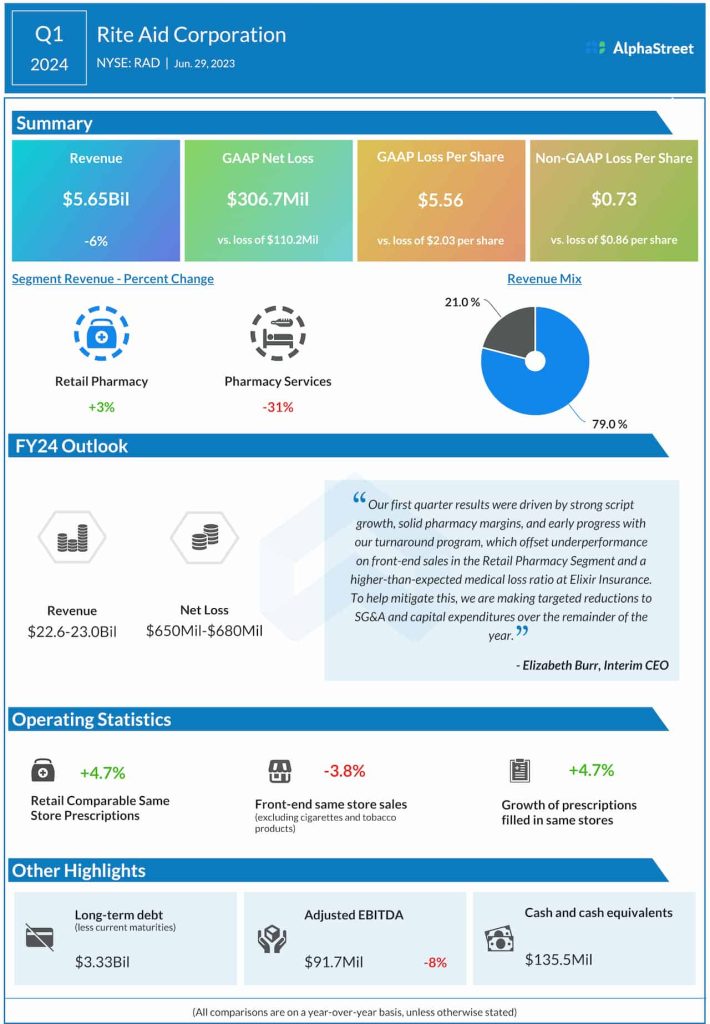

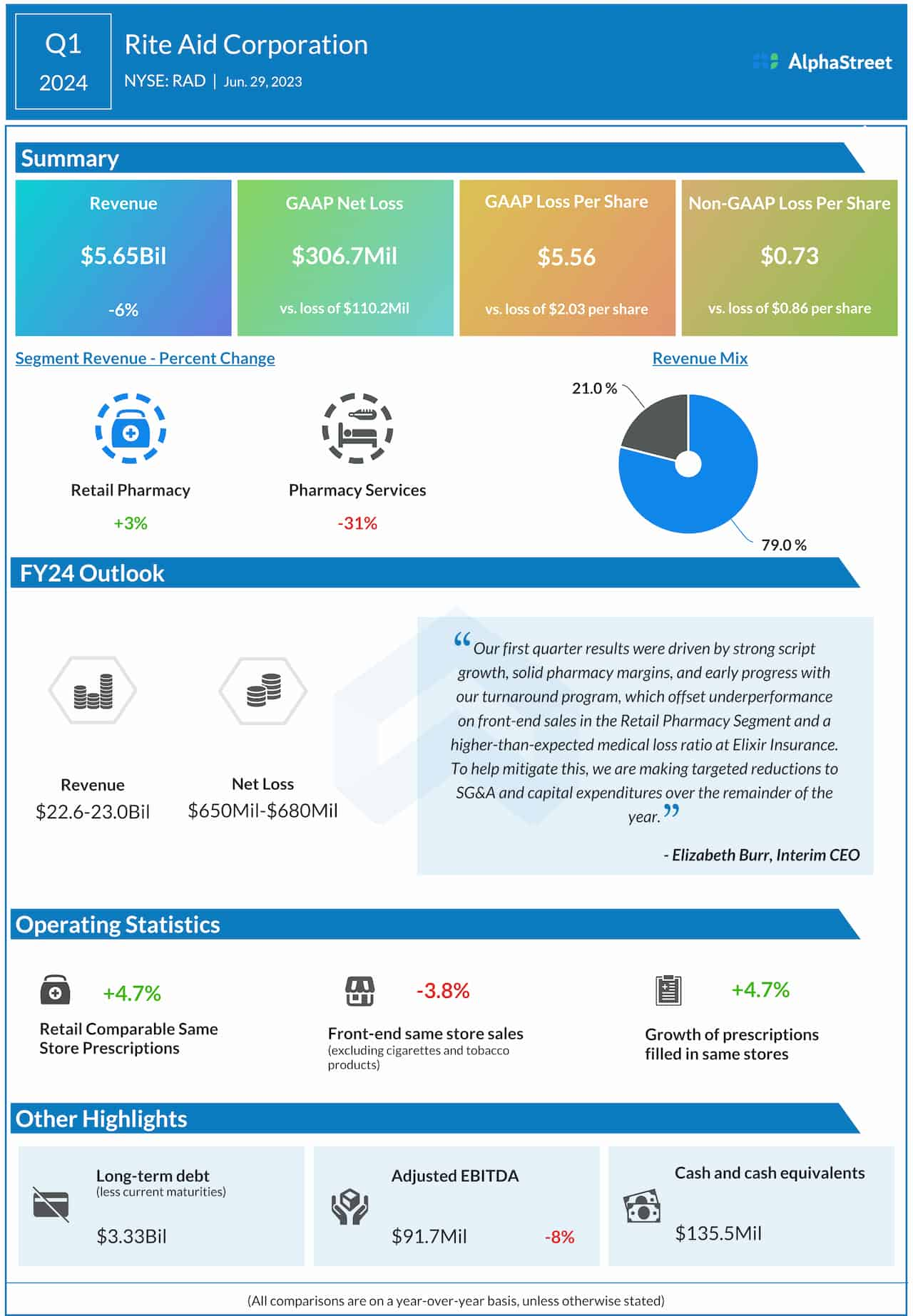

First-quarter loss, excluding special items, improved to $0.73 per share from a loss of $0.86 per share in the same period of last year. On a reported basis, the net loss attributable to common stockholders was $306.7 million or $5.56 per share, compared to a loss of $110.2 million or $2.03 per share in the prior-year quarter.

Total revenues decreased modestly to $5.65 billion in the first quarter from $6.01 billion in the corresponding period of 2023. Retail comparable same-store prescriptions moved up 4.7%, while front-end same-store sales, excluding cigarettes and tobacco products, decreased by 3.8%.

“Our first quarter results were driven by strong script growth, solid pharmacy margins, and early progress with our turnaround program, which offset underperformance on front-end sales in the Retail Pharmacy Segment and a higher-than-expected medical loss ratio at Elixir Insurance,” said interim chief executive officer Elizabeth Burr.