Like in the past, macular degeneration drug Eylea, the company’s flagship product, holds the key to growth this time. Having received FDA approval for Biologics License Application in the treatment of diabetic retinopathy, Eylea will now be reaching more patients than before. Moreover, the management is trying to broaden the prospects of the formulation by pursuing additional indications.

Recently, the company had hinted that work on promoting eczema drug Dupixent – upgrading the label – is also moving in the right direction. In a sign that it is emerging as a key growth-driver, sales of Dupixent picked up steadily throughout last year, especially after it got regulators’ nod for treating atopic dermatitis.

The management is currently trying to broaden the prospects of Eylea by pursuing additional indications

Meanwhile, the company seems to be taking prudent steps to reduce its reliance on Elyea, which is reportedly facing competition from the cheaper alternatives entering the market. The label expansion of Dupixent is in line with that strategy.

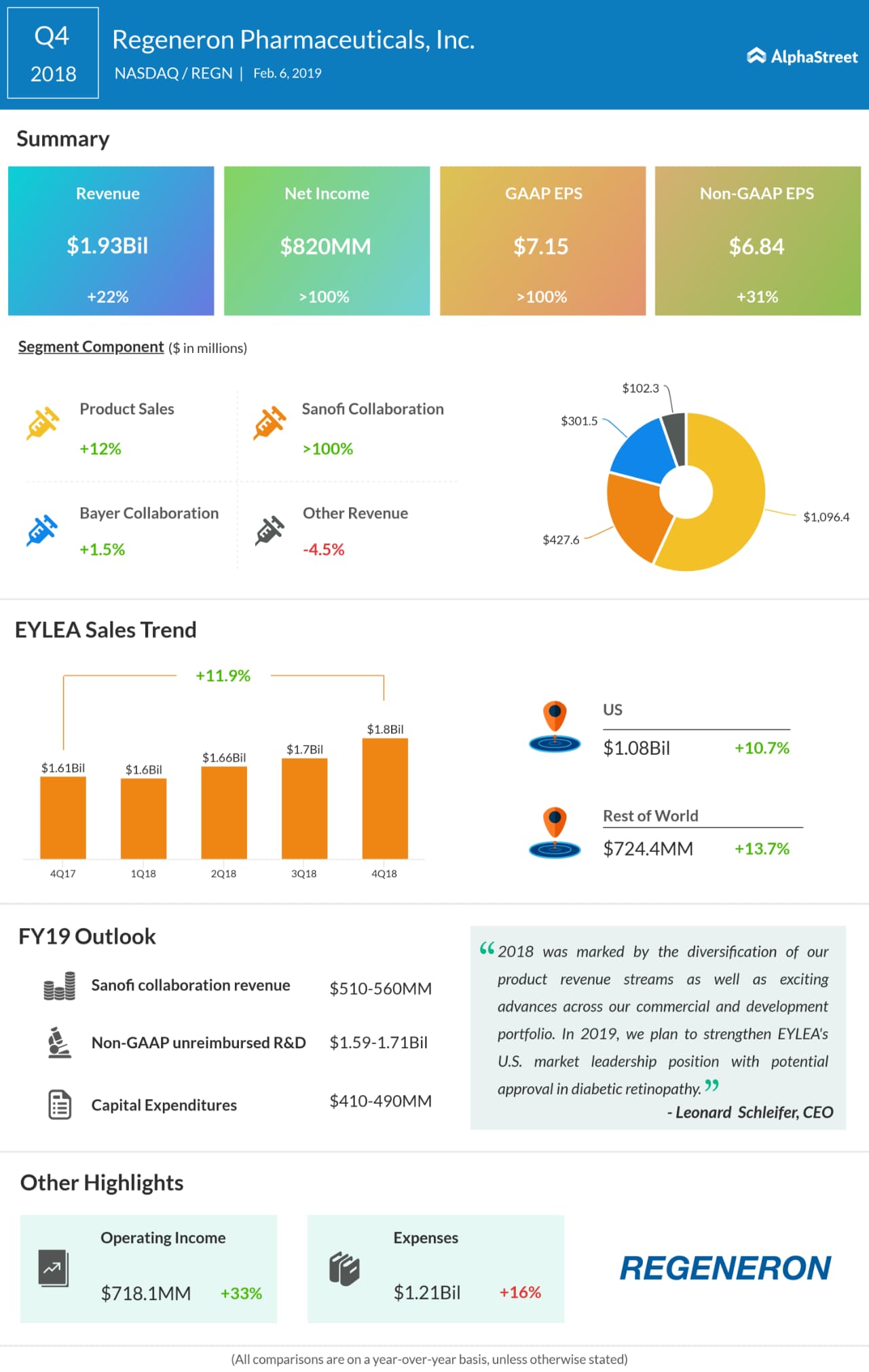

In the December quarter, Regeneron recorded a double-digit increase in both revenues and adjusted earnings – to $1.93 billion and $6.84 per share respectively. The performance reflected a spike in product sales with strong contribution from collaborations, especially Sanofi. Benefits from the cost-cutting efforts and lower income tax added to the improvement.

Also see: Regeneron Q4 2018 Earnings Conference Call Transcript

In what could be a reaction to the reports that competition is rising for the drugmaker, the market has been unkind to the stock. The ongoing selloff, despite the company’s positive performance on almost all fronts, has left many investors speculating.

Though the stock recovered at the beginning of the year, after hitting a low last year, it lost momentum in recent weeks. Since the beginning of 2019, it lost about 10%.