KMI completed about $700 million of projects in the quarter while adding about $900 million of new projects to its backlog during the first quarter.

“Even with the substantial dividend increase, we still expect to internally fund all of our growth capital with some excess remaining. During the first quarter, we made substantial progress on the Elba Liquefaction Project and began work on the Gulf Coast Express Project. We had very good commercial and operating performance,” said CEO Steve Kean.

KMI stock jumped almost 3% after trading hours post earnings release.

Outlook

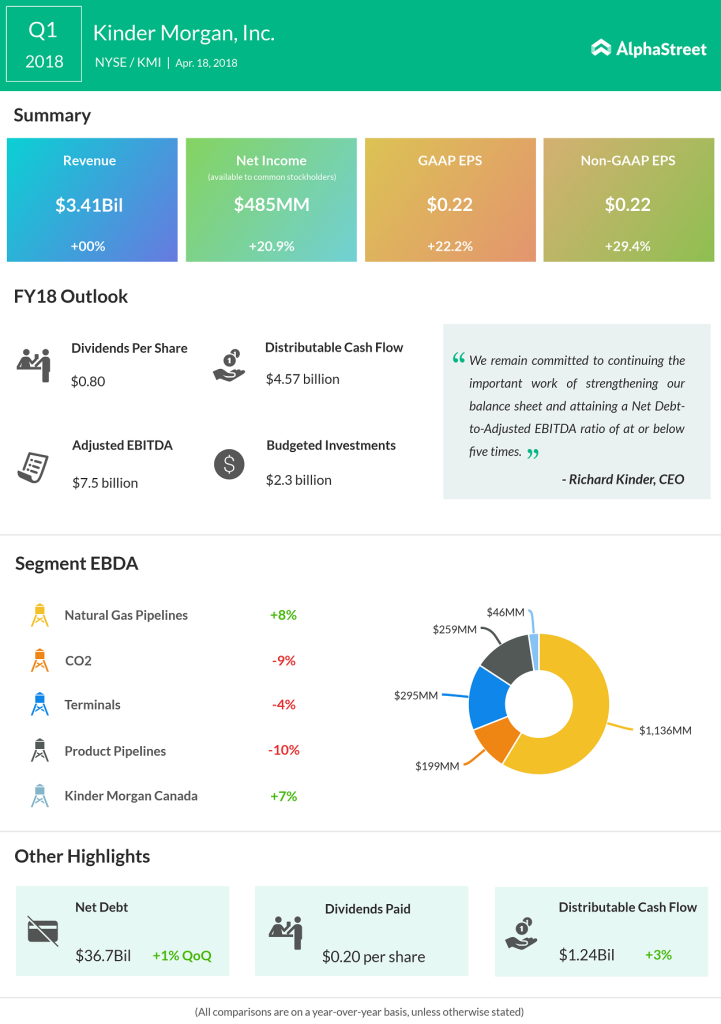

For 2018, the company expects to report DCF of about $4.57 billion and adjusted EBITDA of about $7.5 billion.

Kinder Morgan sees DCF and Adjusted EBITDA meeting or exceeding its targets for the year. The company also expects to invest $2.3 billion in growth projects, up $100 million from what was budgeted and is to be funded with internally generated cash flows alone.