Founded in 2009, RESAAS started out as a networking platform for real estate agents. Over the years, the company has integrated more tools and has collected valuable data that makes conversions easier for users. Currently, the platform has over half a million real estate agents across 160 countries.

Multiple revenue streams

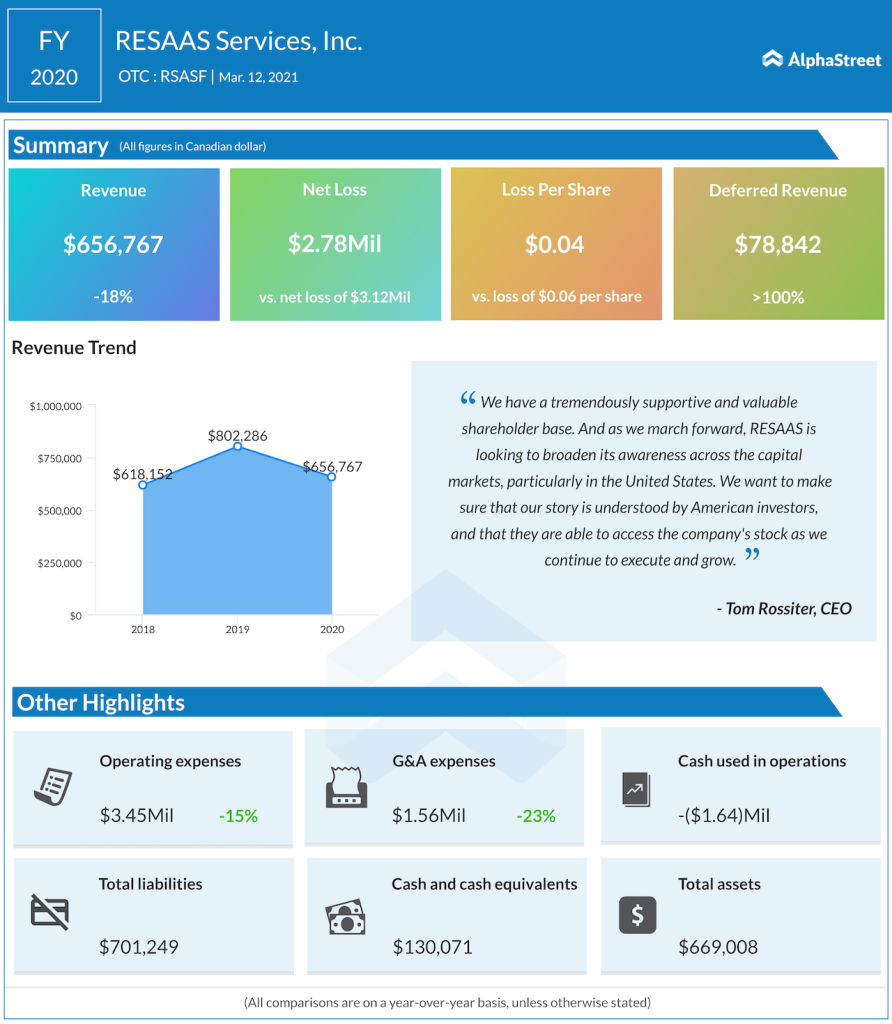

In an interview with AlphaStreet, RESAAS CEO Tom Rossiter said 2020 turned out to be a breakout year for the firm, as more real estate agents saw the necessity to adopt a centralized industry platform to remain connected during the pandemic. This was evident from the company’s financials as well. The fourth quarter of 2020 turned out to be the company’s first profitable quarter, despite the year ending in a loss.

“We have multiple revenue streams. There is a recurring revenue component made up of subscriptions from real estate agents themselves. Over time, we expect to see up to 20% of our agents convert to a paid subscription, which is $100 per month. Separately, some of the largest real estate brokerages and franchises use RESAAS to facilitate the sharing of deals, opportunities, and leads within their companies. And for that, large enterprise companies pay a licensing fee,” Rossiter said. He added that the company also receives some transaction fees for the transfer of funds and fees between agents or brokerages.

Notably, the Vancouver-based company has established partnerships with global real estate firms such as Remax, Intracorp, Keller Williams as part of its global push. The CEO said his company helps these partners supercharge their internal communications, resulting in increased deal flow and insightful business intelligence about how the network of agents, offices, and regions around the world operate. To streamline these operations, the RESAAS platform offers support in 22 languages and 45 currencies.

The pandemic is likely to drive demand for WiSA products: Brett Moyer

Expansion

So what’s on the cards in 2021? The CEO explains, “We have proven within the residential real estate sector how valuable the RESAAS platform is. We are now taking that proven track record and entering an entirely new vertical focused on the commercial real estate sector.”

With this new expansion of operations, the CEO is confident of seeing faster growth in revenues, as well as the company’s valuations.

RESAAS stock has more than doubled since the beginning of this year, following a rally in 2020. The stock is currently trading in the OTC market at $1.15. Meanwhile, RESAAS management is looking to uplist to NYSE or NASDAQ later this year, which could provide better visibility to the stock.

________

Trxade expects its health passport to be a key post-pandemic reopening tool