Retail Pharmacy, the core business, is yet to recover from the continuing slump, amid falling store footfall. However, the management’s efforts to improve operational efficiency, with support from pharmacy-benefit-management division EnvisionRxOptions and the steady rise in Medicare enrollments, should boost store traffic. The increasing focus on health and wellness gives customers a better store experience, complementing the improvement in brand offerings.

In the to-be-reported quarter, the pharmacy business is expected to have benefited from Rite Aid’s partnership with Amazon (AMZN). Also, recent investments in the digital channel are paying off, which is expected to have added to revenue growth.

Cost Pressure

Nevertheless, expenses are likely to remain elevated, mainly due to spending on promotional activities to tackle competition. Another concern is the impact of new generic drugs on the retail pharmacy business, which also faces pressure from unfavorable prescription reimbursement rates.

Market watchers forecast that earnings would drop 55% annually to $0.09 per share in the third quarter. Revenues are expected to remain broadly unchanged at $5.42 billion.

Looking Back

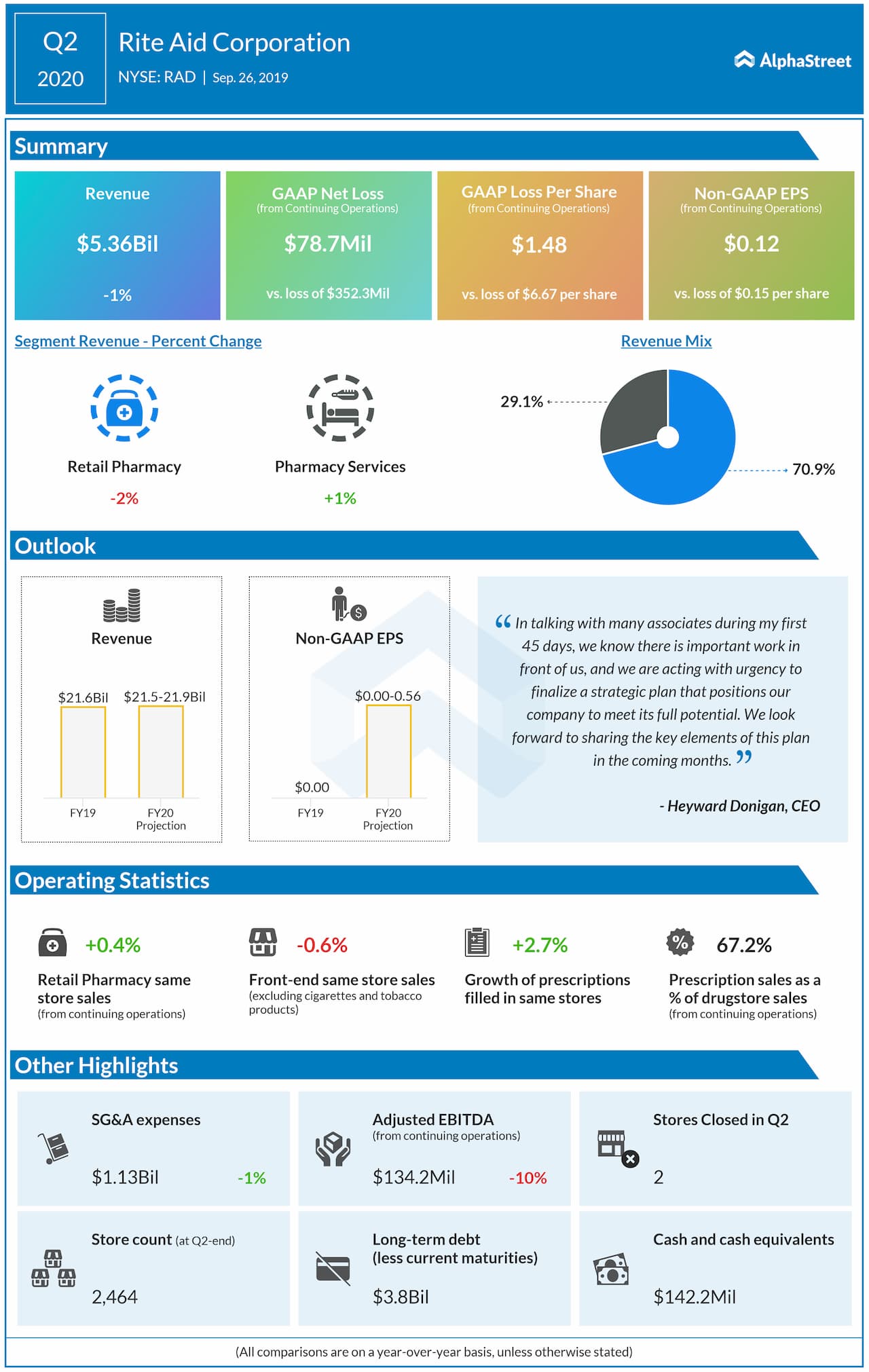

In the second quarter, Rite Aid turned to profit from last year’s loss, despite recording flat revenues. At 12 cents per share, earnings were above analysts’ forecast. Revenues came in at $5.36 billion and fell short of expectations, reflecting weakness in the retail pharmacy business.

CEO Exit

Recently, John Standley was forced to step down as CEO, ending a nine-year stint at Rite Aid, after his efforts to arrest the stock’s free-fall and bring the company to the recovery path failed. Earlier, Rite Aid’s attempts to clinch a merger deal with Albertsons fell apart. Currently, the stakeholders are pinning hope on the company’s new chief Heyward Donigan to turn things around.

Rite Aid’s stock witnessed a persistent downturn in the past few weeks, reversing the recent gains that marked a recovery from the multi-year lows seen earlier this year. The stock has lost 55% since the beginning of the year.