Upfront royalty model to drive consistent growth

In a major win last year, the company licensed its XBAR RF filter design with 5G capabilities to Murata, the world’s largest RF filter manufacturer with close to 40% market share. Murata has also pumped $7 million to the Goleta, California-based firm, underlining the firm’s growth potential.

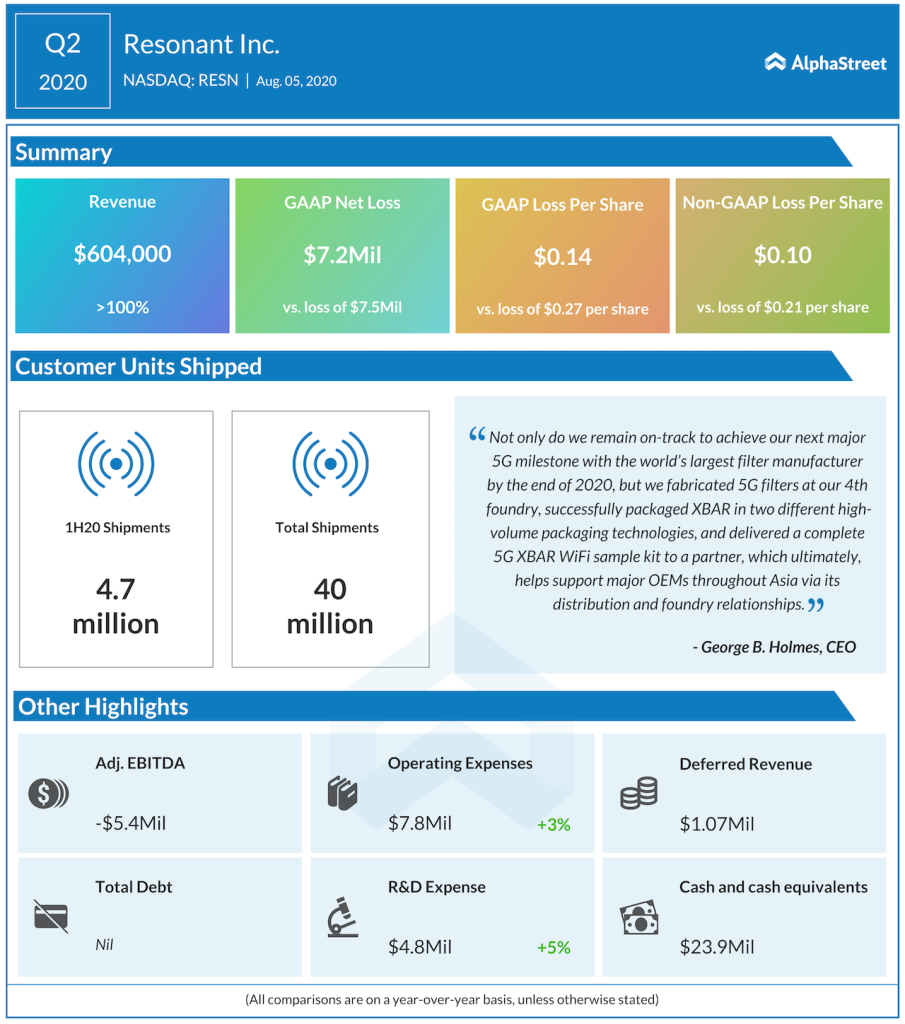

In an interview with AlphaStreet, CEO George Holmes expressed his confidence in achieving higher revenues and volumes in the second half of 2020 compared to the first, thanks to the big deal with Murata, upfront royalty payment model, and the high predictability offered by Resonant’s design timelines. He said:

“We had said that we would start seeing royalty revenue unit volumes starting to ramp last year, which they did. We added on to that our deal with the world’s largest filter manufacturer for 5G components. And those two things combined pushed us upward into the right trajectory.”

ADVERTISEMENT

Muted investor interest

The last couple of months saw massive growth in valuations for companies building on 5G technology. Even though RESN stock maintained modest growth during this period, it still lagged behind the bigger 5G firms. Holmes said the small size of the firm, as well as a hiccup in 2015 could be playing against it.

He added that while Resonant is ahead of the curve when it comes to maturity durations, a general lack of understanding on how licensing companies work is another tailwind.

The CEO, meanwhile, expressed confidence in the headstart the company has gained with its solutions and lack of competing suits that customers could go to. Resonant has over 250 patents pending or issued in its IP portfolio.

5G opportunity

The management believes revenues over the next five years will primarily be driven by its 5G-based XBAR architecture, despite 4G continuing to be a major business. He said:

“5G is where the dollars will be. Unit volumes will be smaller than 4G in that timeframe, but the dollars will be in 5G. This is because we’ll still be at the front end of the product lifecycle curve and cutting edge technologies will be dominating the ASPs.”

ADVERTISEMENT

Apart from smartphones, there are abundant opportunities in non-mobile segments including IoT, medical and automotive fields; and Resonant is expanding into this sphere, targeting WiFi and WiFi 6. However, owing to the deal with Murata, almost 80% of its revenues are estimated to come from mobile devices.

The market is pretty bullish about this stock with three analysts covering it rating it Buy. The average 12-month price target is at a 31% upside from its last close.

In its latest analyst note, Needham wrote that it sees increased adoption of XBAR architectures in the mobile handset space, particularly in 5G handsets. With positive analyst sentiments, strong margins, and heavyweight clients on its side, Resonant is gradually establishing its space in the 5G market.

______

For more insights about Resonant, read the latest earnings call transcript here.