Latest quarterly results (Q4 FY25)

Net interest income (before provision): $29.5 million for Q4 2025.

Net income: $10.2 million for Q4 2025.

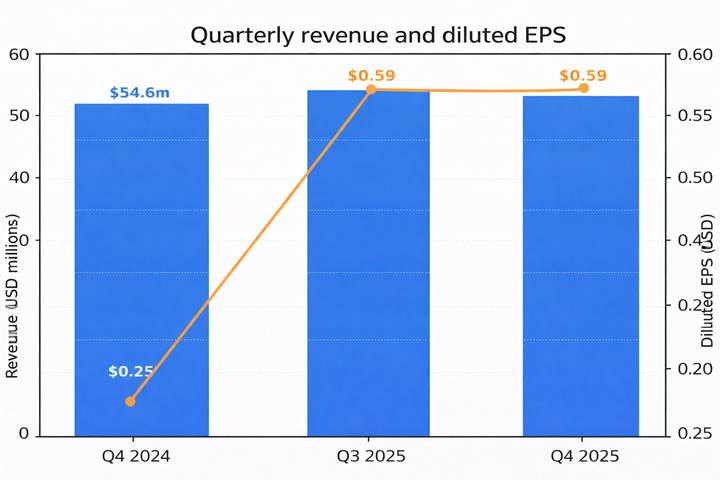

Diluted EPS: $0.59 for Q4 2025.

Financial trends

Chart 1: Quarterly revenue and diluted EPS.

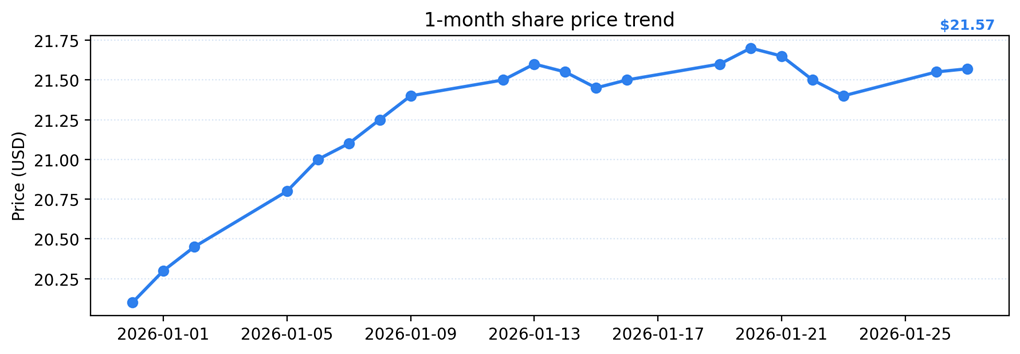

Chart 2: 1-month share price trend.

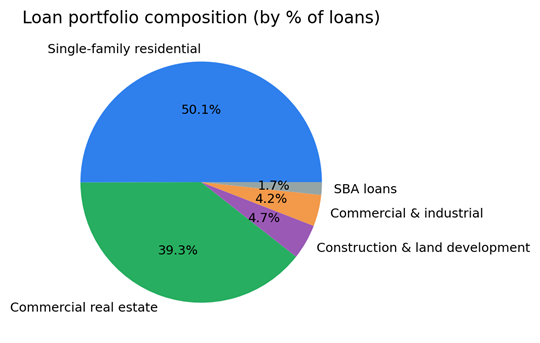

Chart 3: Loan portfolio composition (pie chart).

Full-year results context

Annual net income for fiscal 2025 was $31.9 million, with diluted earnings per share of $1.83.

Both annual net income and EPS increased compared with the prior fiscal year. Directional trend: yearly earnings growth.

Business & operations update

Classified and criticized loans were $94.4 million at Dec. 31, 2025, down $71.3 million versus year-end 2024.

Nonperforming assets decreased to $53.5 million, down $27.6 million year-over-year.

Loans held for investment increased 8.6% in fiscal 2025.

Management reported modest loan growth in the quarter (annualized 1.4%) and continued asset-quality remediation efforts.

M&A or strategic moves

No mergers, divestitures, or completed strategic transactions were announced in the quarter.

Equity analyst commentary

Institutional research summaries following the quarter highlighted improved asset-quality metrics and flagged net interest income as a key metric to monitor.

Guidance & outlook — what to watch for

What to watch for: further reduction in classified and nonperforming assets; trends in net interest margin and deposit costs; quarterly loan-growth momentum; any updates on capital return policy.

Performance summary

Shares closed flat at $21.57. Q4 net income was $10.2 million with diluted EPS of $0.59.

Fiscal 2025 net income totaled $31.9 million and EPS $1.83. Asset-quality metrics improved, and loans held for investment grew year-over-year.

Additional context: The bank continues efforts to improve asset quality while sustaining prudent credit underwriting. Market participants will monitor quarterly margin dynamics and deposit pricing in coming reports.