our pivot to offering everything as a service by 2022.”

READ: Boxlight President Michael Pope on its products, marketing strategy and the stock

Last month, HPE stated that its strategy of investing in high value, software-defined solutions had helped improve profitability across the company over the past year. The company plans to offer the entire HPE portfolio as-a-service by fiscal year 2022 and sees solid market opportunity in this space.

Hewlett Packard is on an aggressive mission to exit low-margin businesses and shift focus to profitable products and services. The company bought Cray (CRAY) earlier this year, marking its foray into the supercomputer business.