Business Overview

Financial Performance

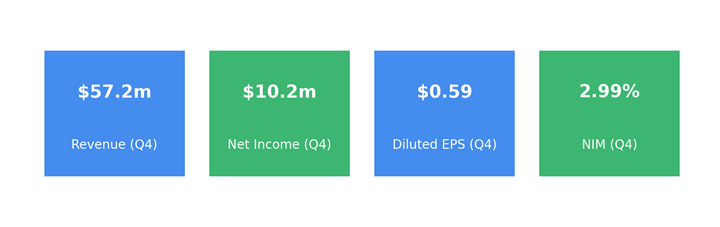

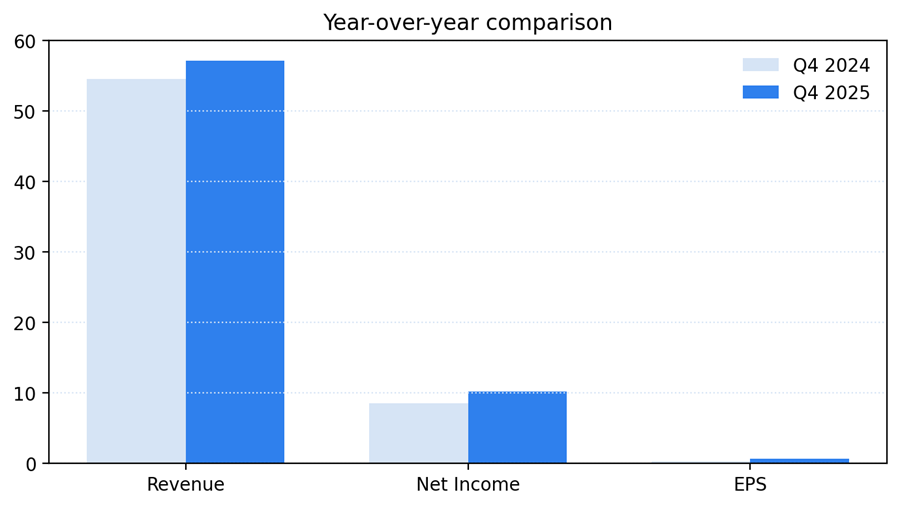

For the quarter ended Dec. 31, 2025, consolidated interest and dividend income totaled $57.2 million. Net income for Q4 was $10.2 million, and diluted earnings per share amounted to $0.59. Full-year 2025 net income reached $31.9 million with diluted EPS of $1.83, both higher than the prior year.

Operating Metrics

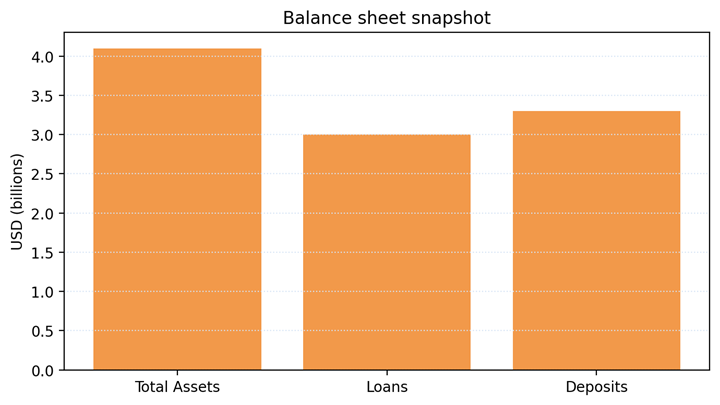

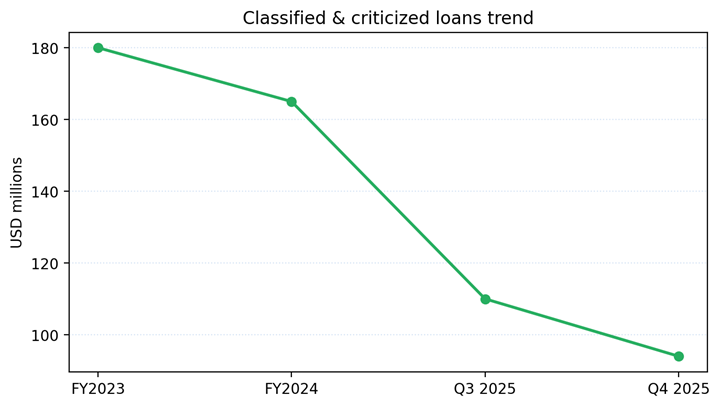

Net interest income for the quarter was approximately $29.5 million. The net interest margin rose to 2.99% in Q4 2025. Loans held for investment grew 8.6% for the fiscal year, while classified and criticized loans declined during the period.

Key Developments

Management reported reductions in classified loans and nonperforming assets during the year. The bank continued asset‑quality remediation and modest originations in targeted segments. No material corporate transactions were announced in the quarter.

Risks and Constraints

Key constraints include sensitivity to deposit costs, margin pressure from funding mix changes, and the pace of loan resolution. Credit normalization remains subject to macroeconomic conditions and local real estate market performance.

Outlook / Guidance

What to watch for: trajectory of classified asset reductions, quarter‑to‑quarter net interest margin movement, loan‑growth momentum, and any management updates on capital deployment or capital returns. Upcoming quarterly releases will clarify margin and provisioning trends.

Additional context: The bank remains focused on restoring asset quality while pursuing disciplined lending in core markets. Market participants will watch funding costs and margin management in coming quarters.

The quarter’s results continued to reflect the bank’s multi-quarter efforts to improve asset quality while maintaining lending activity.

Management highlighted progress on workout programs and pledged continued focus on resolution timelines for remaining classified loans.

Funding and liquidity metrics remained stable during the quarter, supporting ongoing lending operations and deposit flexibility.

Market observers will watch for any shift in deposit pricing and its impact on net interest margins in coming periods.

Operational initiatives to streamline expense lines and improve efficiency were reiterated in management commentary during the period.