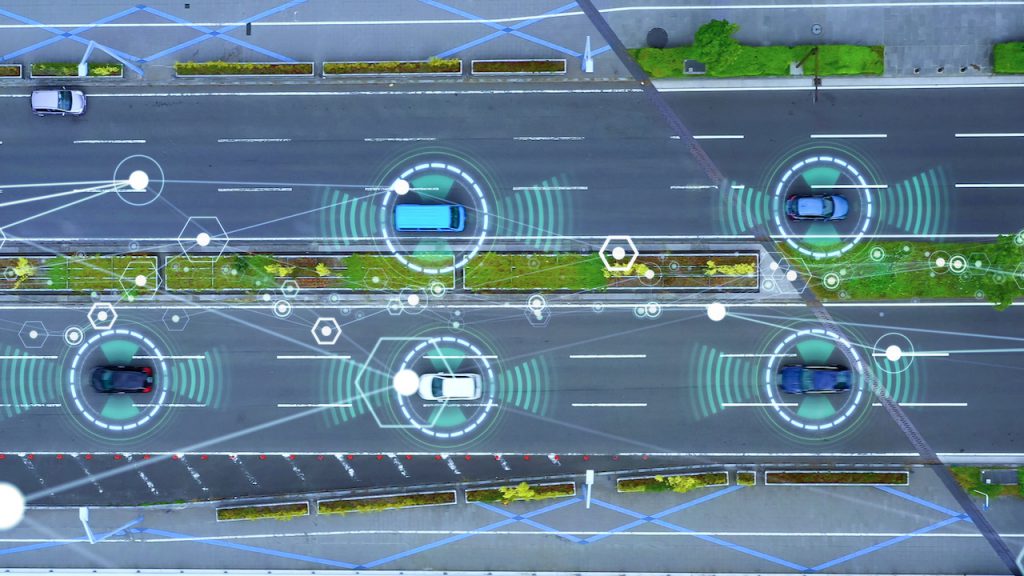

One of the things that make us a bit unique is that we are among the few players that are actually focused on the internet of things market as a bridge to the automotive market, which might take a little longer to develop. We have three technologies. One is a mechanical sensor that we use for the internet of things; the second is the optical phased array (OPA), which is the low-cost target product for the autonomous vehicle market; and the third is software.

The optical phased array is the unique signature of this company. What is unique about it is that there are no moving parts. It’s very efficient in terms of energy and getting all the light where you want it. As for the implications of that, the market is going to grow very fast and there are going to be multiple competitors. I believe there will be a dozen or more people just to cover all the growth of the verticals associated with these markets.

Can you elaborate more on your OPA technology?

We were fortunate in having a number of investors including Sensata Technologies, Aptiv, and Samsung. And the notion of having an all-solid-state sensor, so that you benefit from very low variable costs, was very appealing. We have an architecture that is proven for automotive and radar. We are basically taking that and applying it to LiDAR. It is a hard thing to develop. But once you get it, it’s the ultimate lowest cost.

No other companies have brought an optical phased array to the market in a product form, which we did about a year ago. And in terms of the range, we have demonstrated in excess of 100 meters. We will carry that further later in the year. So not a lot of competition here because the barrier of entry is fairly high.

How do you see your product mix going forward? Is it primarily going to be hardware sales, or will it be a more balanced mix of software and hardware?

In the end, what we create is sensor and that is hardware. But that hardware is going to become smaller and smarter. In the next several years, the majority of our revenues and demand will be fulfilled through mechanical sensors in the internet of things side of the market.

And then it will segway and transition to solid-state, probably by 2025-26. During that period, especially on the internet of things side of the market, you need software to basically abstract what you are learning from the sensor, besides presenting and organizing the data in ways that are useful. So software is very important in a layered fashion for the internet of things that is more constrained from the point of view of integration for the solid-state side.

You had announced a SPAC merger with CITIC Capital earlier this year. What’s the update on that? When will investors be able to grab Quanergy shares?

We announced the merger in mid-June. There are three or four major thresholds to traverse, and all are progressing well. We are right in the middle of it and so far, so good.

The whole process, in general, for most people takes about 110 to 120 days. So if that stays true for us, listing would take place in the October time frame. Right now, I don’t have any information that would suggest that we would be different from that.

What’s ahead for the company over the next couple of years?

We have got to continue to bring innovation to the market. Last year, we were able to bring over 10 products to the market. We want to do the same thing this year. We want to have beachheads established in the industrial markets. So moving beyond smart cities and smart spaces, into a market where you get a design and the market just pulls you. We also want to verify the OPA technology around 200 meters and begin bringing versions of that, to a select group of auto manufacturers, and getting their feedback.

ALSO READ Delta 9 Cannabis CEO John Arbuthnot: We want to grow while being profitable

What is going to be the management’s primary focus — profitability or scale?

I think it’s going to be predominantly scaling up the company. I think the market is going to grow fast. If you read some of the other players in the industry, you will note that we are in a period of quarter-on-quarter growth. The right thing for us to do is to execute and scale up the company.

How is LiDAR going to transform the IoT market? How do you see the evolution of LiDAR in the future?

The largest part of today’s market is really 2D LiDAR. And what we are seeing with our customers is if you can deliver three-dimensional capability at 2D pricing, people want more information. They want to see the shape, they want to be able to make the best decision based upon more information.

So I think that’s the big change that is occurring and it is going to happen application by application. From mapping to measurements, LiDAR is great at it.

ALSO READ International Land Alliance President: Mexican real estate offers great value to homebuyers

______

(Written by Arjun Vijay)