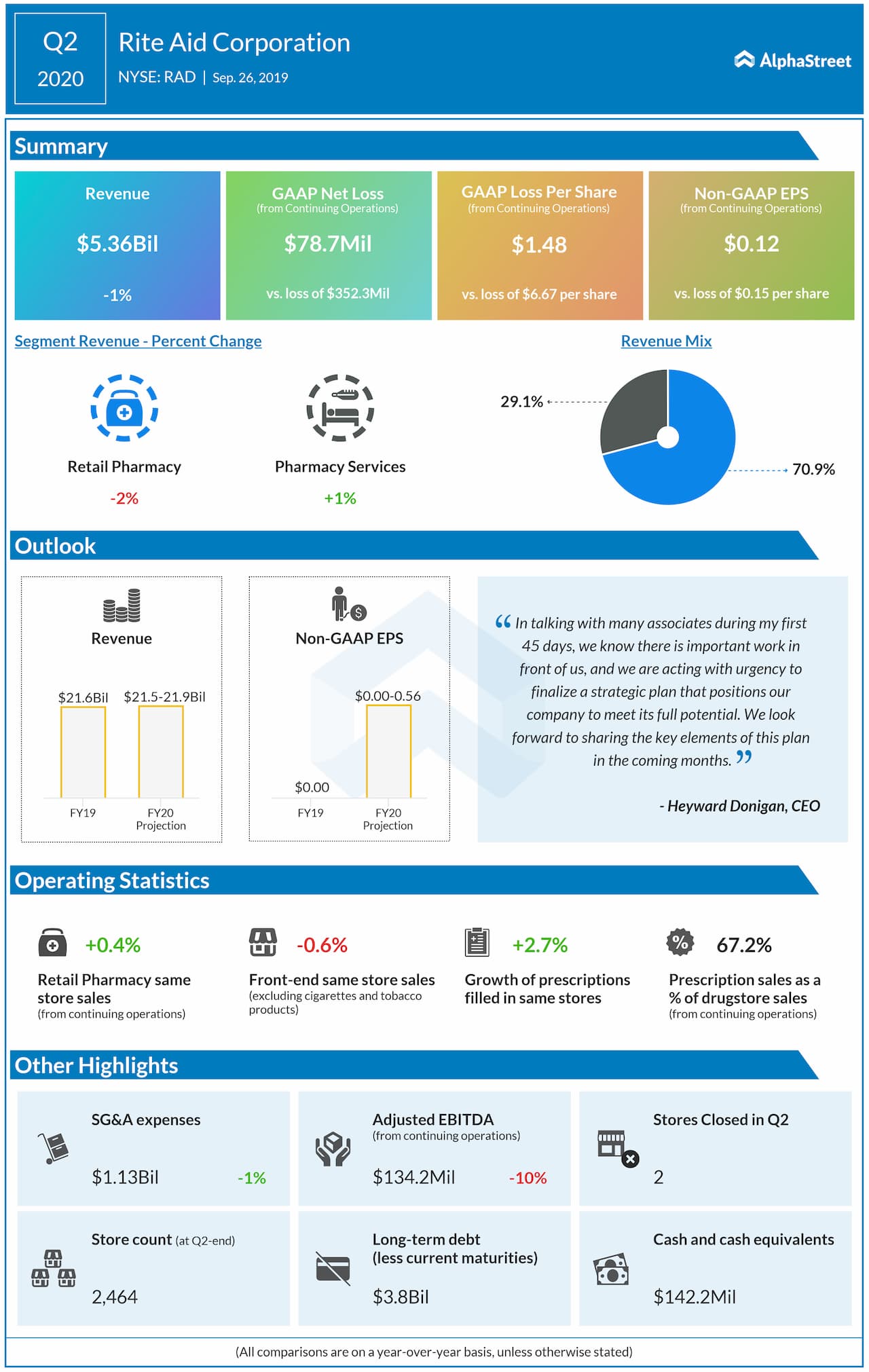

Revenues edged down almost 1% from last year and came in at $5.37

billion. This missed the analysts’ projection of $5.41 billion.

In the Retail Pharmacy segment, revenues edged down 1.6% hurt by store closures, even though same-store sales modestly increased 0.4%. Pharmacy sales have been negatively impacted by new generic introductions.

Front-end same-store sales, excluding cigarettes and tobacco products, decreased 0.6% year-over-year.

Outlook

Looking ahead, the company expects net sales to be in the range of $21.5 billion to $21.9 billion in fiscal 2020 and annual same-store sales growth in the range of 0-1%. Adjusted EPS is expected to be between $0.00 and $0.56.

RAD stock has declined 70% in the last one year, and 52% in

the year-to-date period. The company’s inability to stop its stock from

free fall culminated in CEO John Standley stepping down from the top post last month.

The newly appointed CEO Heyward Donigan has vast experience in the healthcare industry and is on Fortune’s watch list of executives who have the potential to become the world’s most powerful women.

READ: Major IPOs expected in late-2019 or 2020

ADVERTISEMENT

Following failed merger bids with Walgreens (NASDAQ: WBA) and more recently Albertsons, the company is now looking up at the new CEO to save the sinking ship. The stock has slightly recovered since the appointment of Donigan.

Donigan said in a

statement after the earnings announcement, “Our Adjusted EBITDA results

exceeded our plan driven by prescription count growth and strong expense

control. This gives us important momentum for our future, and I look forward to

working closely with our team to deliver a solid finish to our fiscal year and

position Rite Aid as an innovative leader in our industry.”