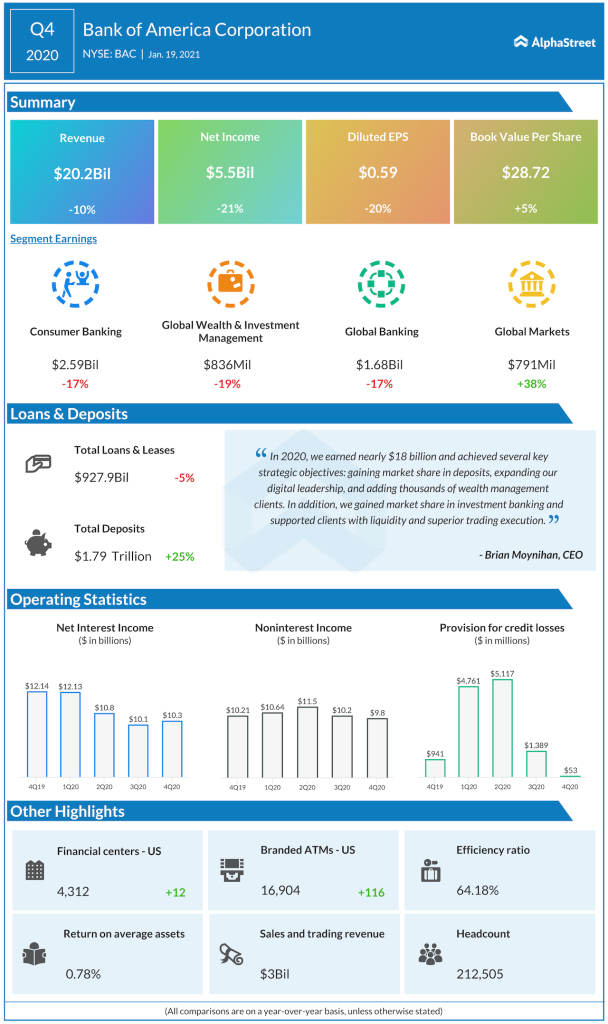

CEO Brian Moynihan said, “During 2020, we witnessed the dramatic effects of the health crisis on the economy and our company’s operations. In the fourth quarter, we continued to see signs of a recovery, led by increased consumer spending, stabilizing loan demand by our commercial customers, and strong markets and investing activity. The latest stimulus package continued progress on vaccines, and our talented teammates – who performed well helping their customers through this crisis – position us well as the recovery continues.”

_____